To read the full report, please download the PDF above.

Contextualising the “art of the delay” in tariffs across commodities

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

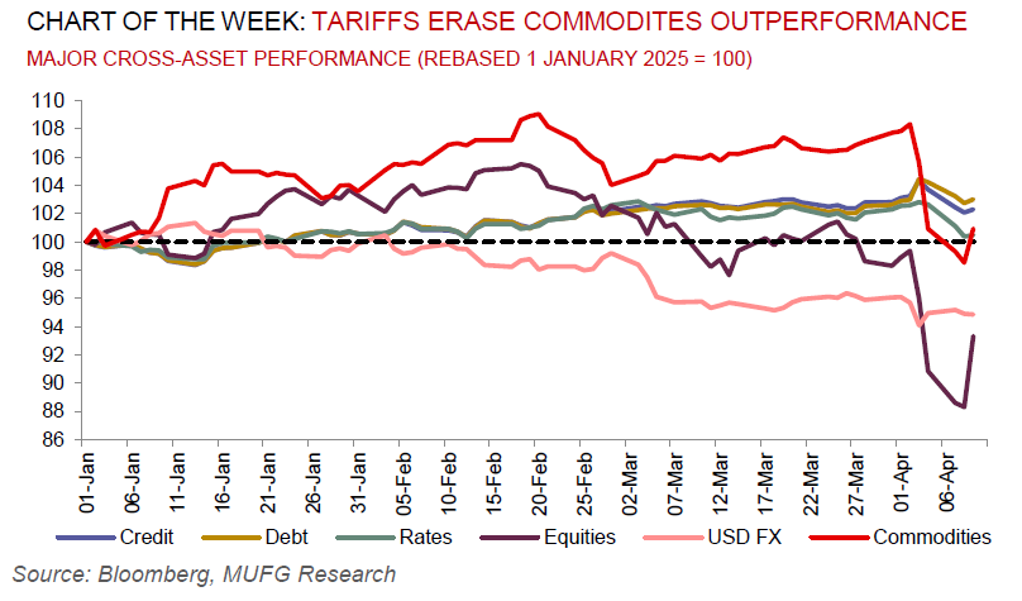

Commodity prices that initially were hit hard by the escalation of trade tensions since President Trump’s “Liberation Day” announcement have found some reprieve. On 9 April, President Trump announced a 90 day pause on the additional country-specific portion of the “reciprocal” tariff. This leaves in place all prior tariffs and the 10% “universal” portion of the reciprocal tariff (and we continue to expect additional sector-specific tariffs). Critically, there was no relief for China, with US tariffs rising to 125%, after China raised tariffs on US goods to 84%. This matters for the commodities complex as China is the world’s largest importer across a host of commodities. The lingering uncertainty is still likely to drag on global growth though conditions are promisingly not as dismal as the 11th hour 90 day pause announced by President Trump. Looking ahead, the opacity of the Trump administration’s approach to policymaking is set to keep volatility elevated. In such an environment, we maintain our conviction gold’s role as a geopolitical hedge of first resort remains resolute. We recently raised our end-2025 gold price forecast to USD3,450/oz (from USD3,080/oz) on the back of recent upside surprises in ETF inflows and continued robust EM central bank demand. We view the risks to even this higher (and above consensus) forecast as skewed to the upside over the medium term, and find that gold prices could breach the USD4,000/oz by year-end in extreme tail scenarios. Accordingly, we reiterate our 2025 commodities outlook long gold conviction, though we believe a potential Russia-Ukraine peace deal or sharp equity selloff that triggers margin-driven gold liquidation may offer investors a more attractive entry point.

Energy

Global oil markets have been hit by a perfect storm – higher-than-anticipated (albeit delayed) US reciprocal tariffs and higher-than-articulated OPEC+ supply increases. This has prompted us to revise our already loose fundamentals balance this year to an oversupply of 1.2m b/d (from 0.9m b/d previously) on average. We maintain our Brent Q2 2025 and 2025 average forecasts of USD69/b and USD73/b, respectively, for now but should signs suggest that the tariff tantrum will be sustained, we will look to lower our price estimates. For now, we recommend investors and producers hedge further downside, while refiners hedge deferred margins.

Base metals

Across the base metals, since 2 April, US copper prices have fallen by ~19%, close to bear market territory levels, while aluminium and zinc prices have fallen by 8% and ~7%, respectively. China’s retaliatory measures in response to US tariffs included an announced 34% tariffs on all imports from the US (starting 10 April), rare earth export restrictions, and a number of other non-tariff countermeasures. More recently, there has been further escalation with the US administration adding a further 50% to tariffs, taking the total import duties from China to 104%. Looking ahead, the tariffs’ downside risk implications to global economic growth reinforce our cautious near-term view on the complex.

Precious metals

Gold continues to break record highs (see Global Commodities section), driven by haven demand amid geopolitical tensions as well as concerns over a US economic slowdown. In a disconcerting sign, the gold/oil ratio – representing the number of barrels of crude oil equivalent in price to one troy ounce of gold, with a higher ratio presaging slower global economic growth – is currently above 43, returning to levels seen during the height of COVID in 2020.

Bulk commodities

Bulk commodity price movements have thus far been a tad more muted compared to base metals, although spot iron ore prices have fallen quite sharply in recent sessions. Iron ore prices have fallen by ~8% since 2 April, while thermal coal prices have fallen by ~3%, and coking coal prices have risen by ~8%. For the demand outlook for bulk commodities, a key signpost is whether China’s policy stimulus, such as support for infrastructure and consumer spending on manufactured goods, will be suffice to maintain steel demand and output.

Agriculture

Agricultural commodities have also seen some moves following the recent tariff announcements, largely reflecting risks to the demand outlook. The most heavily impacted across the grains has been soybeans, with prices down 4% since 2 April, reflecting downside risks to demand stemming from retaliatory tariffs. As we in February, the US-China trade war under Trump 1.0 saw US farmers, particularly soybean producers, heavily impacted.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.