To read the full report, please download the PDF above.

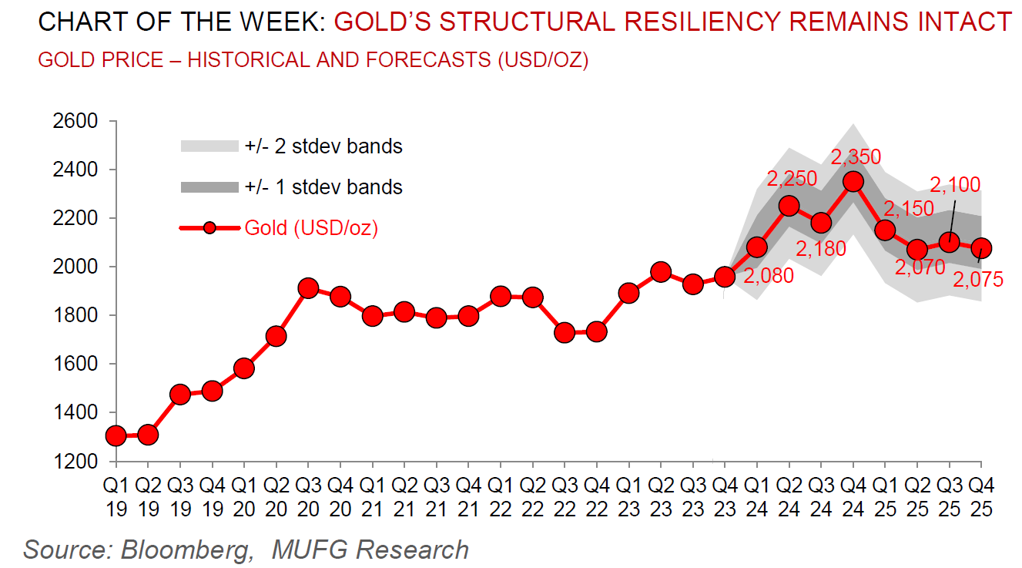

Gold’s structural resilience has further to run

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Gold is enjoying a remarkable start to the year, surprising even our above-consensus forecasts, both in its upward intensity, as well as in outpaced cues from FX and rates markets. With investors hardening their call for a June Fed rate cut following last week’s tepid US payrolls print, bullion is flirting closer to the USD2,200/oz level (up ~6% year-to-date). Our 2024 commodities outlook stressed gold as our most bullish call with our year-end forecast at USD2,350/oz on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here). Whilst these factors are very much in play, it is of note that the inflow pushing gold higher in recent sessions is more financial than physical. Encouraged by a confluence of a stronger safe haven bid and more technical drivers, the recent boisterous gold price action points to acute investor lengthening, predominantly from the systematic momentum-based CTA community, accentuating the influence of flow in gold. Yet, beyond the likely solidification of Fed cut expectations in the coming weeks and months, it is the structural channels of physical demand for gold that excites us most, which we view will unlock more than just systematic momentum. As such, we expect central bank purchases for gold to remain resilient on the back of reserve diversification by EM countries (compared with DM peers) with geopolitical tensions elevated.

Energy

Oil is rallying after US crude stockpiles shrunk for the first time in seven weeks and Ukraine’s latest attacks on another Russian refinery raises the geopolitical risk premia. Meanwhile in the natural gas space, the Asia LNG price (JKM) premium to European gas (TTF) is widening – with the JKM-TTF spread rallying to ~USD0.6/mmBtu from ~USD0.40 in recent weeks driven by tighter supply availability – and we now expect a more moderate upside to the spread from here relatively to our previous expectations.

Base metals

Copper has spiked to a near one year high after Chinese smelters pledged to explore measures to cope with a plunge in processing fees, including the prospect of production curbs that could leave buyers undersupplied. We would caution the base metal’s upside from here by ongoing demand apprehensions in China and higher interest rates.

Precious metals

Beyond gold’s stellar outperformance, silver and precious group metals (PGMs) are also up notably as investors are targeting these precious metals in wake of gold rally – all three can go higher from here (see Global Commodities section above).

Bulk commodities

Iron ore is sinking as investors are forced to recognise that policymakers in China are not about to turn up the dial on steel-intensive stimulus this year. The latest leg of the sell-off signals that benchmark prices are ~25% year-to-date lower, that brings into view the level that may begin to call into question some of the world’s higher cost production.

Agriculture

Wheat prices are edging lower, easing back recent gains as demand remains limited against abundant world grain supplies. To put this into context, the wheat market had been boosted in recent weeks by investors buying back earlier short positions, even as China was cancelling record amounts of US wheat export shipments. Yet, with cash values declining in major shippers Russia and Australia, US prices have remained under pressure unless weather conditions worsen.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.