To read the full report, please download the PDF above.

Tariffs and commodities diversification role as a critical inflation hedge

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Commodities are front and centre in President Trump’s trade and foreign policies as his administration pursues dominance on “America First” terms. This paradigm envisions affordable US energy prices, higher US output in the “old economy” (crude oil and manufacturing) and “new economy” (power, metals and AI). This elevated policy uncertainty and wide range of potential trajectories of how the outlook will be shaped strengthens the diversifying role of commodities in portfolio allocations in 2025, in our view. From a commodities subcomponent perspective, we envisage two core implications from the tariff announcements to date. First, in the energy space, oil market reverberations from a 10% tariff on all oil imports is unlikely to markedly raise Brent and WTI crude prices – but may raise the cost of refined oil products, that could counterproductively increase US gasoline prices. Second, in the metals complex, the 25% tariff on steel and aluminium (as well as the tariff risk premia in copper) will predominantly be passed onto higher US (than global) prices. More broadly, as tariff threats, inflation expectations and inflation uncertainty rise further, commodities act as a critical inflation hedge as physical assets historically deliver strong real returns when inflation rises, while equity and bond real returns tend to be negative – as we catalogued in our 2025 commodities outlook.

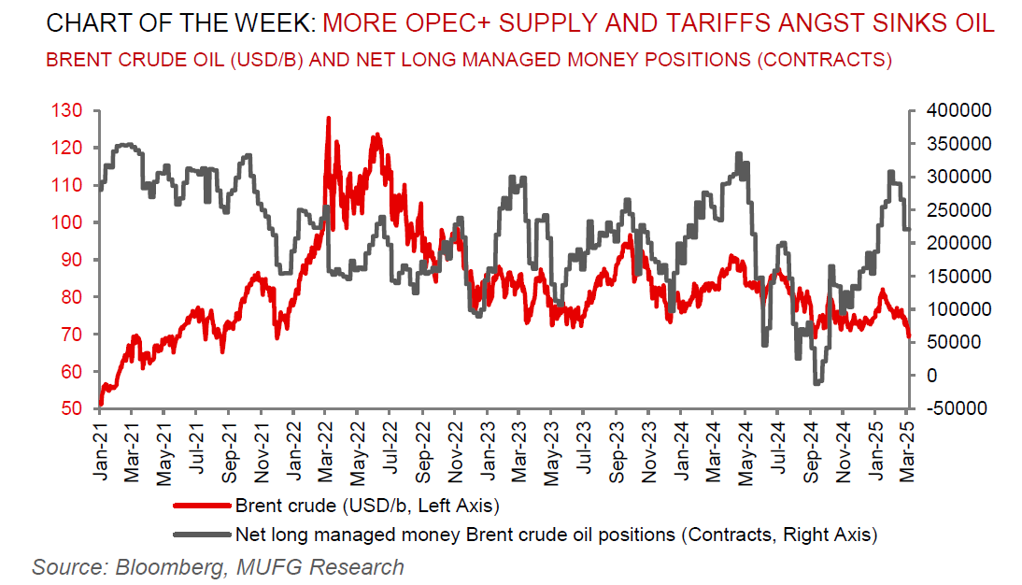

Energy

A confluence of bearish forces from OPEC+ green-lighting a gradual plan to restore its 2.2m b/d of supply from April 2025, to the flurry of trade tariffs (and associated risks) accentuating recession probabilities as well as President Trump negotiating an end to the war in Ukraine, has taken Brent oil prices sub-USD70/b – close to the lowest levels since December 2021. Crude bulls are hard to find in today’s complicated geopolitical environment with traders exhibiting little incentive to buy the dip in the absence of a constructive catalyst.

Base metals

North America’s aluminium sector are struggling to decipher how businesses will be affected after US President Trump imposed import duties on Canadian and Mexican supplies. A key uncertainty stems from whether raw aluminium and related products incur a 25% tariff or if they will get a more favourable 10% treatment for being a critical mineral. Note the US’s share of aluminium imports from Canada and Mexico, is 53% and 2%, respectively.

Precious metals

Gold’s safe-haven perception has seen prices rebound sharply, striking back above USD2,900/oz in response to US tariffs on Canada and Mexico coming into effect, along with an additional 10% tariff on China. Gold benefited from its safe-haven perception as both the USD and yields fell. We hold conviction in gold’s unshakable bull market (our most constructive commodities conviction for the second consecutive year), reinforced by a combination of “fear” (geopolitical hedge of first resort) and “wealth” (EM central bank demand) dimensions.

Bulk commodities

China’s National Development and Reform Commission (NDRC) has pledged to address overproduction in its steel sector and restore profitability at mills. There were no specifics given on the volume of cuts in the sector – one of the worst-affected by the property market slowdown.

Agriculture

Grain prices – wheat, corn and soybean – have halted their recent slide after US Commerce Secretary Lutnick signalled potential tariff relief for Mexico and Canada. Meanwhile, China has responded to US tariffs, by targeting US agricultural exports. China’s Ministry of Commerce has rejected the US tariff increase, imposing import suspensions on a number of US firms (including agricultural firms), along with the imposition of retaliatory tariffs from 10 March of an additional 10% on US soybean, pork, beef, aquatic products, vegetables and dairy imports (the main agricultural import line from the US) and an additional 15% tariff on US imports of corn, wheat, sorghum, cotton and poultry products.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.