To read the full report, please download the PDF above.

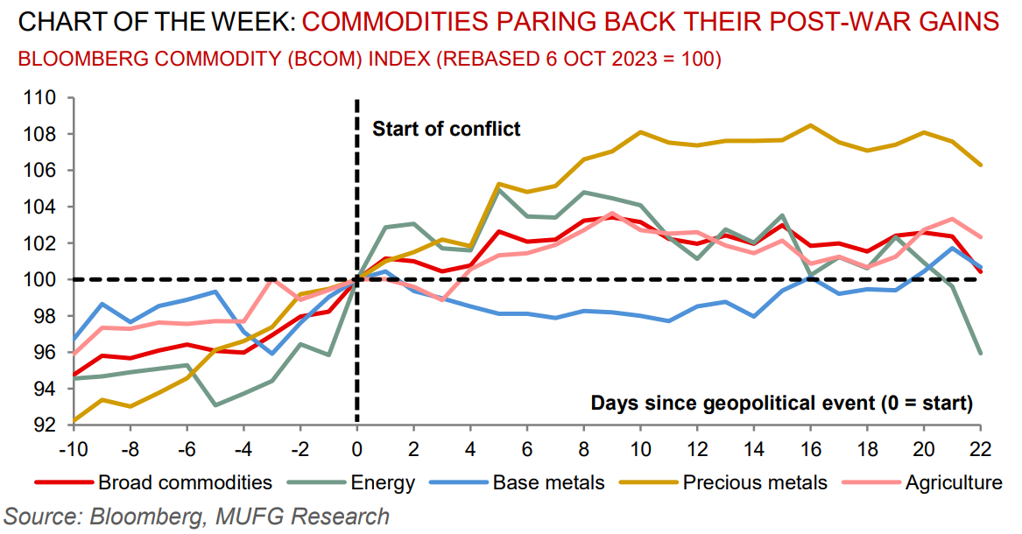

Commodities have all but given back their war-risk premium

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Our thoughts continue to be with those affected by the ongoing conflict in the Middle East. Major commodity option markets attracted a host of geopolitical investor positioning after Hamas attacked Israel on 6 October. Traders piled into bullish call options (notably in energy) to protect against, or profit from, rising commodity prices in the scenario that the conflict widens in a broader conflagration. Now, with the geopolitical pulse pivoting towards a humanitarian pause and expectations that escalation will be contained (in line with our base case scenario – see here), commodity option call skews (a measure of the relative value of bullish call options versus bearish put options) are waning. Beyond the options market, all major commodity sub-indices have all but given back their geopolitical risk premiums in the spot market (bar safe-haven precious metals which is being supported by rising recessionary angst). On net, global markets had been bracing for another negative supply shock in the form of elevated commodity (especially energy) prices when the conflict began. With an intensified push for conflict de-escalation gathering momentum somewhat, attention is returning to volatile swings in bond markets and the broader fragilities of the global economy.

Energy

Oil bulls are in distress with Brent crude flirting back around the USD80/b handle – lowest in more than three months. The mood music has pivoted from pricing in geopolitics-induced supply-side risk premiums back to pricing in demand-side risk discounts. Lacklustre Chinese demand is in focus – with refining margins tumbling, stockpiles building and the anticipated jump in air travel yet to take-off. Meanwhile, a warmer turn of the weather in the US thus far in the winter heating season is leaving risks to US natural gas (Henry Hub) prices skewed to the downside.

Base metals

Nickel is solidifying its status as this year’s weakest base metal (down ~40% year-to-date and falling to the lowest in more than two years) as new supplies from Indonesia overwhelms demand. More broadly, base metals are retreating as investors weigh demand prospects following tepid trade data from China having been given a boost earlier this month over China’s steps to prop up growth.

Precious metals

Gold continues to lose ground to both a rise in risk-on trading as war haven bets wither and a rising US dollar. As we have been cataloguing, we continue to believe that the conflict is not likely to cause a sustained gold rally with bullion comprising a poor track record as a hedge against heightened geopolitical risk that often proves short-lived, with the exception being when oil supply is threatened (see here).

Bulk commodities

The most considerable upside surprise across the commodities complex thus far in H2 2023 has been iron ore’s striking performance, up ~12% since the beginning of July. This has reflected a tighter balance path since mid-year, in turn rooted in two bullish onshore micro surprises. First, the policy steel cuts anticipated for H2 2023 this year – which would have generated a negative iron ore demand shock – have not materialised. Second, even though mills margins have deteriorated over the past quarter, this has not generated production cuts as might have been expected.

Agriculture

Australia – a top exporter of wheat, barley and canola – experienced the driest October in more than 20 years as an El Nino weather pattern continues to bring dry, hot conditions. Combined with more extreme weather and hotter temperatures due to accelerated climate change, the stage is set for the world’s costliest El Nino cycle that can disrupt supply chains and adds to the risk of stagflation (see here).

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.