To read the full report, please download the PDF above.

Red Sea geopolitical risk premium a menace more for global inflation than for commodities

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

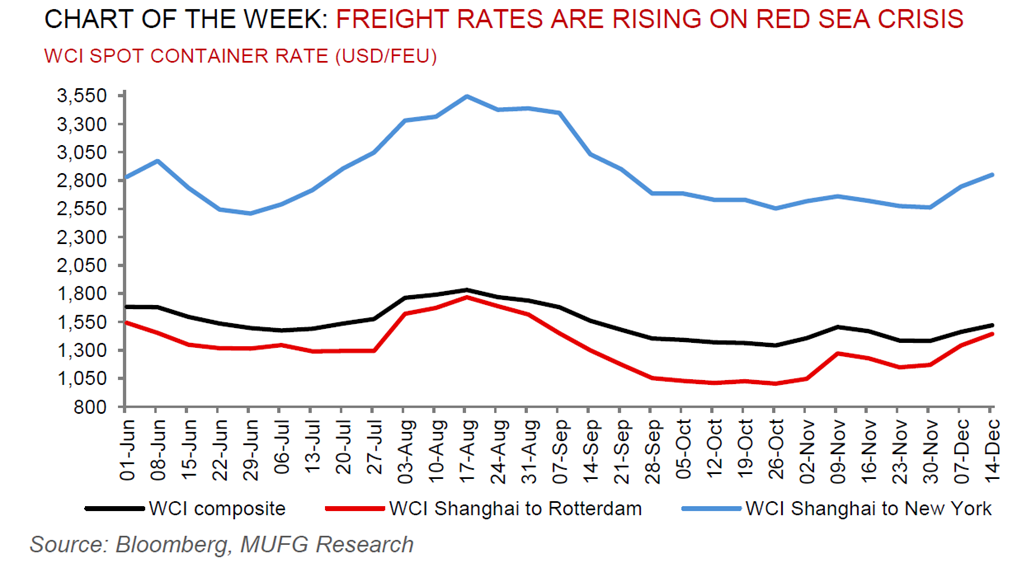

For the world to orderly function, ships must reach their ports. They are most susceptible when passing through narrow passages, such as the Bab al-Mandeb Strait, in the Red Sea (the only southern conduit into the Suez Canal). The recent spate of attacks by Yemen’s Houthi rebels on vessels transiting the Red Sea and Suez route that a hefty ~20% of global container volumes, ~10% of seaborne trade and ~9% of seaborne gas and oil passthrough (in a campaign to affront the principle of the freedom of navigation) is threatening global trade. The decision by the world’s five largest container liners – with ~65% of global capacity – to suspend transits through this sensitive waterway means higher freight rates, further price pressures for consumer goods and services, which ultimately risks fanning the flames of global inflation just as the Fed signalled it’s preparing to cut rates in 2024. Critically, we believe the disruptions are unlikely to have sustained ramifications on energy (crude oil and LNG) and broader commodity prices on a first order basis, as vessel redirection hamper global supply chains, not volumetric production that should not be directly impacted (ultimately reaching final destination but later than planned through longer voyages via South Africa’s Cape of Good Hope). Whilst the Red Sea crisis increases the risk of a regional conflagration, the announcement of an US-led new maritime task force to patrol the area on 18 December is likely to address this heightened Houthi threat. Whether that swiftly restores the flow of shipping through this critical passageway, and keeps inflation in-check, is an open question.

Energy

Oil’s geopolitical risk premium – dormant throughout the Israel-Gaza conflict – is reigniting some angst amongst traders as Houthi rebels menace tankers in the Red Sea. Yet, despite the heightened tensions, the market pulse still hinges on recession obsession through demand-side concerns – in particular, recently weakened Chinese demand for fuel and crude oil. Meanwhile, milder European weather for December have helped send natural gas (TTF) prices down ~20% thus far this month to ~EUR33/MWh – reinforcing that the winter heating season will pass comfortably with inventories well north of their five year averages.

Base metals

The Fed’s dovish pivot last week and subsequent rapid acceleration in easing expectations, has removed one of the key obstacles to base metals upside. High rates have been a crucial headwind to base metals economy this year, driving a significant negative physical demand distortion from destocking and weighing on capital intensive end-demand segments. With the sharp rates unwind in a robust US growth environment offers the space for a marked revival in prices.

Precious metals

The significant revision to the Fed’s policy path in last week’s dovish pivot, reinforces our US rates strategist all for rate cuts to commence early in 2024. As we highlighted in our 2024 commodities outlook, a friendlier Fed and falling US dollar strength should act to remove fundamental hurdles from gold’s upside path (see here). Indeed, gold is our most bullish call and is to hit record levels in 2024 on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort.

Bulk commodities

Iron ore is finding some lost ground amid tentative signals from Chinese authorities over efforts to ramp up fiscal and monetary policy support for the economy in the new year. Separately, Nippon Steel has defended the 142% premium it’s paying for US Steel (creating the second largest global steel producer), with president Eiji Hashimoto declaring that he wants to “complete to global network for a new era in the industry”.

Agriculture

Brazil has overtaken the US as the leading exporter of corn to China, just a year after the world’s top importer gave the go-ahead for supplies. Chinese imports have exceeded 20m tons for three straight years as the country looks to replenish stockpiles, while satisfying demand from the livestock feed and processing industries.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.