To read the full report, please download the PDF above.

Red Sea tensions remain more significant to global supply chains than commodities

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

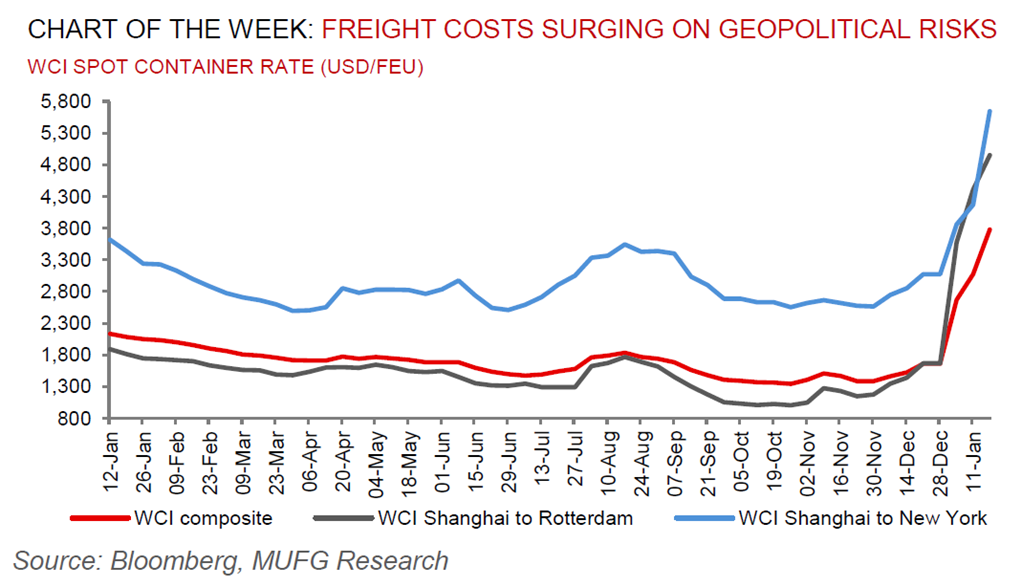

Two months of missile, drone and hijacking attacks against civilian vessels in the Red Sea have caused the largest diversion of international trade in decades, pushing up costs for shippers across the world. The disruption is spreading, fuelling fears of broader economic fallout. US and UK led strikes against Houthi targets in Yemen are now part of a distinct military operation called “Poseidon Archer”, and will run in parallel to “Operation Prosperity Guardian”, the multinational maritime coalition to protect commercial shipping in the Red Sea. Whilst providing an official name to the military campaign against Houthi targets suggests that the US is prepared for a more long-term approach to operations in Yemen, our base case remains that the Red Sea geopolitical risk premium is more a menace for global inflation than for commodities (see here). Absent a regional conflagration, we continue to believe disruptions are unlikely to have sustained ramifications on energy (crude oil and LNG) as well as broader commodity prices on a first order basis – vessel redirection hampers global supply chains, not volumetric production that should not be materially impacted (reaching final destination but later than planned through longer voyages via South Africa’s Cape of Good Hope).

Energy

Notwithstanding geopolitical confrontations in the Middle East, Brent crude continues to find itself grappling to move north of the psychological OPEC+ put threshold of USD80/b, with demand side uncertainties equally front of mind. Meanwhile, European natural gas (TTF) prices remain in oversold territory sub-EUR30/MWh, with demand conservation, mild weather and healthy LNG inflows all helping to keep inventories at adequate levels to see through the remaining weeks of the winter heating season.

Base metals

The increased probability of a sharp interest rates unwind in a resilient US growth environment offers a significant positive incremental factor for copper upside in the months ahead. In non-recessionary Fed cutting cycles driven by policy normalisation and not a growth shock (such as today’s environment), copper on average rises ~15% over the first three months post the first Fed cut. On the flipside, nickel continues to trade under pressure this year after slumping more than 40% in 2023 as increased supplies from Indonesia have raised concerns over a global supply glut.

Precious metals

Gold is edging higher as traders await readings of the latest US economic data that may provide a steer on the timing, pace and depth of monetary easing. We reiterate that gold is our most bullish call in 2024 and is set to hit record levels on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore prices have edged back in recent trading sessions, as inventories data have been piling up at Chinese mills, stemming enthusiasm for the steel demand outlook.

Agriculture

Cocoa prices have soared to the most in almost six years, touching a fresh 46 year high, as resilient demand puts pressure on tight supplies. Whilst the market is technically susceptible to a correction, there is no indication of a top with the market continuing to make new highs.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.