To read the full report, please download the PDF above.

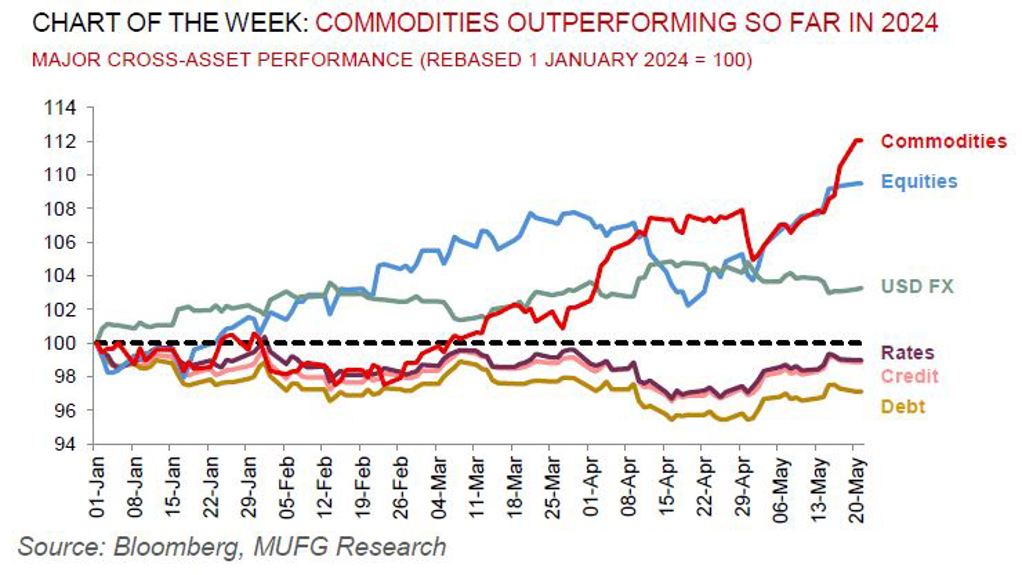

Commodity’s gains are not hard to explain with the classic late cycle rally in full motion

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Copper is in history-making mode. Gold has never been this expensive. Crude oil (WTI) is up nearly 10% this year. In fact, every major sub-component of the Bloomberg Commodities (BCOM) dashboard is up year-to-date, with the aggregate BCOM spot index the highest since January 2023. Whilst idiosyncratic narratives mire each commodity, commonalities signal that commodities have historically proven to be the best asset class to own during a late cycle phase – as we are in today – with demand above supply and inventories depleted (see here). This is corroborated with 15 of 23 commodities in the BCOM index in backwardation (supply tightness), and coverage ratios (inventories as a share of demand) signalling tightness across major commodities. More broadly, we have long argued that our decades-long commodities supercycle has been on pause – but not derailed – for much of the last year, given structural underinvestments in physical commodities (see here and here). Critically, the Fed’s attempt to soft land the economy through higher-for-longer rates that lowers demand and inflation may relieve the symptoms of underinvestment (commodity inflation), but cannot cure the underlying illness of inadequate production capacity. Yet, without sufficient capex to de-bottleneck the system and provide excess capacity through higher physical investments, commodities will remain stuck in a state of long-run shortages, with higher and more volatile prices – just as we are witnessing today.

Energy

Oil prices remain range-bound with volatility low as markets are in a wait-and-see mode ahead of the eagerly awaited OPEC+ 1 June meeting. As we documented last week, we anticipate OPEC+ to extend its 2.2m b/d production cuts for the rest of 2024 (see here), with lower-for-longer OPEC+ production and above historical average oil demand growth, pointing to strengthening balances in H2 2024, supporting our call for Brent to average USD88/b and USD93/b in Q3 and Q4 2024, respectively. Meanwhile, the +50% rally in US natural gas (Henry Hub) prices thus far this month is showing signs of a reversal with US natural gas production set to rebound in June as maintenance concludes – we stick to our average USD2.10/mmBtu forecast this quarter.

Base metals

Copper continues to trade in uncharted territory, testing all time highs from a striking short squeeze on the Comex. Copper’s path to scarcity is garnering traction which absence any near-term mine supply solver, the only way to maintain market function will be via demand destruction. Copper remains our most bullish long-term structural commodity conviction, and we have been cataloguing its unparalleled fundamentals – its central role in the energy transition (best conductor of electricity), in AI (vital for catalysing datacentres) and in military spending (in a deglobalised world) – since 2022 (see here, here and here).

Precious metals

Gold’s ascent to a series of records so far this year reinforces our 2024 commodities views that gold is our most bullish call this year on a trifecta of (eventual) Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here). We recognise that our above consensus year-end forecast of USD2,350/oz that we laid out at the start of the year, now look modest, but hold off in revising our call higher given our expectation of a modest correction with the 14 day RSI in overbought territory.

Bulk commodities

Iron ore – the most China centric industrial commodity – is extending its rebound to hit the highest level since early March. Positive growth sentiment in China owing to government rollouts of more support for its ailing property market. What’s more, China will start selling CNT1tn (USD139bn) of special bonds this week, the proceeds of which will be deployed to steady the economy.

Agriculture

Estimates for Russia’s next crop harvest have been slashed again this month as seasonably cold weather hit growing regions, and concern over tighter supplies is adding pressure to the futures market.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.