To read the full report, please download the PDF above.

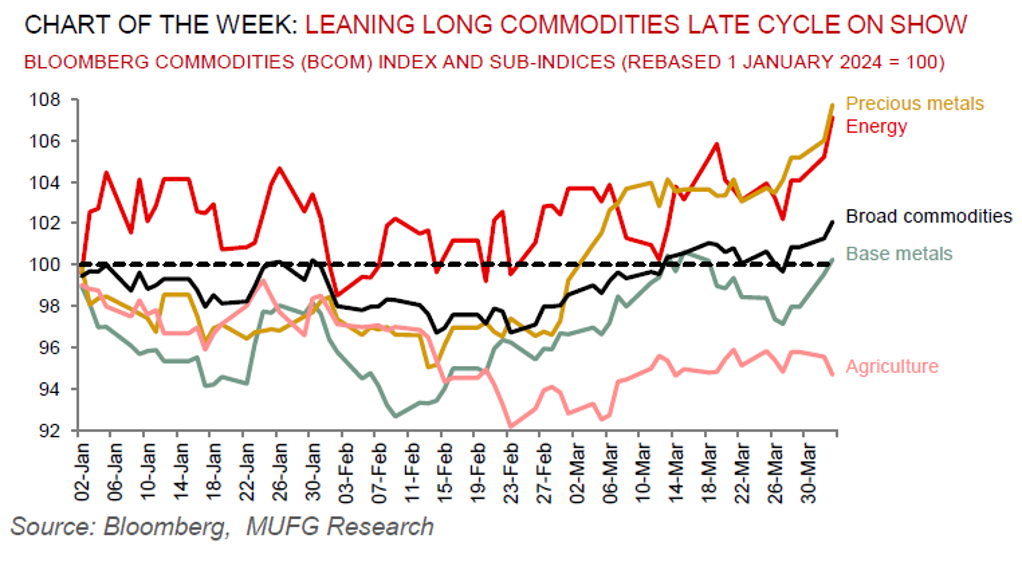

Classic late cycle commodities rally in full swing

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

We are at the end of an economic cycle and months away before some form of “landing”. A number of market mechanisms normally activate during this stage of the cycle, such as a rise in long-term interest rates, a relative outperformance of EM assets and an increase in commodity prices. From a cross-asset perspective, commodities have historically proven to be the best asset class to own during a late cycle phase – as demand remains above supply and inventories are depleted (see here). This is corroborated with 15 of 23 commodities in the Bloomberg Commodities (BCOM) index in backwardation (supply tightness), and coverage ratios (inventories as a share of demand) signalling tightness across major commodities. Our neutral-to-bullish 2024 commodities outlook accentuated three core drivers of commodity returns this year – cyclical and structural support to demand as well as commodities role as a geopolitical hedge (see here). With three months into 2024, we reiterate our constructive view, but emphasise the significance of remaining selective (see page 13 in the report for our commodities forecasts).

Energy

Oil is hovering at six months highs with Brent crude sizing up to challenge USD90/b. Geopolitical supply risks are re-emerging, robust demand is continuing (beats in US and China manufacturing PMIs show early signs of the manufacturing cycle inflection), OPEC+ production cuts are extending and April has historically brought a rally ahead of the expected summer driving seasonal demand. Looking ahead, as we catalogued in our 2024 energy outlook, we believe that OPEC+ market management will ensure Brent crude remains in a USD80-100/b range with a USD80/b OPEC+ put from the group leveraging its inelastic pricing power, and a USD100/b ceiling from spare capacity to handle tightening shocks (see here).

Base metals

Copper – a global economic bellwether – is paring recent losses with the trough in global manufacturing PMIs seemingly behind us, which alongside our US rates strategists view of Fed cuts from June this year, we expect further support to copper (and aluminium) demand and prices. Moreover, the mine supply shock currently at play in the copper market and the impact from China’s capacity cap on aluminium supply, both frame a materially tighter balance path for these metals in 2024 versus 2023.

Precious metals

Gold continues to reach record highs (+10% year-to-date) as the Fed continues to maintain its outlook for three cuts this year – which benefits non-interest bearing precious metals. Yet, a warning from gold futures suggests a reversal may not be far away, with open interest contracts seemingly peaking (akin to December 2023, which coincided with a sharp bullion selloff). We reiterate our 2024 commodities views that gold is our most bullish call this year (year-end forecast of USD2,350/oz), on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore – the most China centric industrial commodity – is seeking to find a floor ~USD100/MT. Although China’s overall manufacturing activity rebound in March (as illustrated by stronger PMI readings), the same cannot be said for the steel industry where the PMI plunged into further contractionary levels. What’s more, China’s home sales figures are also signalling that a turnaround in the sector is not in sight (key for steel demand).

Agriculture

Cocoa futures are taking a dip lower after hitting record highs in recent sessions owing to a supply crunch which has been exacerbated by financial positioning. This year’s dizzying rally combined with lower open interest is leaving the market more susceptible to volatility.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.