To read the full report, please download the PDF above.

Parameterising commodity price volatility and the terms of trade

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

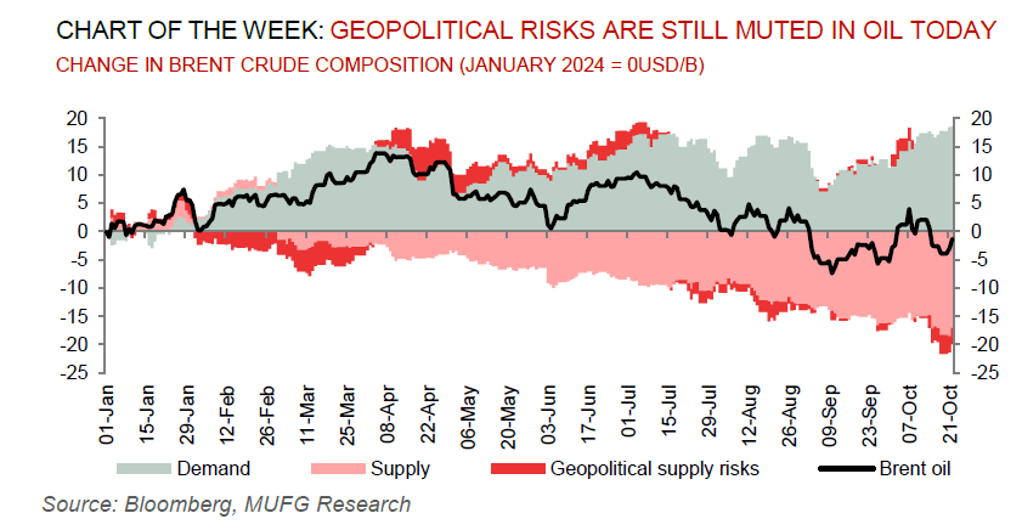

Commodity price volatility is surging and has further to run. Oil prices face two-sided risks – bullishness from potential geopolitical supply disruptions in the Middle East, against bearishness from OPEC+ likely ramping up its barrels into what is already set to be a surplus market in 2025. European natural gas prices also face two-sided risks – bullishness on geopolitical supply disruptions in the Middle East (especially, Qatar, Azerbaijan, Iran, Oman, the UAE and Israel), against bearishness on a potential deal between Ukraine and Azerbaijan that would effectively prevent the halt of the remaining 42mcm/d of Russian natural gas flows through Ukraine into Europe. Meanwhile, gold’s unshakable rally may see a pause as it approaches overbought territory, yet equally may continue to see its structural strength (as a geopolitical hedge of first resort) record new highs. Taken together, seldom has the degree of uncertainties surrounding commodities been as extensive as it is today. With this, given rising geopolitical tensions, the upcoming US election and expected OPEC+ production increases in December, we view that commodity terms of trade – i.e. the difference between the prices of an economy’s exports and imports – is increasingly back in focus. A lasting implication of the current geopolitical crisis may be a level shift higher in the equilibrium price level for many commodities. Thus, trades that take advantage of this structural shift – longs in commodity exporting currencies and shorts in commodity importing currencies – may be opportune for portfolio positioning.

Energy

Notwithstanding the fog of geopolitical uncertainty surrounding Middle Eastern risks, the “lower-for-longer” mantra is firming for oil prices. This is corroborated with investors turning less positive on crude, cutting net long positions in Brent oil for the first time in five weeks. Should Israel’s expected reprisal to Iran’s 1 October attacks on its territory avoid nuclear and/or energy infrastructure, traders may price out what’s left of today’s geopolitical risk premium in the front-end of the curve. This will leave not much in the way of price support given the risks of oversupply in 2025 coming into view as well as signals that the Trump trade is returning (given his recent improving election poll ratings), which could mean a stronger US dollar ahead, and with it another headwind for oil prices. Switching gears, European natural gas (TTF) prices have quietly hit a fresh high for the year as geopolitical tensions and outages in top supplier Norway outweigh weather forecasts pointing to a milder start to November.

Base metals

Expectations of significant stimulus by the Chinese government and Fed rate cuts have buoyed sentiment across the base metals complex but more efforts are needed to remove the clouds of uncertainty over demand amid macro and geopolitical risks. Looking ahead, we view that the sharp rates unwind in a soft landing environment offers good entry given late cycle driven scarcity, a tentative revival in global manufacturing and attractive returns – which now is further reinforced by a plethora of Chinese stimulus measures.

Precious metals

Gold is once again breaching all-time highs as it receives sustained safe haven demand with investors monitoring the looming US elections and the fog of geopolitical uncertainty across the Middle East. Gold’s structural strength continues to be buoyed by its role as a geopolitical hedge of first resort in an uncertain operating environment, unprecedented central bank demand for gold, surging net speculative investor positioning, an expansion in bullion-backed ETFs, the risk of inflationary US policies after the elections from shocks including tariffs and rising debt apprehensions. We hold conviction in our above-consensus call for gold and forecast prices to average USD2,750/oz this quarter, and to breach the USD3,000/oz threshold in 2025.

Bulk commodities

Iron ore is turning lower as traders weigh prospects for rising supplies against China’s efforts to put a floor under the economic slowdown in the top importer. The recent steel price rally has boosted steelmaking margins and resulted in increasing hot metal output and iron ore consumption. However, we view that the impact of stimulus on steel demand is likely to be limited due to a continued property market downturn in 2025 and less steel-intensive infrastructure investment ahead.

Agriculture

India has removed restrictions on shipments of some rice exports in a move that’s expected to bolster its competitive advantage in global markets (especially relative to Thailand) and raise earnings of local farmers during the current harvesting season.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.