EM EMEA Weekly

- Apr 15, 2024

To read the full report, please download the PDF above.

Reflation supports EMs weather higher DM rates

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

PAUL FAWDRY

Head of Emerging Markets FX Desk

Emerging Markets Trading Desk

T: +44(0)20 577 1804

E: paul.fawdry@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

Global markers are trading reflation, as US data surprises have turned up, global PMIs are strengthening and commodities are surging. An improving global growth outlook helps provide offsets for EM assets to higher US yields. While EM assets are usually driven by a global growth factor and a global liquidity factor (i.e. US rates), the past couple of years has seen markets more focused on US rates, as the global growth outlook was being significantly lowered. This process was already bottoming last year and since October growth indicators have been leading to upward revision. The rates implications of this have already been seen in the ~60bp move higher in 10 year US Treasury yields from end-2023 lows and repricing to fewer and later Fed cuts. Yet, the growth implications should support EM assets which have been reluctant to embrace this driver returning, with commodity prices also rising and providing support. This is an environment which we view as net positive for EM assets, given rates have already repriced and growth is broadening ahead of expectations. Though, we acknowledge that EM bond yields will depend on the path of the Fed which is very data dependent, with another strong US inflation print likely enough for a recalibration.

FX views

EM currencies have weakened (except for THB) against the USD over the past week. EM FX volatility has picked up but remains close to multi-year lows. The main driver has been a further hawkish repricing of Fed rate cut expectations in response to the stronger than expected US March CPI report. Further, escalation of geopolitical tensions in the Middle East have added to downside risks.

Week in review

Poland (5.75%) and Romania (7.00%) kept rates on hold. Hungary inflation came slowed for the 14th consecutive month, to 3.6% y/y. Meanwhile, in Egypt, despite the recent currency devaluation, consumer prices slowed to 33.4% y/y, following weaker food prices.

Week ahead

March consumer price inflation data is due in Israel (MUFG and consensus: 2.6% y/y) and South Africa (MUFG 5.5% y/y; consensus 5.4% y/y).

Forecasts at a glance

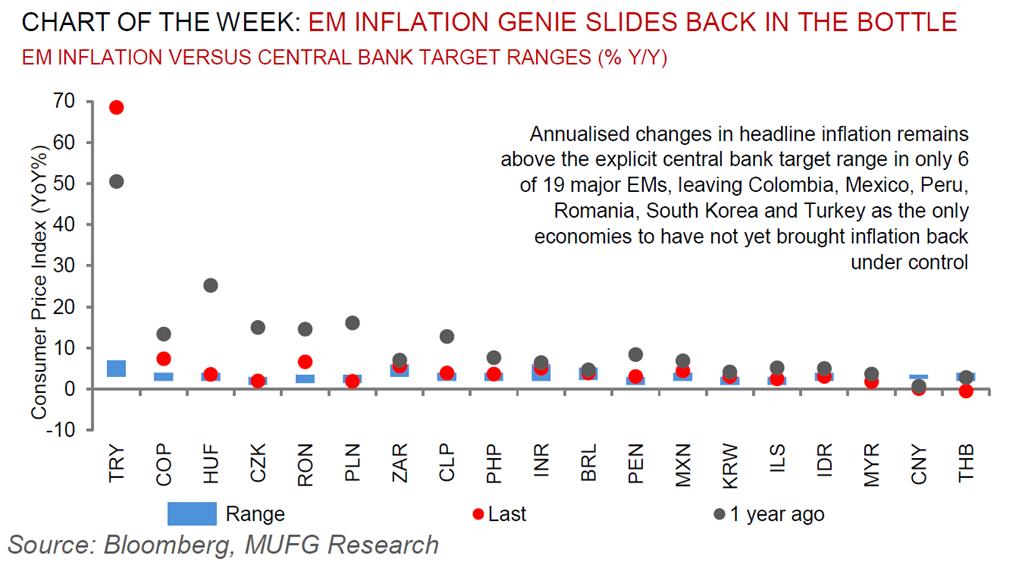

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden in 2024 (see here).

Core indicators

According to the IIF, EM securities have now witnessed net weekly inflows (USD+0.5bn), as inflows in equities surpassed the outflows in bonds.