Taking stock of China's thriving counterintuitive commodities demand

Global commodities

Global markets continue to contend with a flagging Chinese economic recovery. A protracted crisis in the property market, deflation, weak exports and a falling yuan reinforce fissures in the world’s largest commodity consumer. Yet, whilst commodities consumption is at the heart of China’s economy, it would be ill wise to assume that this growth environment has resulted in a similar pressure on the onshore commodity demand trend. Thus far in 2023, for most major commodities, China’s demand has grown at robust rates (copper +8%; iron ore +7%; oil up +6%). That this micro demand level outperformance of China’s macro economy trend has been achieved reflects the idiosyncrasies of specific commodity demand leverage. That is, the balance of China’s growth driver in 2023, weighted toward the services sector, has been particularly beneficial for mobility-tied commodities (oil) and green raw materials (copper and aluminium). The current high frequency data signals suggest this resilient demand environment is well underpinned into year-end, with piecemeal Chinese policy easing likely to limit the degree of deceleration next year. We continue to view China as a positive micro demand side factor for commodity price formation into year-end (see here for our latest thought leadership content of what to expect for commodities into year-end).

Energy

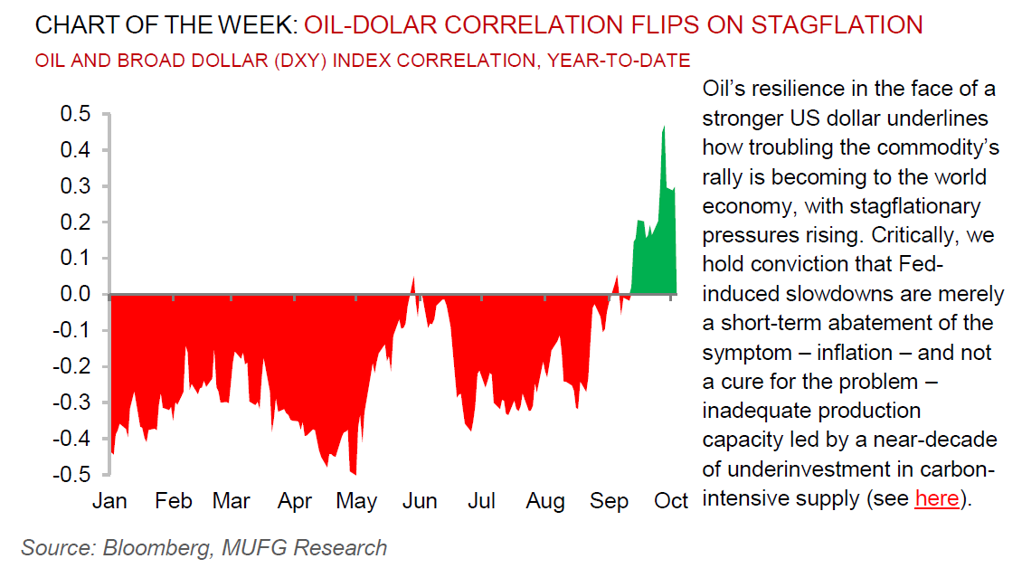

After a blistering Q3 2023, oil’s sharp reversal in recent trading days reinforce the notion that the rally may have run its course. We have recently marked-to-market our quarterly oil price trajectory higher and now anticipate Brent crude to average USD94/b and USD87/b in Q4 2023 and 2024 as a whole, respectively (see here). Meanwhile, in European natural gas markets, with congestion risks significantly reduced on both sides of the Atlantic, the market’s attention has shifted towards the winter ahead. We continue to recommend a long February 2024 TTF position based on winter risk asymmetries commonly experienced in gas prices (see here and here)

Base metals

Base metals, led by copper – the economic bellwether – are extending losses on the US dollar strength and expectations for a higher for longer rates environment. What’s more, copper inventories at the LME have been steadily expanding with above-ground stockpiles still at historically low levels, though the increase is a sign that supply is now starting to run ahead of demand in the spot market.

Precious metals

Gold has plunged to a seven month low, edging closer to USD1,800/oz, as rising bond yields and the US dollar strength is driving non-yielding assets like bullion, incrementally out of investor portfolios. From a technical perspective, gold’s 50-day and 100-day averages are now trending lower, and prices have formed a death cross (with shorter-dated means lower than longer-dated ones).

Bulk commodities

Iron ore’s premium spread between spot high-grade Brazilian ore with 65% iron content and benchmark Australian material with 62% content is narrowing – which carries a warning. The shrinking premium suggests that users in China (the largest market) are less willing to pay as their profitability is under pressure (high grade ore is both more efficient and less polluting, thus its preferred when the steel industry is performing).

Agriculture

Soybean prices have slumped to the lowest since June amid the advancing US harvest and the Brazilian planting season – both of which signalled ample supplies for the world’s top two oilseed producers.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.