To read the full report, please download the PDF above.

Volatility fire sale over with commodities well-positioned for Fed rate cuts next month

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

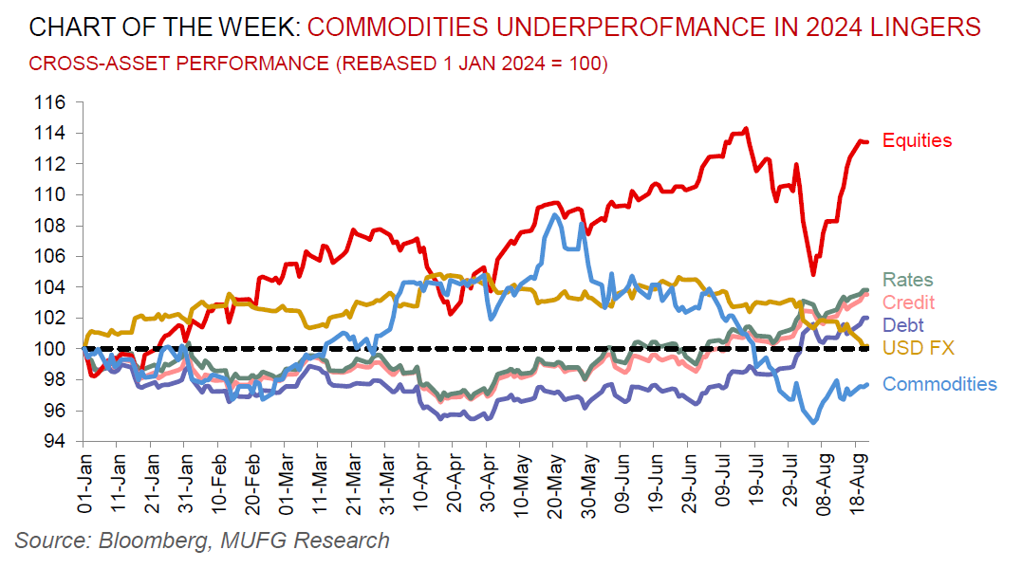

Navigating commodities in micro and macro cross-currents juxtaposed against thin summer liquidity has been the key theme over recent weeks. Hedge funds have turned predominantly bearish on commodities futures for the first time since 2016 – a remarkable reversal from the last eight years wherein the supply-constrained, structurally underinvested market, had prompted investors to hold a net bullish wager on commodities. The Bloomberg Commodity (BCOM) spot index was up 12% in 2024 to its May peak, but has given back those gains since, with the complex the worst performing major cross-asset class thus far this year. Yet, we believe the early August selloff was largely driven by excessive macro recession fears and sharp positioning unwinds across FX, bond, equity and commodity markets, rather than triggered by specific micro fundamentals. Indeed, we view these macro-related apprehensions should abate under our assumption of a no hard landing scenario, leading to renewed compression in volatility across the commodities complex. What does the rest of the year have in store for commodities? Absent a hard landing scenario, commodities have historically generated positive returns during the first six months following Fed rate cuts (which our US rates strategist believes will commence in September). Thus, we continue to see merits to own commodities during late cycle dynamics (where demand outstrips supply, and the output gap is positive), which can support diversification against rate cuts and policy hedging into the US elections.

Energy

Oil bears are having it their way with prices tumbling to January lows on growing recession risks, China’s economic malaise and encouraging signs that we may be nearing a ceasefire between Israel and Hamas that is easing the geopolitical risk premium. This has been reinforced by oil options markets skew (the cost of insuring against spikes and troughs in prices) which has tumbled back to a bearish bias in recent trading sessions. Meanwhile, European natural gas (TTF) prices have broken out of the EUR30-35/MWh range it has priced in during May-July, transitorily breaching EUR40/MWh earlier this month, and now moderating ~EUR38/MWh. The core driver of the move higher has been apprehensions that the remaining 42mcm/d of Russian gas flowing through Ukraine (~95 of total European gas supply) may be halted.

Base metals

The base metals complex is nearing its highest level in a month, with renewed investor appetite stemming from the Chinese authorities consideration of a new funding option for local governments to purchases unsold dwellings, as well as positioning ahead of the expected Fed easing next month (our examination suggests the median price change in base metals 18 months after the first Fed cuts is ~19% in non-recessionary episodes).

Precious metals

Gold has hit a fresh high this week with levels hovering north of USD2,500/oz, owing to the weaker US dollar on speculation that Fed Chair Power will flag steep rate reductions when he gives his Jackson Hole address on 23 August. We hold conviction in our above-consensus call for gold and forecast prices to rise to USD2,750/oz by year-end on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort.

Bulk commodities

Iron ore prices have collapsed over 20% from May highs to ~USD95/MT, as Chinese demand drops, global supplies boom and investor positioning turns increasingly bearish. Whilst the below USD100/MT has offered an attractive dip-buying opportunity in the past, this time is different. China is in transition to an economy led by new productive forces requiring less steel, which in-turn steel exports are also facing rising protectionist headwinds. Meanwhile, we view that the coal price rally in recent weeks (on the back of higher natural gas prices) may have now overshot fundamentals, and we anticipate a correction to ensue.

Agriculture

Grains – corn, soybeans and wheat – are under pressure as ample supplies from major growers (Australia, Argentina and Russia) ahead of the winter season, weigh on the market. Additional consolidation may be instore in the absence a major technical breakout that may offer traders to recalibrate their positions.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.