Global oil markets year of two halves is crystallising

Global commodities

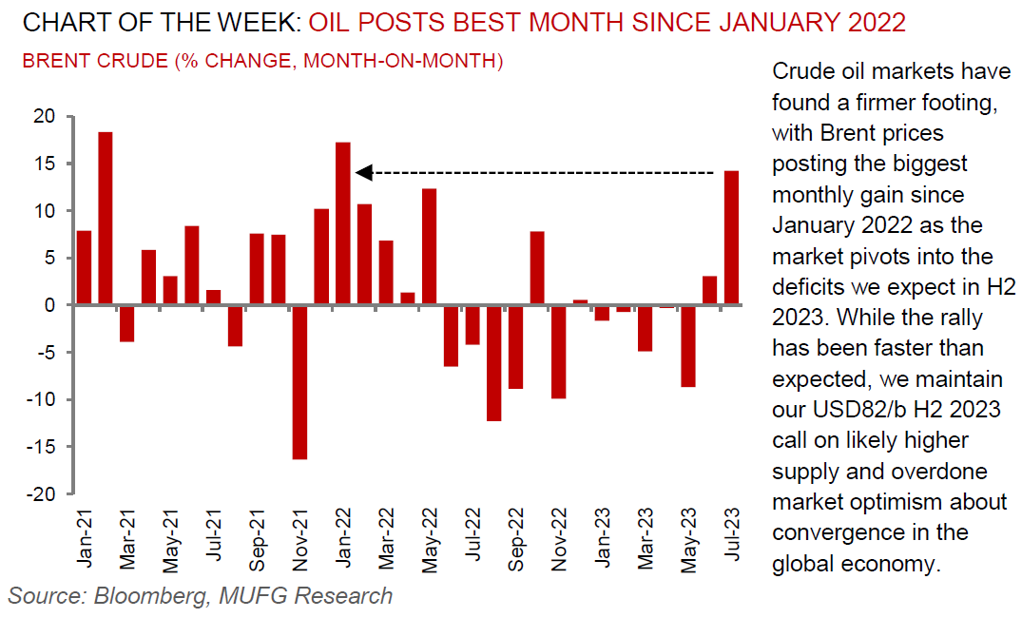

July was exceptional. Global benchmark Brent crude oil surged 14% last month (most since January 2022), as stern OPEC+ supply cuts and buoyant global demand has pivoted the market into deep deficits, reinforced by tightening timespreads in backwardation. Further fuelling oil’s strength has been a plunging US dollar alongside prospects that the Fed may have ended its cycle of monetary tightening which has also aided sentiment. Oil bulls (like ourselves – see here), had to play a lot of defence in H1 2023 as prices and sentiment tanked. Yet with the advent of H2 2023, the mood music has shifted, reinforcing the notion that 2023 is shaping up to be a year of two halves (see here). Whilst we do not believe we will be witnessing oil prices breaching USD100/b anytime soon – given the incentive for Saudi Arabia to reverse its voluntary 1m b/d production cut at these elevated price levels (as well as supply beats from sanctioned OPEC+ countries, Iran and Venezuela) – we do believe the gravitational tilt is to the upside given a less pessimistic global outlook. For now, we stick to our range-bound call for Brent to average USD82/b in H2 2023, given upside bearish supply risks. What is clear, is that a more constructive oil price outlook threatens to fan the flames of global inflation once again, complicating particularly how a dovish Fed pivot plays out.

Energy

After a remarkable run in July, oil’s rally has taken a pause this week on a risk-off tone as Fitch stripped the US of its AAA sovereign credit rating, spurring the US dollar higher. Beyond the headwind that elevated oil prices are causing global central banks, diesel – the workhorse of the global economy – is witnessing a rare summertime price rally as refinery outages and heatwaves are curbing supply. Meanwhile, the LNG spot price premium paid in Asia relative to Europe (reflected in the JKM-TTF spread) is trading at its highest level this year, driven by European natural gas (TTF) declines, rather than a Japan-Korea natural gas market (JKM) rally.

Base metals

Base metal prices are advancing on growing expectations for further government stimulus from China – the world’s largest consumer of base metals. China’s adjustment in its macro policy stance is to act as a solver of key growth headwinds onshore – property slowdown, weak private sector confidence – as a core increment in slimming the left tail on China growth risks, which have been the dominant restraint on base metal prices, especially copper. While there was little in terms of micro policy announcements at the actual Politburo, copper already possesses significant policy support (green, grid, property completions), so any additional stimulus from here adds to robust tight micro fundamentals.

Precious metals

Gold has been in a rough run of late, with developed market rate hikes making non-interest bearing bullion less attractive. Softer-than-expected inflation is also dampening demand for gold as a hedge against rising costs.

Bulk commodities

With the most leverage to China’s property sector, it is understandable that iron ore prices have traded well in the immediate aftermath of the recent Chinese Politburo meeting, approaching USD115/MT for the first time since Q1 2023. Yet, absent a positive surprise, we anticipate micro fundamentals that point to surplus in H2 2023 to generate sustained downward pressure on iron ore prices.

Agriculture

Global rice supplies face new threats as Thailand – constituting 15% of global trade – has urged farmers to reduce their rice planting to save water following poor rainfall, a move that poses a fresh threat to global supply after India some shipments of the grain. Separately, wheat and corn prices are advancing as Ukraine declared a Russian drone attack damaged a Danube river port in Ukraine.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.