To read the full report, please download the PDF above.

China’s long on words but short of numbers stimulus leaves commodities asking questions

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

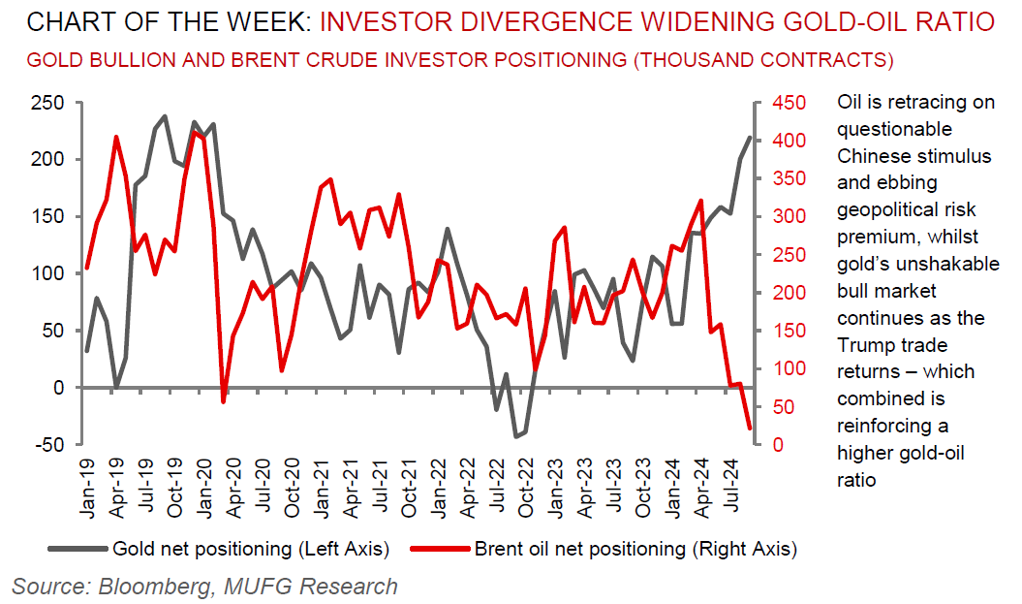

Commodities are struggling to find direction after China’s briefing on 12 October was long on words but short of a big number for fiscal stimulus. At face value, while the market is anticipating further guidance from China’s Ministry of Finance and further direction from the Standing Committee of the National People’s Congress (NPC) on government support measures later this month, the impact across the commodities complex has been nuanced. For the energy space, we expect the stimulus reverberations on demand and prices to remain subdued with stimulus measures doing little to stymie the road fuel shift from oil to power (via EVs) and natural gas. For base metals and bulk commodities, the price pullback on a lack of specifics on the size of fiscal stimulus last weekend, may offer a tactical buying opportunity (especially for copper and iron ore) should a concrete fiscal quantum be communicated at the upcoming NPC meeting. All in, what is clear is that China’s persistent growth weakness has hit policymakers’ pain threshold, with a shift away from the authorities long-standing piecemeal style of policy easing. For commodities, expect the Chinese fiscal stimulus implications – once the total size and details become clear – to be heterogeneous.

Energy

Whilst the spectre of Middle East tensions remains top of mind with volatility gauges at a near 12 month high, crude oil prices have retreated sharply this week with reports that Israel will temper its Iranian reprisal, which is fading the geopolitical risk premium. This, alongside fears of a mounting supply glut in 2025 owing to OPEC and IEA demand-side downgrades, is pushing oil market positioning back towards bearish skews. Furthermore, there are early signals that the Trump trade is returning (given his recent improving election poll ratings), which could mean a stronger US dollar ahead, and with it another headwind for oil prices.

Base metals

China’s record-breaking run of aluminium production may extend into year-end, according to the Shanghai Metals Markets, as supply risks dissipate at a key facility. We have taken a neutral view on aluminium this quarter (USD2,415/MT price target) with global output at all-time highs, led by China, where utilisation is running at ~97%, and global inventories still ~35% higher than 2023 levels. Going into 2025, we view that the sharp rates unwind in a soft landing environment offers good entry given late cycle driven scarcity, a tentative revival in global manufacturing and attractive returns – which now is further reinforced by a plethora of Chinese stimulus measures.

Precious metals

Gold is breaching all-time highs owing to heightened US political uncertainty ahead of the elections in early November, alongside surging net speculative investor positioning as well as an expansion in bullion-backed ETFs. Gold’s structural strength continues to be buoyed by its role as a geopolitical hedge of first resort in an uncertain operating environment, unprecedented central bank demand for gold, the risk of inflationary US policies after the elections from shocks including tariffs and rising debt apprehensions. We hold conviction in our above-consensus call for gold and forecast prices to rise to USD2,750/oz by year-end and to breach the USD3,000/oz threshold in 2025.

Bulk commodities

The push-and-pull in iron ore prices is ongoing as China signalled a deeper push to address its ailing property market, while major miners, Vale and Rio Tinto, reported increased quarterly output with plans for further expansion.

Agriculture

According to latest weather forecasters, Maxar Technologies, rains over Russia’s wheat growing regions will help ease dry conditions, but crop stress continues for the world’s top grower of the grain.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.