To read the full report, please download the PDF above.

Geopolitical tensions reinforce the structural tightness in freight and refining markets

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

From the start of the Red Sea disruptions, expectations have been of larger upside price pressures on refined products, and especially clean freight rates, than on crude oil. The escalation over recent weeks with disruptions to the Ust-Luga exports terminal in the Baltic Sea, the Tuapse refinery in the Black Sea, and an attack on a Trafigura tanker carrying Russian naphtha shows that the scale and geographical scope of oil market disruptions from the Ukraine and Middle Eastern conflicts are expanding. The recent rise in clean freight rates is boosting the prices of refined products in net importing regions, including diesel in Europe, naphtha and fuel oil in Asia, and gasoline in the US. Looking ahead, with the US seemingly laser focused on delivering a Gaza ceasefire and hostage deal owing to the approaching US elections as well as the risks that their absence would entail for regional escalation, we anticipate refined product crack futures to begin pricing an end to the Red Sea disruptions. Yet, the downstream refining system remains tight, implying structurally elevated refined product margins and timespreads – despite the probability of geopolitical tensions easing.

Energy

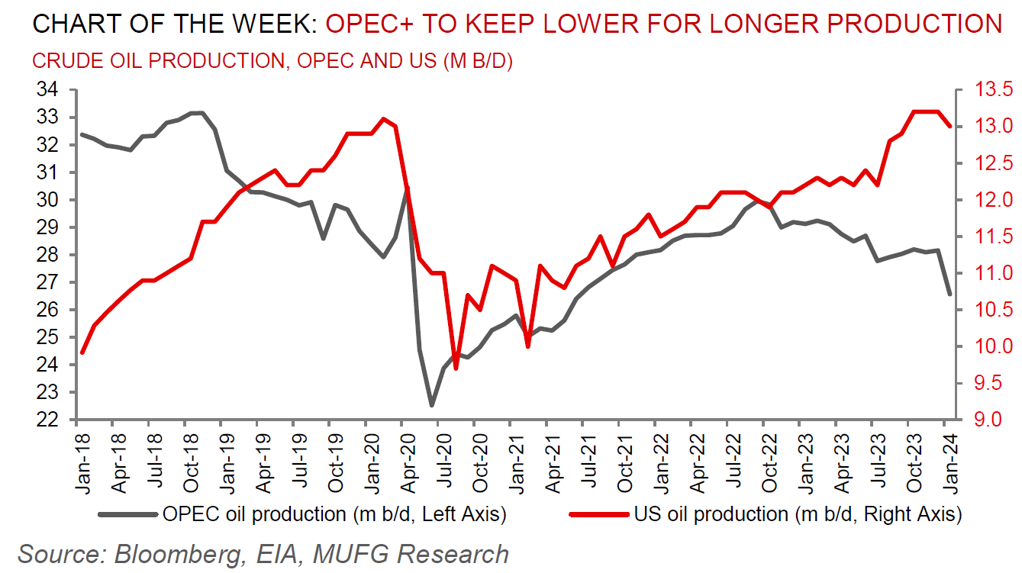

Notwithstanding lingering geopolitical risks, oil prices may be poised for a leg lower as algorithms liquidate net-long positions, reinforced by WTI’s prompt-spread flipping into contango (market structure where barrels for earlier delivery are cheaper than those for later delivery – signalling oversupply). Meanwhile, natural gas prices in both the US (Henry Hub) and Europe (TTF) are now below what we believe is required to induce new capacity growth given recent increases to interest costs but there has yet to be any indication from producers of delays to project development.

Base metals

Copper and aluminium have retraced some lost ground in recent trading sessions as China’s production of the base metals fell in January and risk appetite improved on hopes that the top consumer will take more dynamic measures to prop up its financial market.

Precious metals

Gold’s prospects in the first quarter of year is losing some shine as expectations for a near-term Fed rate cut has ebbed – our US rates strategist has pushed back MUFG’s forecast for the first US cut from March to May. While this development is likely to extend the current phase of range-bound gold prices, with short-term moves tied to data potentially influencing Fed decision-making, we believe downside to the price will be limited by robust support from the other two channels of our trifecta outlines in our commodities 2024 outlook, namely, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Despite promising Chinese stimulus efforts, iron ore’s excessive enthusiasm appears to be draining away. There’s renewed focus on the supply-side narrative with Brazil’s Vale just turning in a bumper quarterly production report, and combined flows from Brazil and Australia’s main gateway at Port Hedland that hit a record last month.

Agriculture

Rice in Asia is set to resume its rum towards USD700/MT as India seeks to tackle challenging high domestic prices, despite a host of restrictions already implemented by the world’s top exporter to keep them in check.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.