ECB to lead the way providing further USD & GBP support

GBP: Strength more versus EUR

The ECB was largely as expected yesterday and President Lagarde certainly delivered on the expectations of a start to the easing cycle commencing in June. We outlined the key takeaways from the meeting yesterday (here). The degree in which the ECB was willing to signal a possible June cut was certainly as explicit as you could get with the statement undergoing considerable changes that laid out in essence conditions that merely have to continue as they are – ECB inflation forecasts (already consistent with a cut); underlying inflation conditions (these have been improving also); and the transmission of monetary tightening (the BLS this week confirmed that was ongoing). So we are now well set-up for an ECB cut in June and the EUR responded as expected with EUR/USD breaking just below 1.0700 yesterday. We see further declines ahead.

That will likely change how the pound will perform going forward. We had assumed GBP appreciation versus the US dollar but with scope for dollar appreciation now, pound appreciation is set to be more evident versus the euro. Evidence in the data continues to emerge of a moderate recovery in economic activity. The data released this morning confirmed this with real GDP expanding 0.1% MoM in February with the January increase revised up from 0.2% to 0.3%. The 3mth/3mth change of 0.2% was the strongest reading since last August. The 3mth/3mth change increases the prospect of GDP growth in Q1 coming in stronger than the BoE’s estimate of 0.1% QoQ. Growth was helped by a 1.2% MoM gain in manufacturing with the auto sector a key driver of the growth. Services activity also picked up and while growth is not rebounding vigorously, there are signs of improvement across the whole of the economy. The BoE Credit Conditions survey yesterday revealed a pick-up in both demand and supply of mortgages as the market rebounds following some easing of mortgage rates.

Appetite for buying the pound is picking up with investors clearly seeing the signs of improvement and the potential for inflation coming down but for the BoE to be more cautious than most other G10 central banks in cutting rates. IMM positioning data saw long GBP positions increasing for the third consecutive week to Tuesday last week, and to the highest level since the beginning of October last year.

We had previously recommended short EUR/GBP as a possible trade idea but EUR/GBP has been stuck in a very narrow trading range. A break stronger now for the US dollar and the clear signal of a rate cut in June by the ECB could now open up a greater move to the downside in EUR/GBP.

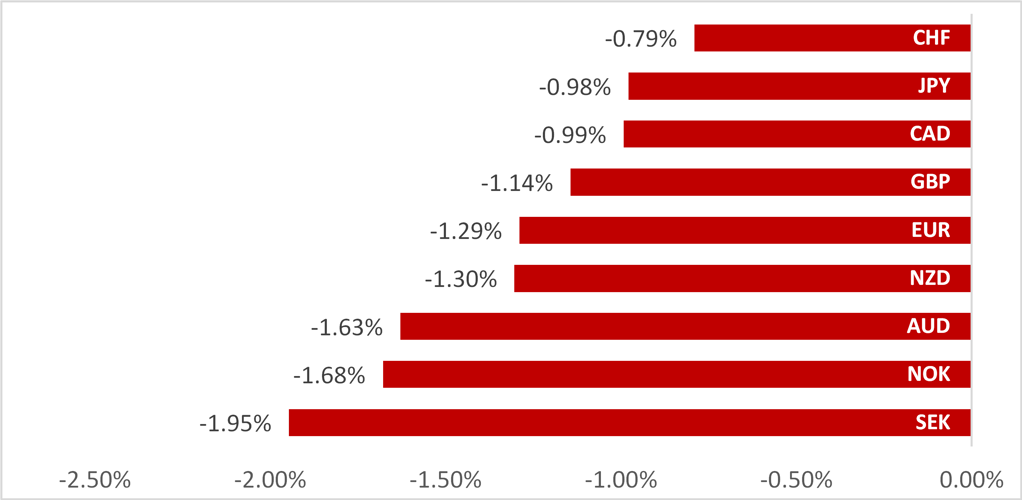

JPY IS 2ND BEST PERFORMER VERSUS USD SINCE TUESDAY CLOSE

Source: Bloomberg, Macrobond & MUFG GMR

CAD: BoC to diverge from Fed too

From being in a scenario just a week or two ago in which the pricing and general market expectations was for a relatively synchronised easing of monetary policy across many of the G10 central banks, we are now in a situation after the US CPI where there is growing conviction of a more meaningful divergence amongst some of the G10 central banks. The BoC meeting on Wednesday has provided another example of where some divergence is emerging with the positive message from the BoC in terms of the outlook for inflation opening up the prospect of a rate cut in June.

BoC Governor Macklem was clear in signalling stronger confidence in a positive inflation outlook stating that he is “seeing what we need to see, but we need to see it for longer”. The meeting this week also saw updated forecasts released with inflation in 2024 revised down from 2.8% to 2.6% and real GDP revised up notably from 0.8% to 1.5%. Stronger GDP growth will not be an issue for the BoC easing with Macklem stating that the BoC is confident that inflation can continue to move lower as the economy strengthens.

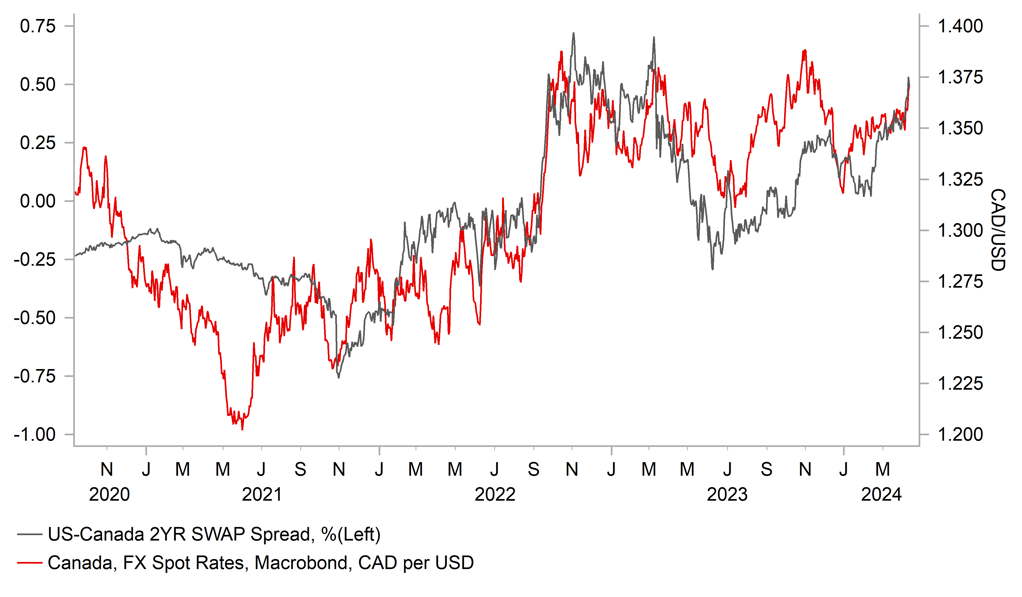

So just like with the ECB, market participants will see this window of divergence that could encourage a move higher in USD/CAD. However, the trade doesn’t look as compelling as short EUR/USD. Firstly, the FX move in CAD is much more aligned with the swap spread move (see above) which limits the scope for catch-up USD buying vs CAD unlike what could transpire in EUR/USD. Secondly, the Canadian economy is more resilient as acknowledged by the BoC’s forecasts. Finally, CAD performance is much more linked to US economic performance and overall risk and if the US economy does remain more resilient that is less negative for CAD than EUR.

Still, there is scope to the upside in USD/CAD over the short-term but we would be surprised to see a move beyond the most recent highs which came in at close to the 1.3900-level in Oct/Nov last year, but it could be a move of less than that.

USD/CAD VS 2YR US-CA SWAP SPREAD – HEADING HIGHER

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

09:00 |

IEA Monthly Report |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

ECB's Professional Forecasts |

! |

|||

|

EC |

12:00 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

UK |

09:00 |

Bernanke report on BoE Forecasting |

! |

|||

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

-- |

-- |

0.0% |

!! |

|

US |

13:30 |

Export Price Index (YoY) |

-- |

-- |

-1.8% |

! |

|

US |

13:30 |

Export Price Index (MoM) |

Mar |

0.3% |

0.8% |

! |

|

US |

13:30 |

Import Price Index (YoY) |

-- |

-- |

-0.8% |

! |

|

US |

13:30 |

Import Price Index (MoM) |

Mar |

0.3% |

0.3% |

! |

|

US |

14:00 |

Fed's Collins on Bloomberg TV |

!!! |

|||

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Apr |

-- |

2.9% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Apr |

-- |

2.8% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Apr |

77.6 |

77.4 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Apr |

79.0 |

79.4 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Apr |

82.2 |

82.5 |

! |

|

US |

18:00 |

Fed's Schmid speaks |

!! |

|||

|

US |

19:30 |

Fed's Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

20:30 |

Fed's Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg