Why China’s bull case for commodities is yet to show up – blame geopolitics

Global commodities

Notwithstanding China’s GDP surpassing consensus expectations, topping 9% on a sequential basis in Q1 2023 on a strong re-opening, paper commodity markets remain subdued. Our core 2023 commodities outlook was premised on a resurgent Chinese economy by the second quarter to drive the complex higher (see here). Whilst this is materialising, the mood music across global investors is one of trepidation and persistent caution. Beyond stagflationary risks across developed markets, we believe the driving force for bearish flows and returns is increasingly coming from geopolitical apprehensions – a far chilling and less predictable arena that may continue to put a lid on commodities. The US-China relationship remains on a managed decline – whether that’s because of Taiwan, Russia, further tit-for-tat restrictions on tech or moves to limit US investments into China (or all of the above). Despite being hawkish on China one of the few commonalities uniting Democrats and Republicans ahead of next year’s US election cycle, we believe the tightening trend in micro fundamentals (tightening arbs, drawing inventories and downstream demand) – will form the basis for the next leg higher in commodities (notably base metals), once macro uncertainty and rates volatility settles.

Energy

Crude oil has wiped out all of its gains after the surprise OPEC+ production cut earlier this month, and now trading below its 50 and 100 day moving average, with recessionary angst compounding a bearish technical correction. Meanwhile, the EU formally launched “AggregateEU” – a new platform for joint gas purchases – on 25 April, creating a pool of natural gas buyers and pairing them with sellers to curb extreme price spikes that roiled energy markets last year.

Base metals

Copper, aluminium, zinc and nickel are all under pressure, caught between stronger Chinese micro and growing concerns of possible US recession alongside heightened US-Chinese geopolitical concerns. As we catalogued last week, the structural drivers that base metals possess tied to the underinvestment of supply but also the ESG-induced positive demand-side leverage to green transition technologies (see here and here), are set to increasingly become spot drivers for the complex, in our view.

Precious metals

Non-interest bearish gold is holding its own right now and flirting ~USD2,000/oz, sustained by falling Treasury yields as well as a weaker US dollar. Some gold gains may also be the result of safe-haven buying after China’s envoy to France questioned the legal status of some states in the EU, notably the Baltic states, after the break-up of the Soviet Union. Investors are also closely watching corporate earnings in the banking sector, after weaker results reignited credit distress concerns, as well as potential US debt limit commotions.

Bulk commodities

Iron ore traded below USD100/MT for the first time since December 2022, highlighting a frail recovery for China’s commodities demand even during what’s meant to be the busiest construction period of the year. Exacerbating the strains, China’s National Development and Reform Commission (NDRC) continues to voiced concerns over “excessive pricing”, in addition to top miners Vale, Rio Tinto and BHP pointing to ample supplies over 2023.

Agriculture

Wheat is holding around the lowest level since July 2021 as a strike in major exporter Canada counters a bearish outlook for global supplies. Whilst this is positive from a food inflation standpoint, food prices remain elevated, especially in emerging markets that usually comprise a larger weight of food in CPI baskets.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.

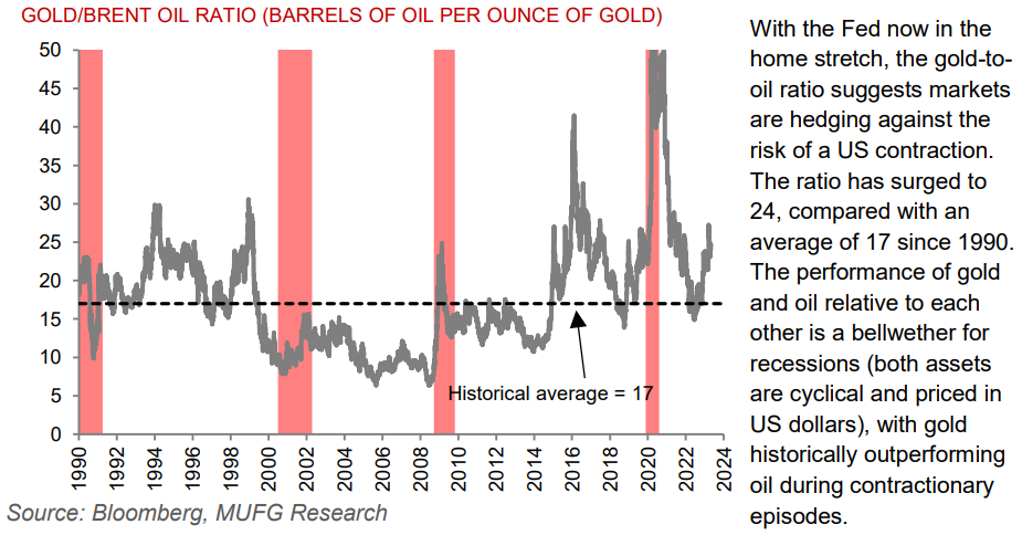

CHART OF THE WEEK: COMMODITIES BELLWETHER FLASHES US RECESSION