To read the full report, please download the PDF above.

- We address commonalities from recent client queries surrounding the global oil market outlook – and particularly on how low oil prices can go as downside risks to the global economic outlook proliferates – through a Q&A format.

- The global economic outlook remains extremely fluid, particularly with respect to the US imposition of tariffs on China. Will the exemptions (or rate reductions) for telecoms and semiconductor equipment remain in place? Will Chinese firms be able to reroute their exports to the US via other EM Asian countries? Is there any prospect for an agreement that brings broad tariff rates back to levels which allow for at least a moderate amount of mutually beneficial trade outside of favoured products and sectors?

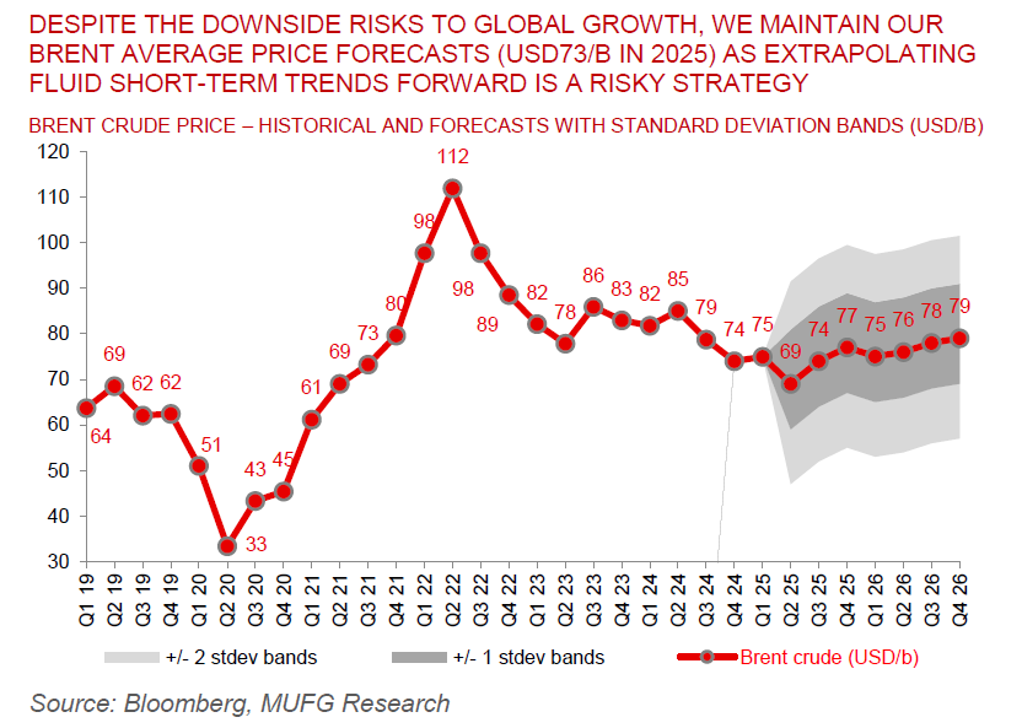

- In part because of these uncertainties, and in part because it is unclear how the global economy will cope with the dramatic increase in uncertainty, we prefer to maintain our Brent crude call for prices to average USD69/b and USD73/b, for Q2 2025 and 2025 as a whole, respectively, until the dust settles somewhat. Indeed, extrapolating short-term trends and events into the future has turned out to be a very risky strategy less than three months into the new US administration. What we do provide, however, are three scenarios – base, bear and bull case – given the larger-than-usual uncertainty embedded into global markets today.