To read the full report, please download the PDF above.

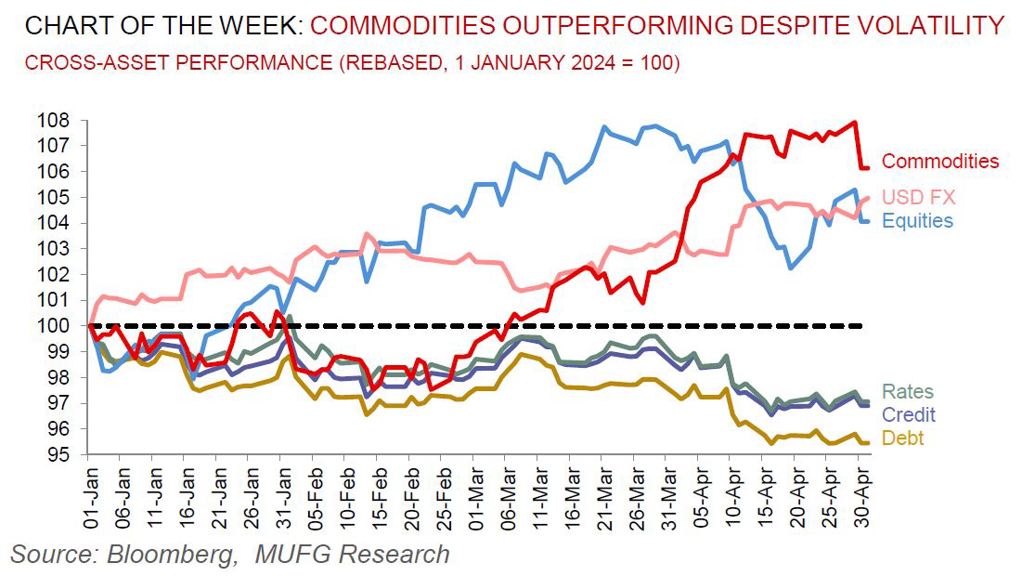

Commodities ride the waves as volatility in the Japanese yen sets the narrative

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Commodities are feeling tremors from the Japanese yen’s week of turbulence. Seldom does the Japanese currency manage a ~5 USD/JPY move intraday – and it has managed this twice this week (-5.63 on 29 April and -4.95 on 1 May). There’s no confirmation yet as to whether there was intervention by the authorities, but the fallout has been evident as commodities across the complex catch a bid with the yen. Worst off has been gold (which recently hit a record) hovering ~USD2,300/oz, as well as oil with Brent crude trading below its 50 day moving average at USD84/b. Yet in aggregate, notwithstanding the yen’s yo-yos, our constructive commodities conviction remains intact. As we catalogued in our 2024 commodities outlook, timespreads – spot prices versus forward prices – do not lie about the physical tightness of most major commodities that are mired in backwardation, which signals supply tightness (see here). At this late-stage of the business cycle, we continue to postulate that it pays to lean long commodities. Indeed, not only have commodities historically proven to outperform in a high rates environment that has been driven by strong underlying global growth (as is the case today), but once the Fed eventually begins to ease rates, it forces liquidity into the system that propels commodities higher as has historically been the case in most easing cycles back to the 1990s.

Energy

Brent oil has fallen ~5% this week to USD84/b – trading below its 50 day moving average for the first time since mid-March – as signs of potential Israel-Hamas de-escalation, a significant drop in speculative positioning, a surge in US crude inventories, a stronger US dollar and broad risk-off trading following Japanese yen volatility, are keeping oil bulls at bay. We continue to hold conviction that effective OPEC+ market management will ensure Brent crude remains in a USD80-100/b range in 2024, with a USD80/b OPEC+ put from the group leveraging its inelastic pricing power, and a USD100/b ceiling from ample spare capacity to handle tightening shocks.

Base metals

Copper’s significant upside price move year-to-date is showing signs of respite with prices falling below USD10,000/MT as traders turned their attention to conditions in China where a seasonal pickup in demand is being delayed as the rapid surge in prices deters buying from fabricators (which are grappling to pass-on costs to consumers). Still as we have recently documented, copper’s time is now given the acute fundamental shortfalls owing to a continuation of green demand strength (copper is central to decarbonisation) and a cyclical recovery in DM manufacturing (see here).

Precious metals

Gold is trading at near one month lows (sub-USD2,300/oz) as continued US resiliency dents hopes the Fed will rapidly pivot towards monetary easing (swaps markets show only one rate cut is now fully priced in for 2024, down from three that the Fed said in December 2023 that it was aiming for this year). We reiterate our 2024 commodities views that gold is our most bullish call this year (we recognise that our above consensus year-end forecast of USD2,350/oz that we laid out at the start of the year, now look modest), on a trifecta of (eventual) Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore has followed the broader base metals complex down this week with Japanese yen volatility alongside renewed concerns surrounding higher-for-longer rates, triggers a risk-off sentiment.

Agriculture

Wheat prices have pared some recent gains as expectations for improved weather in key growing regions in the US weighs on markets – we see prospects for an increase in US export share over the year ahead amid declining inventories elsewhere.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.