To read the full report, please download the PDF above.

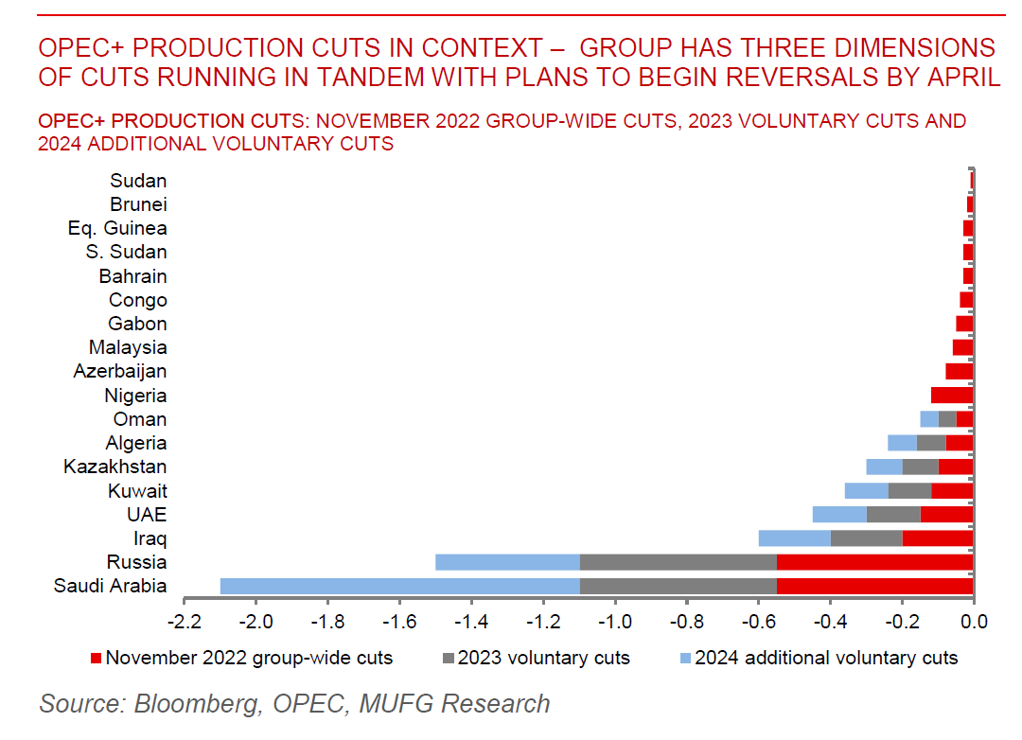

- OPEC+ has communicated that it intends to proceed with its articulated plans to unwind its 2.2m b/d voluntary production cuts in a gradual, flexible and reversible fashion from April 2025, adding 138k b/d per month.

- The production increases are in line with our view we catalogued in our 2025 outlooks (see here and here), which we believe is motivated by the market pivoting from a strategy wherein OPEC+ had supported prices to a more long-run equilibrium wherein OPEC+ defends market share by restraining non-OPEC+ supply as well as fortifying internal unity and compliance.

- Oil prices have tumbled to year-to-date lows on the announcement, given the market had been expecting OPEC+ to further delay an increase in supply – the negative price reaction has been further exacerbated by the risk-off mood triggered by the US-led escalations in the trade war, which adds up to a weighty one-two bearish combo.

- On net, this development has not changed our bearish oil price thesis as we had already thought OPEC+ supply will return by the second quarter – exacerbating what is set to be an oversupplied market this year. Indeed, an unresolved surplus (+0.9m b/d) in 2025, alongside, elevated spare capacity (~5.5m b/d), should drive oil prices to fall to drive a rebalancing – we look for Brent oil to average USD69/b in Q2 2025 and USD73/b for 2025 as a whole.