To read the full report, please download the PDF above.

Macro and micro re-align, thrusting commodities higher

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

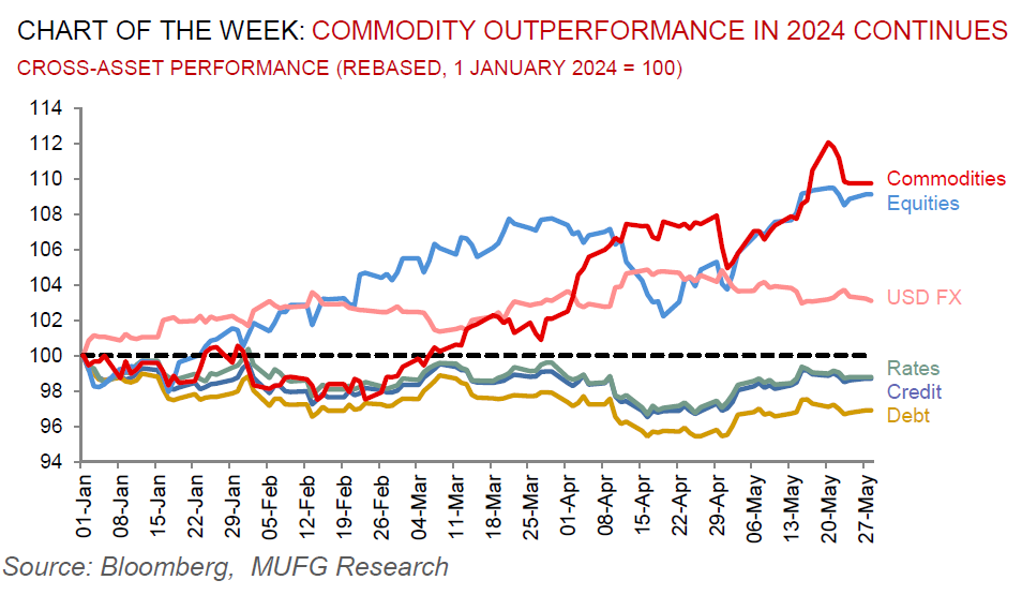

Commodities remain the best performing cross-asset class year-to-date (+9%), coinciding with a constructive shift in the global operating environment. With the macro backdrop pivoting from headwind to tailwind, and the micro fundamental setting putting almost all major commodity markets into deficit, alongside low inventories (see here and here), we view the back half of 2024 will witness further synchronised support across the commodities complex. With investors still concerned about the growth outlook, the commodity space remains heavily underinvested from money managers, ETFs as well as discretionary capital – not helped by a poor return performance in 2023 (see here). With macro and micro dynamics re-aligning again, we believe investors are likely to take a fresh look at the commodities complex and our long-term supply-constrained supercycle narrative that points to a severe lack of long-term capex (see here, here and here). In our view, even a small shift in commodity positioning can go a long way in creating commodity reflation given tight fundamentals. More fundamentally, long-run inadequate production capacity supply issues take years to resolve and thus, we are convicted that the global economy will be dealing with an underinvested decades-long supercycle, with price overshoots being the new normal.

Energy

Oil is extending gains in recent trading sessions as the decision by OPEC+ on 24 May to move its highly anticipated 2 June meeting from in-person to online, cements that the group has all-but-agreed to hang tough. This reinforces our belief we flagged two weeks ago that the group will likely extend its 2.2m b/d production cuts for the rest of 2024 (see here). Lower-for-longer OPEC+ production and above historical average oil demand growth, points to strengthening balances in H2 2024, which supports our call for Brent to average USD88/b and USD93/b in Q3 and Q4 2024, respectively.

Base metals

Copper has resumed its remarkable 2024 rally after steep losses last week, with fresh efforts to support China’s property market helping bolster the demand outlook. Absent any near-term mine supply solver, copper’s path to scarcity remains unfazed with the only way to maintain market function being via demand destruction. Copper remains our most bullish long-term structural commodity conviction, and we have been cataloguing its unparalleled fundamentals – its central role in the energy transition (best conductor of electricity), in AI (vital for catalysing datacentres) and in military spending (in a deglobalised world) – since 2022 (see here, here and here).

Precious metals

Last week’s gold decline appears to be a consolidation rather than a start of a correction with money managers now the most bullish on bullion in more than four years. We maintain our 2024 commodities outlook call that gold is our most favourite trade this year on a trifecta of (eventual) Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here). We recognise that our above consensus year-end forecast of USD2,350/oz that we laid out at the start of the year, now looks modest, but we hold off in revising our call higher for now given the likely seasonal summer lull.

Bulk commodities

Iron ore – the most China centric industrial commodity – is steadying as traders assess gradual progress in China’s efforts to ease the property market crisis. Countering China’s latest measures to rescue the property market are unprecedented flows from the two main shippers – Brazil and Australia.

Agriculture

Wheat is flirting close to 10 month highs, as clod and dry weather in major producing countries of the US, Russia, Ukraine and Australia, deepen supply angst. The US Department of Agriculture (USDA) forecasts that global wheat stockpiles may fall to a nine year low in the coming season, and money managers have been trimming net-bearish bets in the US market.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.