To read the full report, please download the PDF above.

(Practically) full European gas stockings for Christmas

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

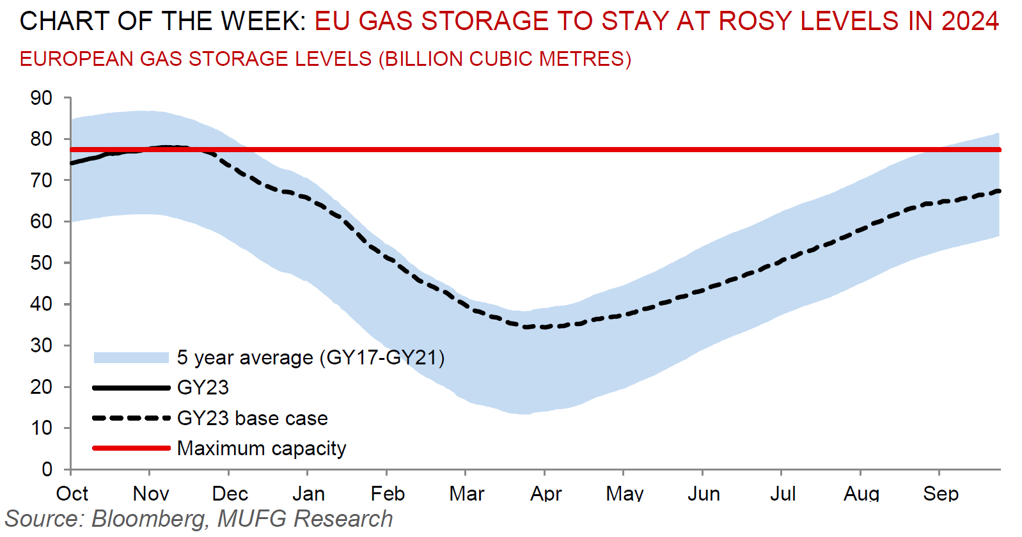

2023 has been a year of solidifying pivotal changes in the European natural gas market as a result of the Russia/Ukraine war, namely: (i) volatile prices; (ii) diminishing industrial demand; (iii) changing consumer behaviours and with it lower residential demand; and (iv) a drastic reduction of Russian pipeline gas and an ever growing reliance on LNG imports. With two months into the heating season (that kicked off in October), record high gas storage levels of 98% full positions Europe extremely well this winter season with very limited risks of energy shortages under our baseline and downside scenarios. Based on our modelling of supply and demand fundamentals and futures curve prices, we estimate that storage levels will end the winter period (end March 2024) at 45% full – comfortably above the five year average of 31%. We further forecast that by the end of summer next year (September 2024), the continent’s storage will be 88% – below the record level of 96% observed this year but still close to the European Commission’s target (90%) to withstand the 2024/25 winter period. On net, whilst we anticipate European natural gas (TTF) prices remaining in-check this winter on both benign gas stocks and expected more normal winter temperatures (unlike the mild winter last year), our core concern that we have frequently catalogued is that the gas price risks are now second-order to European de-industrialisation risks with the continent having to compete with the unparalleled US Inflation Reduction Act (IRA) (see here, here and here).

Energy

There are no good options for OPEC+ as it meets virtually today (30 November). As we documented last week, our base case (70% probability) is for the group to confirm existing cuts and the extension of Saudi and Russian voluntary cuts to Q2 2024, with risks (30% probability) of 0.5-1.0m b/d larger group-wide coordinated output curbs – both scenarios in our view skew neutral on prices (see here).

Base metals

Copper has surged to a near three month high after the closure of a major mine in Panama (due to its fat carbon-intensiveness) reinforces the base metals paradox for the most critical conductor of electricity – greening the economy will support a surge in copper (and other green metals) demand but inelastic supply screams that the playbook is unprepared.

Precious metals

Gold has hit a six month high and it’s record is now in play – bullion’s ascent has been sufficiently acute and powerful that a challenge of it’s record of USD2,089 set in August 2020 seems inevitable before year-end. The fuel comes from bets that the Fed is done hiking, which hampers the US dollar and Treasury yields but drives non-yielding assets like bullion incrementally deeper into investor portfolios.

Bulk commodities

Iron ore is extending its losses after Chinese authorities declared that they were conducting research on commodity price indexes – signalling a campaign to rein in a rally in the steelmaking staple is continuing.

Agriculture

Cocoa has extended its rally to the highest since 1977 as wet weather continues to hamper harvests in the key West Africa region, which provide the bulk of world supply.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.