Buy the last Fed rate hike – tactical upside for commodities

Global commodities

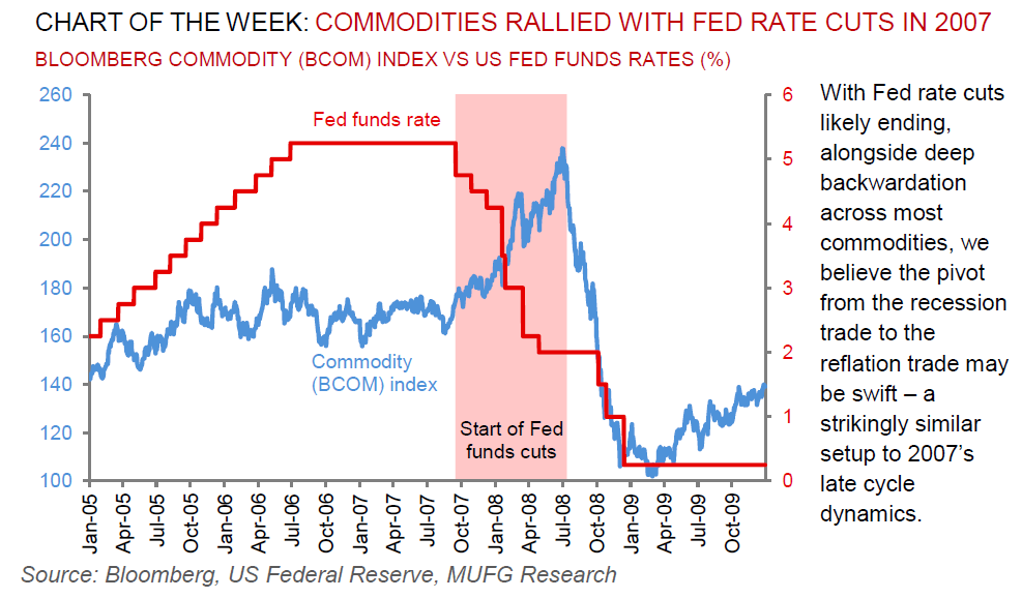

In contrast to June’s FOMC, yesterday’s meeting was rather a barren affair even though the policy rate was increased by 25bp to 5.25-5.5%, with the hike fully priced into the market and minimal changes to the (non-committal) accompanying statement. With our US rates strategists view that this likely concludes the Fed’s tightening cycle (absent a flaring in inflationary pressures), we recommend buying commodities at this point in the cycle which has proven to be a favourable strategy historically. Indeed, as we have recently catalogued, today’s set up bears striking resemblance to 2007’s late cycle wherein the global economy is below capacity and growing, yet inventories and spare capacity are depleted (see here). As we move towards a likely period of a Fed pause with the US seemingly slowing without derailing growth elsewhere, alongside a weaker dollar and policy easing in China, all against a backdrop of tight micro fundamentals, underscores the susceptibility of commodity markets to price gains (fashioning classic late cycle strong returns). On net, with Fed hikes likely now behind us, and should recessionary fears not materialise over the next six months, idiosyncratic risks leave the entire undervalued and under-owned commodities complex positioned favourably for tactical upside.

Energy

Oil’s quiet but relentless rally continues, threatening softening US inflation, which may complicate how a dovish Fed pivot transpires. US WTI’s psychological level of USD80/b is now in sight given tight oil market micro conditions (see here). Meanwhile, European (TTF) and US (Henry Hub) prices are softening as the summer heatwave has loosened its grip on power cooling demand on both sides of the Atlantic.

Base metals

After what has been disappointing growth momentum in China, a manufacturing slowdown across developed markets and accelerating supply conditions for most base metals for much of 2023, we believe the complex is on the cusp of a revival with Fed rate hikes likely now concluded. Yet, we would caution the upside quantum as base metals prospects remain heavily tied to China macro sentiment and we caution the scale of stimulus support arising from the slightly more dovish-than-expected statement from the Politburo meeting earlier this week.

Precious metals

Gold is gaining momentum as bond yields and the US dollar slipped following Fed signals that its hiking cycle is likely concluded. We however caution gold’s near-term gains with technicals signalling that it has formed a death-cross with the 50 day moving average crossing below the 100 day moving average – a bearish signal.

Bulk commodities

Iron ore’s rally over the last two months appears increasingly fragile as hopes fade for the type of heavy stimulus that China used to deploy following the actual policy detail from the Politburo meeting earlier this week signalling a more gradual roll out of stimulus with no language indicating major fiscal or monetary stimulus.

Agriculture

Global food markets are being shaken by a brutal combination of war reverberations, protectionism and temperamental weather. While these disruptors differ in their scale and scope, the commonality of hampering supplies and boosting prices adds another headwind, on top of higher crude oil prices, for global central banks to navigate in H2 2023.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.