Physical (fundamentals) markets trumps paper (positioning) markets – commodity prices will respond

Global commodities

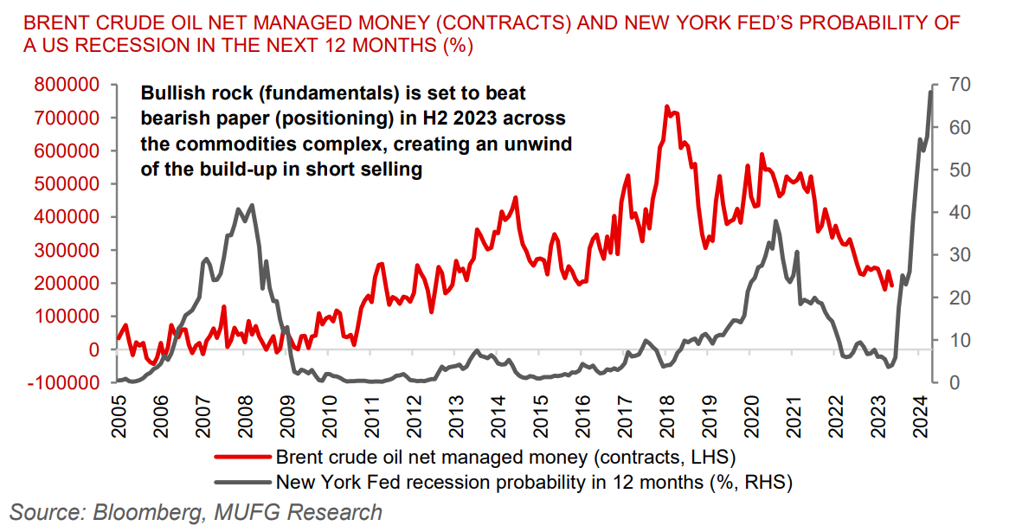

Investors are increasingly cashing out on their insurance policies in the form of paper commodity markets with positioning swinging sharply negative in recent weeks. Mounting macro apprehensions over the health of the financial sector, US debt ceiling risks, fears of an impending demand slowdown in developed markets as well as a depressing recovery in China have raised fears of an upcoming global recession. Indeed, with the New York Fed’s recession probability indicators placing recession odds at 68% over the next 12 months, such net selling across the commodities space is not entirely irrational. Yet, recessionary concerns are resulting in commodity prices that are lower than what fundamentals would suggest. We have catalogued over the years that commodities are spot, physical assets, driven by today’s fundamentals, in contrast to financial instruments (equities, bonds, credit) that are anticipatory which are driven by future expectations (see here, here and here). As such, barring a hard landing, key paper commodity market distortions should disappear over time, especially given the acute backwardation (signalling supply tightness) across major commodities today. This sets the stage for an unwind of the significant build-up in paper commodity shorts – the key is the catalyst which may come from (i) a robust rebound in Chinese manufacturing once margins improve; and/or (ii) momentum that the Fed will commence its easing cycle (see here).

Energy

Global oil markets are sending bearish signals on cash prices and timespreads as supply – predominantly production from sanctioned countries – remains stronger than previously anticipated. Our base case heading into the 3-4 June OPEC+ meeting is for the group to deliver a hawkish message but not implement another round of cuts – OPEC’s own estimates shows a significant supply shortage in H2 2023 and any further reductions in actual output would only exacerbate tight fundamentals. Meanwhile, the latest daily data continues to suggest that European gas storage inventories (currently 68% full) are on track to be filled 100% before the 1 October start of the winter heating season (see here).

Base metals

Copper continues to hover near the USD8,000/MT handle, as signs of China’s disappointing economic recovery continued to weigh on the demand outlook, while a likely deal to avoid a US debt default is supporting sentiment. The potential for sustained bullish momentum in base metals prices remains fundamentally tied to an improvement in Chinese manufacturing activity data momentum, at least until the micro can provide an extreme bind via inventory depletion risk (a scenario still possible by the last quarter of 2023).

Bearish signs surrounding copper abound, which could push prices below USD8,000/MT as we catalogued last week (see here). The latest headwind came out of the Chinese property market this week, with April home price growth slowing. Whilst we acknowledge near-term demand angst, we still believe that the market deficit in copper will serve to reinforce the market tightness and eventual necessity for a scarcity price spike to the upside.

Precious metals

Gold ticked higher late last week as the Fitch headline (placing the US sovereign on rating watch negative) cross the wires, though has since found support as investors assessed the possible impact of a US debt ceiling deal that could cut federal spending. Looking ahead, gold is one of our favourite commodities to be long, as we are now past Fed peak hawkishness, alongside continued purchases of gold from EM central banks (see here).

Bulk commodities

Iron ore is oscillating ~USD100/MT, with the steel-making raw material still under considerable downward pressure as China’s recovery continues to underwhelm which is hampering demand from the largest consumer, whilst supplies from major miners in Australia and Brazil is proving buoyant.

Agriculture

Wheat is extending its losses to the lowest level since December 2020 after US crop conditions considerably beat expectations in the latest data readings, which compounds the two month extension of the Russia-Ukraine Black Sea grain deal.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.

CHART OF THE WEEK: RECESSIONARY ANGST SUPURRING SHORT SELLING