To read the full report, please download the PDF above.

ESG Monthly Compendium

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

ESG Monthly Compendium

MUFG’s leading ESG financing for our clients

In March 2025, MUFG was involved in the following sustainable financing transactions:

- In the bonds space:

- Across corporates, MUFG was Active Bookrunner and Sole SLB Structuring Coordinator for Sappi’s €300mn 7NC3 Sustainability-Linked Bond and Active Bookrunner on Greenko’s $1bn 3.5NC2 Green Bond, Kinetik Holding’s $250mn Green Bond due 2028 and SSE’s €600mn Green Bond due 2032.

- In the loans space:

- MUFG acted as MLA on Fosun International’s $870mn Sustainability-Linked Loan, Deere & Co’s $11.5bn Sustainability-Linked RCF, Fengmiao Wind Power Co’s $3.1bn Green Loan Facility, Trafigura’s €5.63bn Sustainability-Linked RCF, Stack Infrastructure’s $4bn Green Loan Facility and LA on TUI’s €1.9bn Sustainability-Linked RCF.

ESG charts of the month

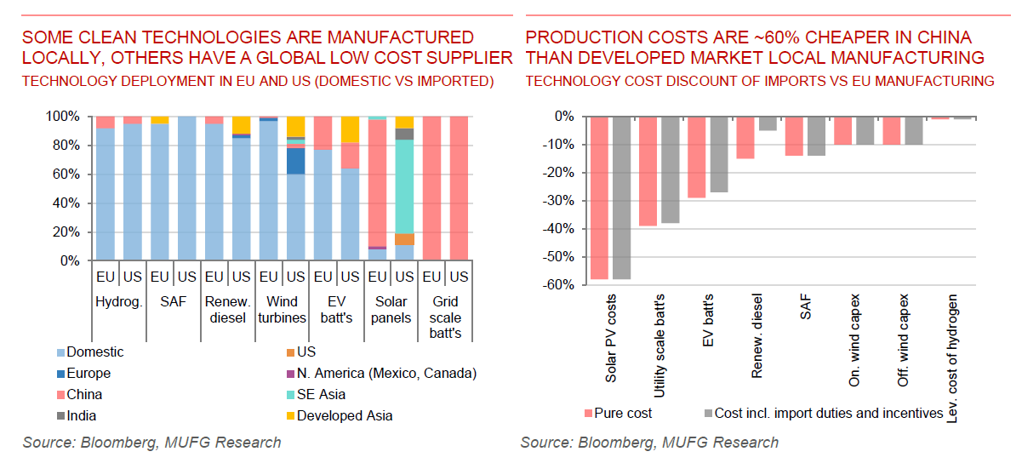

- Deglobalisation and the cost of decarbonisation. The US administration has imposed towering tariffs on all countries. These tariffs have a distinctly stagflationary flavor (see here). They push up import prices that then pass through into higher consumer goods prices and inflation – acting as a tax on spending and, thus, creating a corresponding drag on economic growth. At face value therefore, deglobalisation raises decarbonisation costs – some clean technologies are manufactured locally but others have a dominant, global, low-cost supplier that continues to gain cost competitiveness. This thus raises questions over the benefits of local manufacturing versus imports. Prevailing US Inflation Reduction Act (IRA) incentives and tariffs can materially impact relative cost positioning, with domestic EV battery manufacturing, in particular, being the most evident cast study. Given increasing liquefied natural gas (LNG) supply from 2026 onwards, alongside a potential restart of Russian gas flows lowering gas prices, we anticipate that the benefit of accelerated coal-to-gas switching more than offsets the negative reverberations on renewable economics.