Please download PDF using the link above for the full report

A stronger US dollar was one of the main drivers for the depreciation of Asian currencies in Q1.

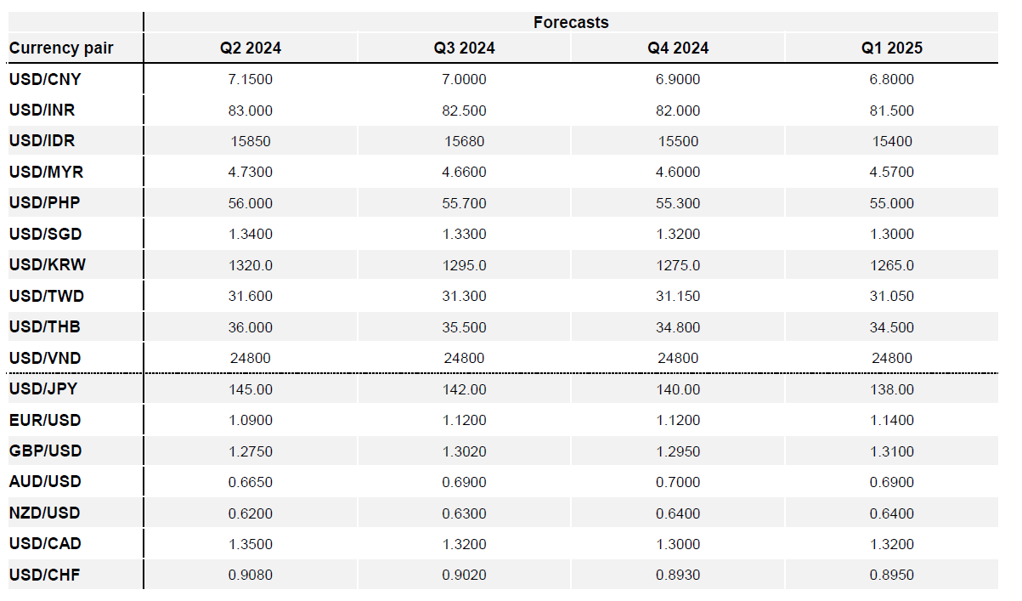

Looking forward, our global team expects the US economy to experience a growth deceleration in 2024 (although avoiding a recession), as high funding costs transmits to the economy through channels such as the Commercial Real Estate sector, a weaker US consumer, and a softer labour market over time. Our USD FX strategist currently expects the Fed to commence rate cuts from June and cut by a total 125bps this year. A slightly weaker US dollar in Q2 and more noticeably weaker dollar in Q3 are assumptions we use to forecast Asian FXs.

There are some positive developments closer to home here in Asia. Exports are improving, prices pressures are easing, private consumption appears resilient (albeit impacted by headwinds such as the real estate sector for some Asian economies), while tourism is improving helped by visa requirement relaxation. These tailwinds should continue till the end of this year. There are nonetheless divergences across countries. For example, Asian countries with larger production exposure to AI-related demand enjoy stronger exports compared with others, and as such, South Korea and Taiwan are likely to continue to benefit most from AI-related demand.

These country-specific idiosyncratic factors no doubt matter in our analysis of Asian FX movements, beyond our global assumptions.

For Q2, our top picks are KRW, THB, TWD and CNY. The drivers for their outperformance are due to their exposures to AI-related chip and machinery demand, current account situation, sensitiveness towards Fed’s rate cut, China’s positive developments in economic fundamentals, different exposure to China’s demand and etc.

For 2024 as a whole, our top pick currencies are KRW and THB. Apart from the positive factors mentioned above, KRW will take a lift from improving China sentiment, Fed Fund rate cuts, and stronger growth will help limit the outflows from both the national pension service and retail investors. Meanwhile, a return of peak tourism season for Thailand around late Q3 and Q4 should lead THB to strengthen to 34.5.

We remain bullish on India’s economy in 2024, and continue to see strength in private investment and public infrastructure, together with robust prospects for private consumption. More importantly, India looks good from a macro stability perspective. Its current account deficit is manageable helped by an improvement in services exports, capital flows are rising with bond index inclusion, while FX reserves provide a strong buffer. We are constructive on INR but expect RBI to accumulate FX reserves whenever it has the chance to, limiting INR appreciation. The upcoming General Election is a key risk, but we think policy continuity remains likely.

More details are enclosed in this file.

Hope it helps,

GMR Asia