Higher-for-longer rates is catalysing commodity de-stocking

Global commodities

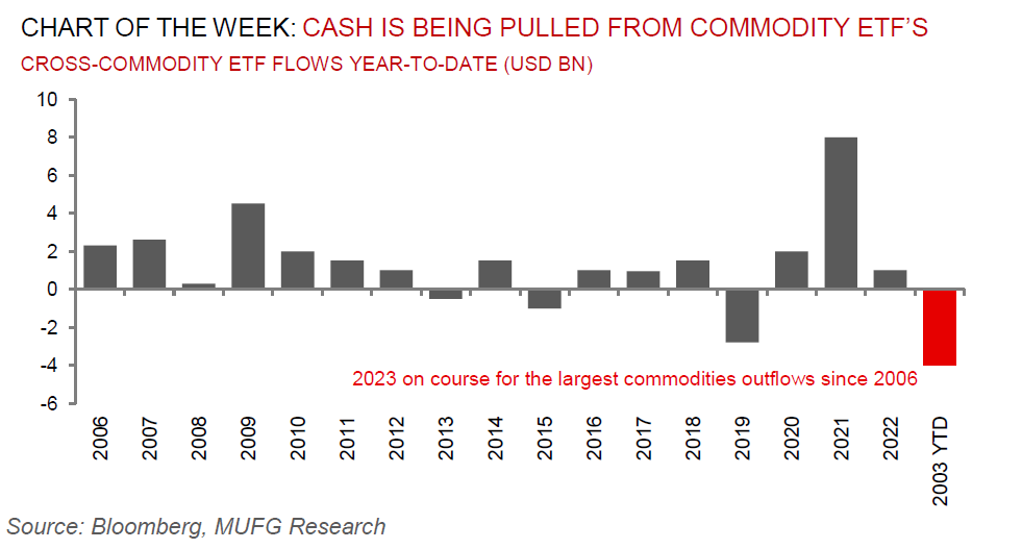

Global markets have seldom seen such an acute rise in funding costs from such a low level. Higher borrowing costs is rationally driving commodity destocking as physical storage increasingly turns expensive. Paper commodity markets have also experienced a similar de-stock, given the cost of holding positions against higher funding costs and more volatility – hence higher net short managed money positioning (see here). In essence, global markets have cashed in on their insurance policies in the form of physical and financial hedges, which in our view leaves the commodities complex exposed to upside should we avoid a hard-landing recessionary scenario. Should inventories draw back down towards levels of depletion that warrant convex scarcity premia, the key question is what then comes next after de-stocking. As much of the physical and paper de-stocking was driven by recessionary concerns, a risk reversal must come from an easing of such fears, concurrent with a physical tightening in commodity markets. With receding debt ceiling crisis concerns, a more stable DM banking sector and increased backwardation (supply tightness), we are convicted that commodities multi-month price slump is coming to an end.

Energy

Oil’s renaissance has taken Brent back north of USD80/b, as indications mount that the long-held view of a tightening in H2 2023 is beginning to materialise through higher prices. With this, despite an encouraging US CPI print for June this week, alongside persistently robust data on labour-market strength, the tentative signs that oil prices are quietly rebounding does add to reasons for the Fed to maintain its hawkish settings for a while longer. Meanwhile, US natural gas production as reported by Wood Mackenzie has broken its 102.2Bcf 23 February record this month, reaching 103Bcf, driven by a sharp rise in Permian volumes.

Base metals

Whilst manufacturing PMIs for June – a core barometer for base metals demand – remained in sub-50 contractionary territory for the tenth consecutive month. We note that base metals inventories remain at extreme lows, signalling that any material policy adjustments (notably Chinese stimulus or DM rate cuts), could have marked motivations on prices when they eventuate. Until then, the base metals complex is likely to remain restrained.

Precious metals

Gold has extended gains to three-week highs aided by moderate data, which is pushing yields and the US dollar lower. As we have regularly catalogued, gold is one of our favourite commodities to be long, as we are now past Fed peak hawkishness, alongside continued purchases of gold from EM central banks (see here and here).

Bulk commodities

Iron ore remains lacklustre with the steelmaking staple under pressure from both sides. Demand is challenged as China’s recovery underwhelms and the property sector continues to misfire. In tandem, miners’ supply seems to be delivering well to market, with vessel-tracking pointing to near-record flows from Australia in June.

Agriculture

All eyes are on the UN-backed Black Sea Grain Initiative that has enabled Ukrainian grain shipments since July 2022, which is set to lapse on 17 July unless it is extended for a fourth time. Amid Moscow’s threats to end the deal, citing a refusal by the West and Ukraine to meet its demands on facilitating Russian grain and fertilizer exports, the deal’s extension is at risk.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.