To read the full report, please download the PDF above.

Gold’s steamroller rally is far from overblown

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

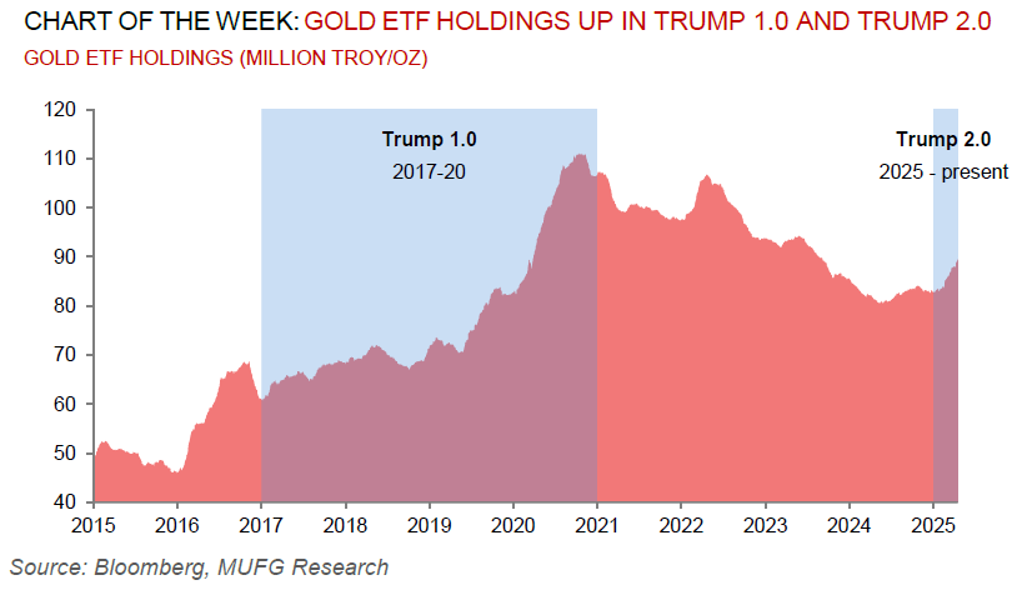

Gold’s history-making rally looks ferocious. The breakneck surge has witnessed bullion check off another box in its extraordinary rally, surpassing the USD3,500/oz threshold this week and up ~30% year-to-date. Yet, despite persistently notching fresh peaks, our conviction remains resolute that we are a distance away from overextended or bubble territory, and maintain our above consensus forecasts for gold to catapult even higher and hit USD3,850/oz by year-end and breach north of the USD4,000/oz threshold by Q2 2026. Our structural bull gold narrative that we have held since January 2024 is anchored on two dimensions. First, is its dominance as a “fear” play, with gold offering clear value against hedging geopolitical risks (risks of financial sanctions, especially post Ukraine war) and hedging financial risks (concerns around Fed subordination and US debt sustainability). Second, is its standing as a “wealth” play, premised on a structural pivot in reserve management behaviour by central banks (especially in emerging markets) that have increased bullion purchases by ~5x post Ukraine war, as well as our US rates strategists view of two 25bp Fed cuts in 2025 that will underpin further ETF inflows. On net, we reiterate our long gold recommendation but recognise that two potential (albeit uncertain) events may offer more attractive entry points – a Russia-Ukraine peace deal triggering speculative selling and/or a hawkish Fed adjustment leading to rate hikes that would present a mounting headwind to gold given its infinite duration.

Energy

Oil’s quiet ascent since its tariff-induced trough on 9 April has been stymied by renewed concerns that Kazakhstan has defied OPEC+ by prioritising national production targets over group quota levels. This growing internal discord within OPEC+ comes as oil bulls have been relishing on the recent risk-on mood reflecting easing Fed independence apprehensions, softer US rhetoric on China tariffs and a clearing of short positions in the midst of the first quarter’s earnings season. The next key catalyst for global oil markets is on 5 May when OPEC+ meets to decide production levels for June – note OPEC+ surprised markets by raising supply by 411k b/d in May (more than the 138k b/d initially planned). Meanwhile, European natural gas (TTF) prices are retracing some lost ground as traders assess reports that the European Union is preparing to discuss the notion of restricting spot purchases of gas from Russia as part of a plan to phase out energy imports from the country – thus, potentially limiting the continent’s supply options.

Base metals

The rebound in across the base metals complex continues with the latest catalyst stemming from US signals of a more conciliatory tone towards China in its trade war. While hopes of accelerated Chinese stimulus and still firm demand (and micro fundamentals) in China can potentially keep prices treading water near-term, we view the emerging and increasingly apparent loss in global demand momentum in the coming months will eventually pressure the base metals space, in our view. We thus remain guarded, especially for copper given its historical sensitivity to global growth uncertainty.

Precious metals

Beyond gold (see Global Commodities section above), despite still good fundamentals for silver, we see less scope for silver to outperform gold as the industrial outlook turns more uncertain – granted China solar module output is outpacing installations but Indian and US demand is set to contract, according to the Silver Institute.

Bulk commodities

The pressure on cyclically sensitive iron ore continues on concerns over the global growth outlook. Looking ahead, while the US only directly takes ~1% of China's steel exports, it does take ~20% of steel in goods (such as, machinery), signalling that the rapid tariff hikes on China may also put some downstream steel demand at risk. However, expectations are that potential Chinese stimulus may offset this weakness.

Agriculture

The prices of grains – wheat, corn and soybean – are under pressure this week as better-than-expected planting progress in the US and South America is buoying the supply outlook. Yet, US prices have fared relatively well thus far this year despite concerns that exports to China will be affected by the ongoing trade war.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.