To read the full report, please download the PDF above.

A new chapter in the US commodities tariff playbook – Section 232 on copper

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

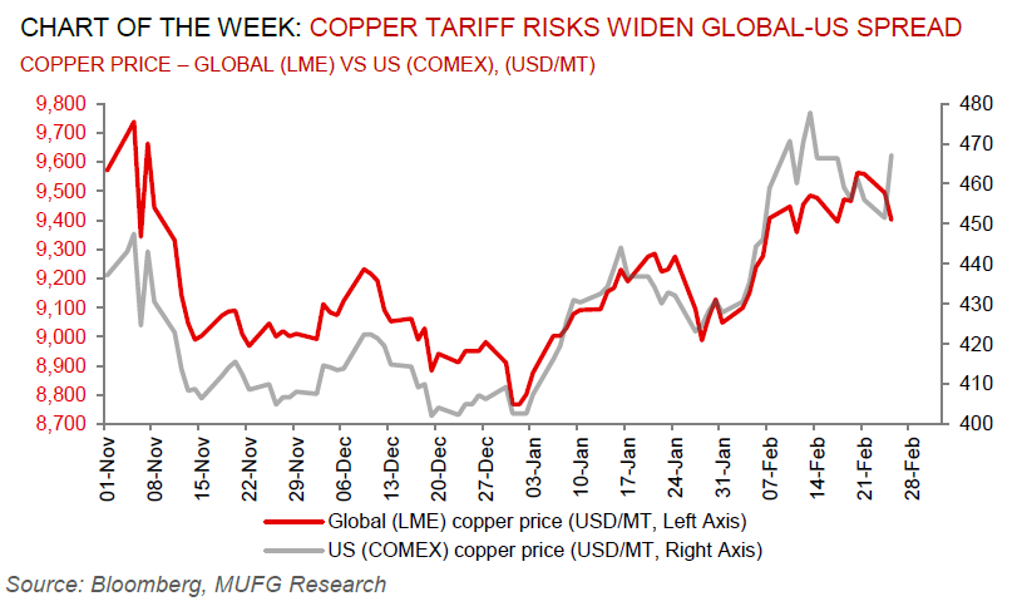

Base metals volatile start to the year driven by tariff risks may have further to run with President Trump signing an executive action directing the Commerce Department to examine possible copper tariffs – the latest in a string of measures that commenced with aluminium and steel earlier this month, that is set to reshape global supply chains. The results of the investigation under Section 232 of the Trade Expansion Act requires a Commerce report within 270 days whilst the outcome is unclear at this stage, President Trump declared that the order will have a “big impact”. US (COMEX) copper prices have surged on this probe announcement, reflecting front loading of inventories ahead of any tariffs coming into effect. Though global (LME) copper prices remain broadly unchanged, reflecting apprehensions that a US-led global trade war is bearish for the copper, which holds a reputation as a barometer for the health of the global economy. The COMEX-LME copper spread is fast diverging, with the widening spread likely attracting arbitrage trades. Going forward, as we catalogued in our Commodities 2025 outlook, tariffs are fundamentally bearish for copper and other base metals in the context of slowing global growth that risks keeping inflation higher-for-longer.

Energy

Oil prices have plunged to 2025 lows as Trump’s aggressive moves on trade is stoking investor apprehensions at a time when traders are already concerned about lacklustre consumption in China. The supply-side of the oil equation is also adding bearish concerns with the prospect of a restart of considerable pipeline flows from Iraq’s Kurdistan region, that is pushed the US for a resumption. Meanwhile, in line with our expectations, European natural gas (TTF) prices are collapsing owing German utilities are pushing to loosen storage targets ahead of next winter, alongside milder winter weather as well as the US moves to end the war in Ukraine (that raises the prospects of higher Russian gas flows into the continent).

Base metals

Ukraine has agreed with the US on a deal to mutually develop its natural resources, with rare earth minerals in focus – which could ease recent tensions with President Trump and advance his administration’s goal of a ceasefire with Russia. The agreement came together after the US dropped its demand for Ukraine to commit to paying USD500bn from resource extraction to a fund as a form of repayment for US aid, and will create a joint US-Ukraine fund to manage future revenues from Ukraine’s natural resources.

Precious metals

Gold’s unshakable bull market continues with prices edging ever close to the USD3,000/oz level, with President Trump’s resolve to reorder the global economic landscape likely adding further fuel to the rally. Critically, the rising gold-oil price ratio – currently 42x (the highest since 2020), compared to an average of 31x since 1980 – is a clear market signal that Trump-induced polices could once again fan the flames of global inflation.

Bulk commodities

Shares of Chinese steelmakers are surging amid speculation the authorities may step up measures to aid the industry, which could see production cuts mandated, which may raise product prices and profitability.

Agriculture

Grain prices – wheat, corn and soybean – are oscillating in a narrow band as the prospect of lower Russian exports (price bullish), is being weighed down by improving weather and tariff threats (price bearish).

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.