To read the full report, please download the PDF above.

Gasoline price risks ahead of the US elections

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

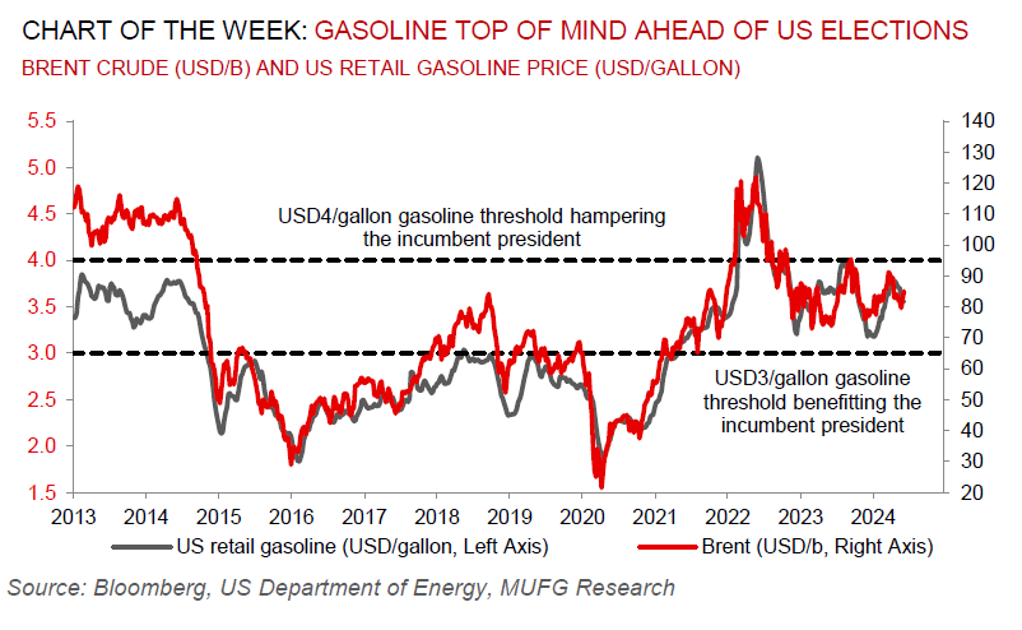

Notwithstanding gasoline prices constituting only ~4% of overall US consumer spending, ubiquitous gasoline price signs emblazoned with prices play an outsized role in voter perceptions on election day. Disruptions on the world’s major trade routes, refinery closures and resurgent demand are pushing up gasoline prices ahead of a fraught election campaign. In line with our moderately bullish Brent oil price call of USD88/b and USD93/b in Q3 and Q4 2024, respectively, we are equally constructive on US retail gasoline prices and expect levels to modestly expand from USD3.5/gallon today to average USD3.7-3.9/gallon ahead of November’s US presidential elections. Based on historical assessments, previous presidential election outcomes signal that if gasoline prices fall towards USD3/gallon by election day, the incumbent president is well-positioned (ceteris paribus) to win re-election. Whilst, if gasoline prices are north of USD4/gallon, the opposition candidate is more likely to prevail. What is clear to us is that the current retail gasoline prices may be at an inflection point of awareness for the US consumer as today’s levels tallies to the salient “~USD50 to fill a tank” level. Looking ahead, further gasoline price increases may begin to garner public attention. Indeed, the Biden administration stated on 17 June that it is ready to release even more crude oil from its Strategic Petroleum Reserves (SPR) to halt any jump in gasoline prices. Although SPR releases may help reduce gasoline prices (and inflationary pressures) ahead of the elections, we view that does little to address the underlying supply/demand imbalance miring the global oil complex in H2 2024.

Energy

Brent crude prices are back north of USD85/b (highest since late April), buoyed by a risk-on sentiment move, as well as more evident signs that fundamentals remain mired in deficit (demand above supply), reinforced by ongoing global crude stockpile draws and a backwardated futures curve (signalling supply tightness). Meanwhile, European natural gas (TTF) prices are finding support following an unplanned outage at the Nyhamna processing plant in Norway (impacting 33.8mcm/day of production). Yet, with European natural gas storage levels currently at 68% full (well above seasonal average) and on track for 100% “tank top” full levels to start the winter heating season in October, we reiterate our bearish TTF average price call of EUR23/MWh and EUR30/MWh in Q3 and Q4 2024, respectively.

Base metals

The latest Chinese customs data point to copper exports hitting a record in May, as weak domestic demand forced trades to seek markets overseas for their surplus. This has seen LME copper retreat towards ~USD9,650/MT (following a May peak of ~USD11,000/MT), and with positioning extended and stockpiles high, the case for a further drawdown may be gaining traction. Though this could become transitorily self-perpetuating as speculative froth is ebbed, before the bull case (copper is our most bullish structural conviction) is reasserted.

Precious metals

Gold is finding (tentative) support on both, a gauge of US retail sales in May pointed to greater financial strain among consumers, as well as a slew of Fed officials recently emphasising the need for more evidence of cooling inflation before lowering rates. Separately, in an important development, around almost 60% of developed markets’ central banks believe that gold’s share of global reserves will rise in the next five years (up from 38% of respondents last year), according to an annual survey conducted by the World Gold Council.

Bulk commodities

Iron ore is continuing its chary rise, as traders weighed prospects for a recovery in China’s steel demand and a modest gain in output last month. Meanwhile, India is set to add more new coal power capacity than it has in almost a decade in 2024, as the country sprints to deploy generation to manage with soaring electricity demand.

Agriculture

Wheat from European countries bordering the Black Sea is trading cheaper than the commodity from competitors, as bumper crops in the region (especially Romania and Bulgaria) help push down prices.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.