To read the full report, please download the PDF above.

OPEC+ boosts bears (near-term) but still needs an exit strategy (long-term)

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

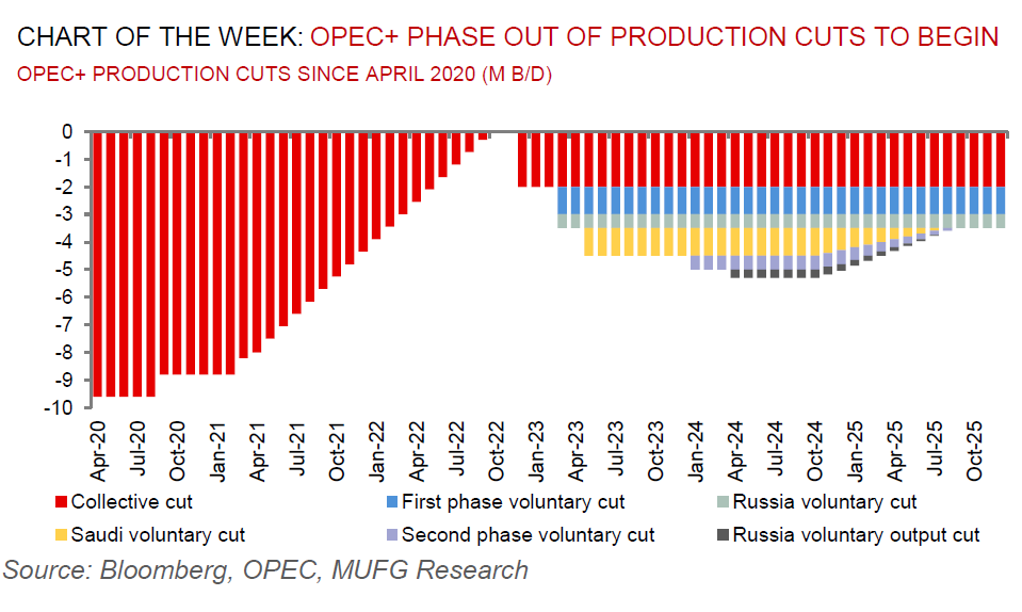

Promptly following the OPEC+ decision on 2 June to phase out its additional voluntary cuts totalling 2.5m b/d from October 2024 to September 2025, we catalogued that the move was incrementally price bearish (see here). Since then, Brent crude has surprised our expectations to the downside and slid ~4% – lowest since February. To put this into context, prices stayed relatively calm following the OPEC+ meeting on 3 June in early trading – signalling to us that it is challenging to accredit the leg lower in oil prices merely to the OPEC+ meeting alone. With skittish algorithmic oil traders’ recent pivot towards net short positions as Brent crude slipped into oversold territory – as per the 14 day relative strength index (RSI) – we view that technicals have been predominantly behind Brent crude breaching sub-USD80/b, rather than the OPEC+ meeting exclusively. Indeed market fundamentals remain tight with demand above supply (corroborated with a backwardated futures curve) – thus the selloff this week is overdone. Nevertheless, we acknowledge that the hoary old question of how OPEC+ will navigate its dilemma of how long it can keep acting to prop-up prices by curbing its production, is beginning to bite. All in, OPEC+ is mired in a quagmire and needs an exit strategy. On the one hand, it has no incentive mechanism to let oil production rip in a world where US shale has tapped unimagined efficiencies – and thus its not clear a price war would help OPEC+ sustainably regain its market share. On the other hand, it lacks the means to manage a well-supplied market without getting trapped in a vicious cycle of a boundless iteration of irreversible cuts.

Energy

Oil has tanked to a four month low, with rising US crude stockpiles adding to the bearish mood music compounded by the OPEC+ strategy to phase out its voluntary cuts from Q4 2024. Absent any unforeseen surprises, we now see risks to our Brent call of USD88/b and USD93/b in Q3 and Q4 2024, respectively, as moderately skewed to the downside, given the OPEC+ message to markets that it is intent on (gradually) reversing its production cuts due to high spare capacity. Meanwhile, European natural gas (TTF) prices have erased this week’s sharp gains on the expectation an unplanned outage at Norway’s Nyhamna plant will be short-lived – note, European inventories (71% full) remain well above their five-year averages.

Base metals

China’s copper inventories are growing at precisely the time of the year when they should in fact be (rapidly) contracting – an anomaly that accentuates apprehensions surrounding demand in the world’s largest market. This rise in Chinese inventories reflects a deviation in the constructive global sentiment on copper, which has staged a remarkable rally year-to-date on looming shortages. Looking beyond the abnormally large Chinese copper stockpiles, we are still convinced that absent any near-term mine supply solver, copper’s path to scarcity remains unfazed with the only way to maintain market function being via demand destruction.

Precious metals

Gold has fallen in recent trading sessions with technical selling intensifying despite data signalling further signs of a slowdown in the US labour market that is reinforcing bets that the Fed will be able to deliver rate cuts this year. We maintain our 2024 commodities outlook call that gold is our most favourite trade this year on a trifecta of (eventual) Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore – the most China centric industrial commodity – has tumbled to the lowest level in more than six weeks on concerns over the outlook for Chinese demand, which has been stricken by the protracted property crisis.

Agriculture

Wheat prices are set for their longest rout since November 2023 as the US harvest is progressing more swiftly than expectations, with wheat beginning to pile up in the southern US Plains as trader wait for global purchasers to pivot to fresh US grain supplies.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.