To read the full report, please download the PDF above.

Searching for the floor

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

The ructions in commodities continues. Headwinds in the largest traded commodity – crude oil – have been most severe this week with Brent oil plunging sub-USD70/b for the first time since December 2021. Another heavyweight, copper, has followed a similar trading pattern with ballooning inventories and weakness in China’s property sector delaying the green transition demand induced structural deficits (and scarcity pricing). Iron ore – the most China centric industrial commodity – may fall further despite seasonal resilience amid weak fundamentals. The broader commonality in the bearishness points by-and-large to China, and its malaise is screaming louder following a slew of data that is raising fresh doubts whether the commodities leviathan consumer can meet its economic growth target this year. All in, the commodities complex is struggling to find a floor with investors lacking conviction in buying the dip, creating an air pocket lower on sparse newsflow. In this context, we recommend a more selective, less constructive, tactical approach to commodity investing. We reiterate our highest conviction views in the current uncertain environment remains long gold, short long-dated European gas, higher implied volatility in crude oil and a delay (not derailment) in copper’s scarcity pricing.

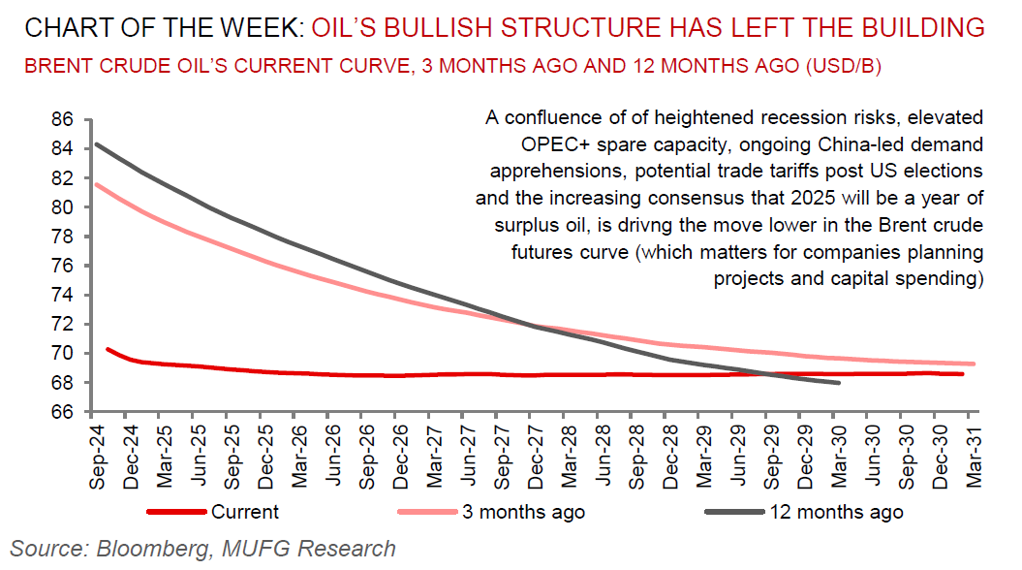

Energy

The oil market’s bullish structure is waning rapidly. Alongside the acute leg lower in Brent spot prices to the low USD70s/b (first time since December 2021), the back-end of the futures curve to 2031 is now trading only a few cents lower than Brent’s nearest contract (a year ago the price differential between the front and back of the Brent futures curve was +USD20/b). A confluence of heightened recession risks, elevated OPEC+ spare capacity, ongoing China-led demand apprehensions, potential trade tariffs post US elections and the increasing consensus that 2025 will be a year of surplus oil, is driving the move lower in the curve (which matters for companies planning projects and capital spending). Whilst it is plausible to assume additional delays beyond the two month extension of the OPEC+ production cuts given the group’s agility and data dependent approach, there is a risk that OPEC+ pivots its strategy in 2025 towards a long-run equilibrium focused on strategically disciplining non-OPEC+ supply (and fortifying internal cohesion), through ramping up its barrels to market.

Base metals

Base metals – led by copper, aluminium and nickel – remain well down from the May peaks owing to elevated inventories and China’s ongoing growth malaise (led by its ailing property sector). High rates have been a critical headwind to base metals, driving a significant negative physical demand distortion from destocking and weighing on capital intensive end-demand segments. In that context, the sharp rates unwind in a soft landing environment offers good entry given late cycle driven scarcity, a tentative revival in global manufacturing and attractive returns.

Precious metals

Gold is on track to notch another record before the week is done with a stronger Japanese yen, a weaker US dollar and the 10 year Treasury yields down for successive trading sessions. We hold conviction in our above-consensus call for gold and forecast prices to rise to USD2,750/oz by year-end and breach the USD3,000/oz threshold in 2025, owing to its role as a geopolitical hedge of first resort in an uncertain operating environment, imminent Fed rate cuts, unprecedented central bank demand for gold, bullion-backed ETFs expanding, the risk of inflationary US policies after the elections from shocks including tariffs and rising debt apprehensions.

Bulk commodities

Iron ore’s sharp leg lower is on tract to test the view whether the steelmaking commodity can find anchored support at USD90/MT as lower prices threatens to force high-cost mine closures (notably in parts of India, Brazil and Mongolia), in order to rebalance market fundamentals.

Agriculture

Soybean prices have fallen to two week lows as US supplies continues to look ample and the harvest accelerates. CBOT soybean positioning appears the most vulnerable across row crop markets relative to seasonal norms, in the event of an unexpected yield or acreage cut.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.