To read the full report, please download the PDF above.

Gauging tariffs risks across commodities

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

After initially refraining from imposing tariffs on his first day in office, instead ordering federal agencies to make trade recommendations, President Trump listed copper, aluminium and steel among the potential targets in remarks on 27 January. Inferring what tariffs are priced is challenging in most global markets. However, given commodity markets price otherwise identical goods in-and-outside the US, we can parameterise what US tariff increases the commodity markets are pricing in. Our conviction is that base metals, led by copper and aluminium, are pricing ~50% probability of at least a 10% US tariff on these commodities in 2025 (akin from the prolonged steel and aluminium tariff process during Trump 1.0 between 2017-18). Meanwhile, relative to base metals, we have less conviction that precious metals fall under the crosshairs of specific industry-focused import tariffs – however, there is a risk that they are not explicitly carved out from any potential universal tariff package. Finally, within the energy complex, imposing tariffs (or sanctions) on energy imports is inconsistent with an administration whose first-order policy objective is to maintain low energy and consumer prices. As such, we assume that energy will likely be exempt from any tariffs, and even if such tariffs are enforced, they will likely be transitory in nature.

Energy

Crude oil has had a bumpy start to the year as US sanctions against Russia and colder-than-normal weather initially ratcheted prices higher, while the reverberations on energy demand from a Trump-induced trade war alongside tepid Chinese economic data, has pulled back prices. We maintain our bearish oil price conviction in 2025 (Brent averaging USD73/b) with the complex mired in an unresolved surplus (+0.9m b/d in 2025) and high spare capacity (~6m b/d), though we recognise that two-tail risks of breakouts in our USD65-80/b corridor on Trump-induced tariffs and/or geopolitical uncertainty, are tangible.

Base metals

Risks of a taxing US-driven trade war is beginning to weigh on the base metals complex, led by copper – a bellwether for global growth given its wide-ranging uses, old and new. As it stands, levies on China, Canada and Mexico may kick-in on 1 February, with a potential universal tariff, while copper itself has been listed as a product at risk.

Precious metals

Gold is edging slightly lower after the Fed stated that it will not rush to lower rates to see further progress on inflation. We hold conviction that gold’s brisk start to the year comprises the impetus to go much further in the short-term with the incoming US administration set to drive the “fear” dimension (geopolitical hedge of first resort) of our constructive bullion thesis this year. Also, EM central banks continue to be purchase bullion through the “wealth” dimension.

Bulk commodities

Iron ore is back north of USD100/MT after Vale missed expectations for Q4 2024 output (though full year 2024 supply was the highest in six years). Looking ahead, tepid Chinese sentiment continues to drive iron ore prices lower as both macro data and new stimulus measures have recently disappointed. While the expansion of eligible categories included in the consumer goods trade-in and equipment upgrade programmes in 2025 should be positive for steel demand, we do not view that this will be enough to turn the negative trend.

Agriculture

The EU has proposed imposing tariffs on the remaining agricultural commodities coming from Russia and Belarus that are not already facing levies, as well as certain nitrogen fertilisers.

Core indicators

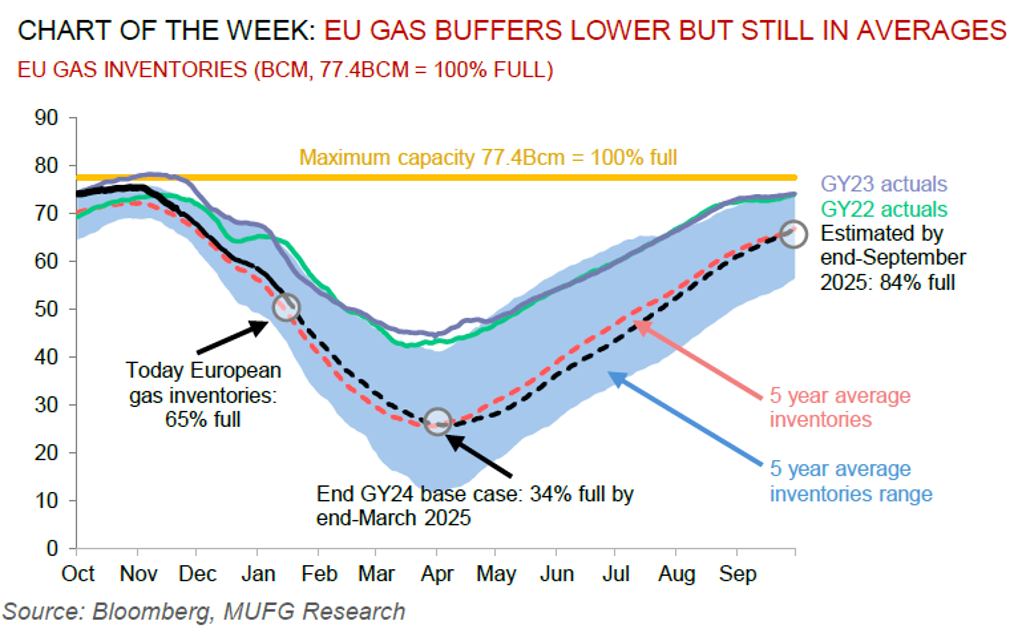

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.