To read the full report, please download the PDF above.

Geopolitical risk premium in oil markets remains negligible (for now)

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

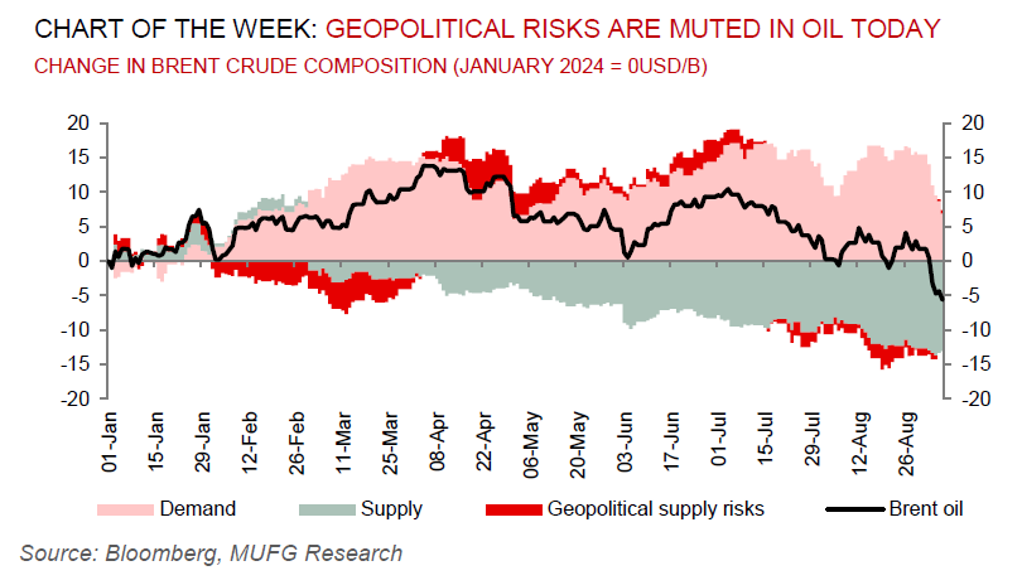

The movements of global markets are of trivial importance compared with the value of human life and our thoughts are with those affected from the ongoing conflicts in the Middle East. The events in the Middle East are unequivocally top of mind and the first order implications across the commodities space have been felt most acutely in oil markets, given the region’s leviathan importance to the energy complex. Iran’s missile attack on Israel, with renewed concerns about the prospect for a regional conflagration that may hamper crude supplies from the region, is raising questions surrounding the quantum of geopolitical risk premium priced into oil markets. Brent crude surged 5% following Iran’s assault on 1 October, catching speculators who had been more bearish than ever in the weeks before the barrage. Israel’s prime minister, Benjamin Netanyahu, has declared that Iran “will pay”, creating the risk of a tit-for-tat escalation in part of the world that’s responsible for around a third of the world’s supply. Yet, estimates signal that today’s geopolitical risk premium remains negligible, predominantly owing to ample OPEC+ spare capacity as well as limited actual production disruptions. To put this into context, whilst the flight to quality trade on the back of investor skittishness that there will be lost barrels to global oil markets is comprehensible, in the absence of actual physical supply or energy infrastructure being hampered, this incremental risk premia that’s been added to oil prices, may ebb away. We have been here before with geopolitical risk premia being baked on heightened Middle East tensions to then only subside with physical markets operating in good order. Will this time be different? The world awaits Israel’s reprisal.

Energy

The oil market is on red alert for how the evolving geopolitical situation in the Middle East may impact physical barrels, energy infrastructure and transportation flows. Whilst Brent crude leaped +5% following Iran’s attack on Israel, it has since pared some of its safe-haven led gains as high spare capacity and the absence of actual physical supply and/or energy infrastructure being hampered, carves a ceiling on prices. Yet, we recognise the acute oil price sensitivity given the fluidity of the situation in the Middle East with key watchpoints being, (i) the potential downside risks to Iranian oil supply (following the ~1m b/d increase in the country’s crude production over the last two years); (ii) the prospects of additional declines in Red Sea crude flows; and (iii) the low probability but severe impact scenario of an interruption of trade through the critical Strait of Hormuz (responsible for ~30% of the world’s crude oil production and ~20% of the world’s global LNG trade).

Base metals

Copper is holding on to gains in the wake of China’s latest economic stimulus measures, which propelled advances across the base metals complex. More broadly, as we have frequently catalogued, we view that the sharp rates unwind in a soft landing environment offers good entry given late cycle driven scarcity, a tentative revival in global manufacturing and attractive returns – which now is further reinforced by a plethora of Chinese stimulus measures.

Precious metals

The geopolitical-led flight-to-quality is driving gold higher in recent sessions, in what continues to be an unshakable bull market. Gold’s structural strength continues to be buoyed by its role as a geopolitical hedge of first resort in an uncertain operating environment, Fed rate cuts, unprecedented central bank demand for gold, an expansion in bullion-backed ETFs, the risk of inflationary US policies after the elections from shocks including tariffs and rising debt apprehensions. We hold conviction in our above-consensus call for gold and forecast prices to rise to USD2,750/oz by year-end and to breach the USD3,000/oz threshold in 2025.

Bulk commodities

Iron ore – the most China centric industrial commodity – is enjoying a stunning reversal higher in recent sessions as China went big on stimulus, with a laser focus on the property sector. Yet, the ~20% since 23 September appear overdone, in our view. Granted, the China’s authorities pre-holiday salvo, alongside follow-through steps in key urban centres, will do much to improve the mood in the ailing real estate market, but whether there’s enough to persuade mills that have been complaining of an industry-wide crisis to change course and sustainably ramp-up steel output is unclear.

Agriculture

Wheat prices have risen to the highest since June, as traders watched the escalation in the Middle east and weighed concerns over Russia’s wheat crop in Voronezh (an important wheat-growing region in Russia’s south which allowed emergency provisions that will help farmers if they need insurance payouts for crop losses).

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.