To read the full report, please download the PDF above.

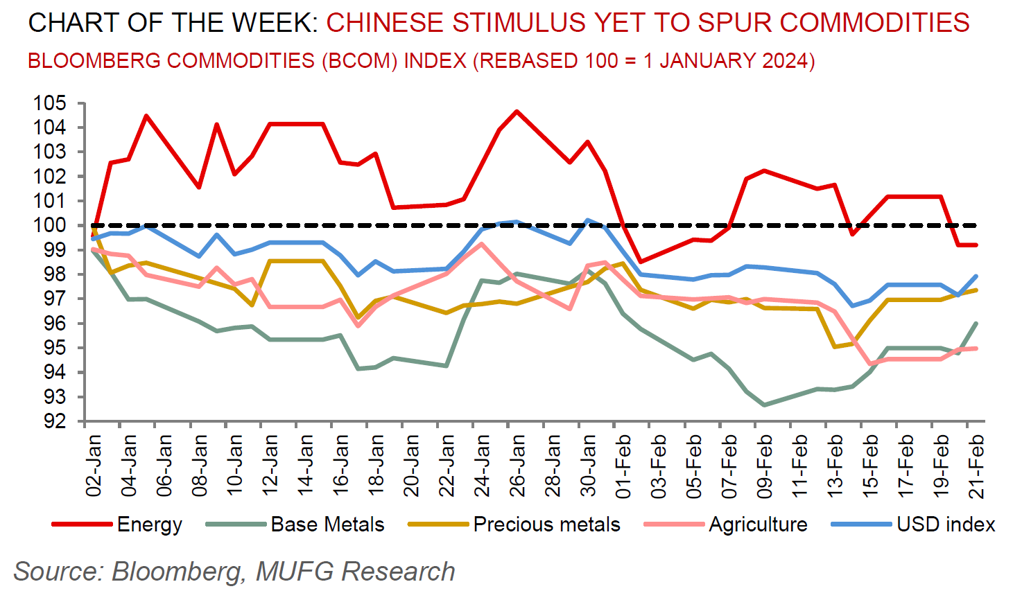

Commodities unimpressed with China’s start to its “Year of the Dragon”

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Commodities have greeted China’s return from its Lunar New Year (LNY) holidays in fairly sombre mood, signalling investors want to see further evidence that the authorities are tackling the economy’s deep-seated woes before turning constructive. Whilst travel and services spending during the LNY holiday exceeded levels from before COVID, suggesting signs of improved consumer sentiment, insights into the industrial economy have yet to show a comparable uptick. Indeed, property market headwinds loom, spurring the People’s Bank of China (PBoC) delivering its largest ever cut to its 5 year loan prime rate (LPR) in a bid offer proactive policy support. Against this backdrop, China-sensitive base metals remain still down year-to-date, although we recognise that the larger-than-expected cut to the LPR this week, may signal that the Chinese authorities remain focused on supporting growth conditions this year which, if reinforced by further policy easing measures, could provide upside risk to 2024 demand. The “Year of the Dragon” may be here, but it’s not exerting the firepower that commodities are craving just yet.

Energy

Crude oil’s quiet rally driven by escalating tensions in the Middle East, favourable seasonal trends and constructive investor sentiment is giving patient bull’s appetite that prices may finally break out of the USD10 range that it’s been confined to so far in 2024. Meanwhile, Asian LNG (JKM) prices have fallen to the lowest level since April 2021 with mild weather, buoyant inventories and robust exports is cementing the supply glut.

Base metals

Aluminium prices have spiked on speculation that a fresh wave of US sanctions against Russia set to be announced on 23 February may target the metal, potentially disrupting supplies. Although US President Biden has not been specific on which industries would be impacted, his comments of a “major” sanctions package stoked investor speculation that Russia’s leviathan metals industries could be in line for curbs that have escaped broad US sanctions to date.

Precious metals

Gold has held onto five consecutive days of gains ahead of Fed minutes on 21 February, that offered guidance on when the Fed may pivot towards monetary easing. Swaps traders are still pricing little prospects of the Fed lowering borrowing costs before June, after recent data reaffirmed US exceptionalism (higher rate are historically negative for non-interest bearing bullion).

Bulk commodities

Iron ore has clawed back some of its recent losses after Chinese steel mills recorded an increase in production, bolstering demand prospects for the bulk commodity. Still, higher steel output was accompanies by a large leap in inventory levels (24% y/y – largest going back four years) at major Chinese mills.

Agriculture

Wheat has held the largest advance in more than three months after lower rainfall across some key production areas in the US and Canada. Short covering is adding to bullish sentiment with geopolitical risks elevated.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.