To read the full report, please download the PDF above.

Framing tariff-induced stagflation risks

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

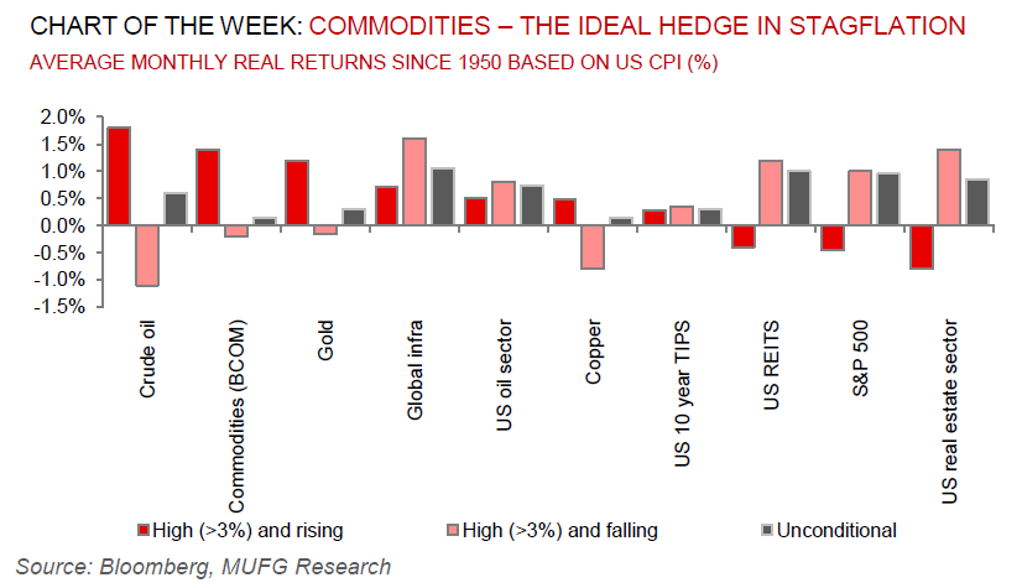

President Trump has imposed towering tariffs on all countries. These tariffs have a distinctly stagflationary flavour. They push up import prices that then pass through into higher consumer goods prices and inflation – acting as a tax on spending and, thus, creating a corresponding drag on economic growth. In such a textbook stagflationary environment as today, a portfolio allocation to commodities – as real physical assets – have historically proven to substantially improve the diversification and the real risk/reward of a multi-asset portfolio. At stagflations core, is the proposition that due to severe limitations on supply, the market needs to rebalance through demand curtailments. A precondition for stagflation, therefore, is the presence of factors which limits supply growth (today’s global trade war). Thus, as commodities are assets which perform best when they are tight, they are an ideal hedge for stagflation, where demand remains above supply (in contrast to recessions, where demand falls below supply, leading to broad-based surpluses, and thus downward pressures for commodities). Yet, we caution that it pays to be selective across the commodities complex as the source of inflation matters. Today’s inflation risks are a mix of cost push (tariff-induced higher input supply costs) and monetary debasement (deglobalisation-induced dedollarisation). Defensive (rather than outright cyclical) exposures are recommended in this setting, which leans us bearish crude oil, guarded on base metals led by copper and structurally bullish on safe haven gold, until the growth momentum troughs.

Energy

Oil prices are quietly advancing after hitting the lowest level in four years last week, as a slew of bullish factors is offsetting still lingering concerns about US tariffs hampering energy demand. A confluence of China’s signal in its openness to trade negotiations with the Trump administration, reports that nuclear deliberations between the US and Iran appear to have hit a snag as well as US crude inventory data that showed levels at the Cushing storage hub have fallen to the lowest in 2008, is offering price support. More broadly, we recognise that that global economic outlook remains extremely fluid, particularly with respect to the US imposition of tariffs on China. In part because of these uncertainties, and in part because it is unclear how the global economy will cope with the dramatic increase in uncertainty, we prefer to maintain our Brent crude call for prices to average USD69/b and USD73/b, for Q2 2025 and 2025 as a whole, respectively, until the dust settles somewhat.

Base metals

US copper majors have called on President Trump to restrict exports of copper ore and scrap metal, instead of imposing tariffs on imports, to boost domestic production. The industry’s recommendations include introducing tax credits, streamlining the permitting process for new mines, and imposing tariffs on imports of semi-fabricated products containing copper to boost the US copper sector. On net, given the uncertainty surrounding exactly how far copper prices can fall, our view is still to wait to buy until President Trump reverses tariffs, fully redistributes tariff revenue, and/or Fed/China policy puts kick-in. Downside for pricing depends how quickly this occurs and how rapidly US copper scrap can return to global markets.

Precious metals

Gold continues to break record highs, and now flirting ~USD3,300/oz – surpassing even our above consensus forecast expectations. Whilst investors liquidated gold holdings to meet margin calls during last week’s equity market turmoil, positions are being bought back on tariff angst as well as central banks continuing to accumulate bullion allotments. We further mark-to-market our price levels higher to USD3,850/oz (from USD3,450/oz) by year-end and raise our 2026 average price level to USD4,150/oz (from USD3,600/oz). This resolutely bullish narrative is centred on our conviction of (1) a confluence of US policy uncertainty that will continue supporting investor demand, (2) fears surrounding US sovereign debt sustainability, as well as (3) central bank bullion demand remaining structurally higher than before the freezing of the Central Bank of Russia’s bank reserves in 2022.

Bulk commodities

Notwithstanding the Chinese authorities pledge to address the steel industry’s overcapacity, crude steel output increased 4.6% y/y in March to ~93m tons, driven by a surge in exports and lower raw material costs. Coking coal also witnessed record-high output last month.

Agriculture

Sugar prices have fallen to the lowest in more than two years on expectations of ample global supplies. The price decline is attributed to strong production in Brazil and robust prospects for supplies in India for next harvest season.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.