Please download PDF using the link above for the full report

This year so far, we saw strong world trades and a resilient global economy. We expect the global growth to remain largely stable in Q4, amid the medium-term trend of growth convergence within advance economies and slight improvement in EM market including EM Asia.

We share Fed’s base case of a soft-landing US economy. We are pricing in a 1.7-1.9% growth for US in 2025 and about a 2.7-2.8% for 2024, a weaker US Dollar and a risk-on sentiment, for our analysis of Asian FXs and Asian economic performance. This assumption of a soft-landing US economy is based on the arguments that the US economy has been experiencing rolling sector recessions and recoveries. This asynchronous sectoral performance means that one sector’s weakness is offset by other’s strength, and adding all together creates a “soft-landing” US economy.

For Asia, credit growth in EM Asia largely held well, despite the restrictive financial conditions. Modest credit growth deceleration was seen for Indonesia and Philippine though. Asia’s growth appeared resilient, particularly Southeast Asia economies. Some economies delivered accelerated sequential GDP growth in Q2, e.g., Malaysia, Indonesia, Singapore and Taiwan. The picture of overall Northeast Asia appeared less positive, with a decelerating growth momentum happening in China and a contractionary sequential GDP growth recorded for Korea’s economy in Q2. India’s growth remained strong with a 2.0%qoq Q2 growth, after a 2.3%qoq Q1 growth.

Going forward, given the room for lower policy rates across Asia has emerged following the Fed’s start of easing cycle, and inflation has been less of a worry in Asia, we expect monetary easing to gather pace across regional central banks. This would help stimulate private consumption and investment across Asia, and help to ensure a stable Asia’s growth, along with continued good exports in Q4.

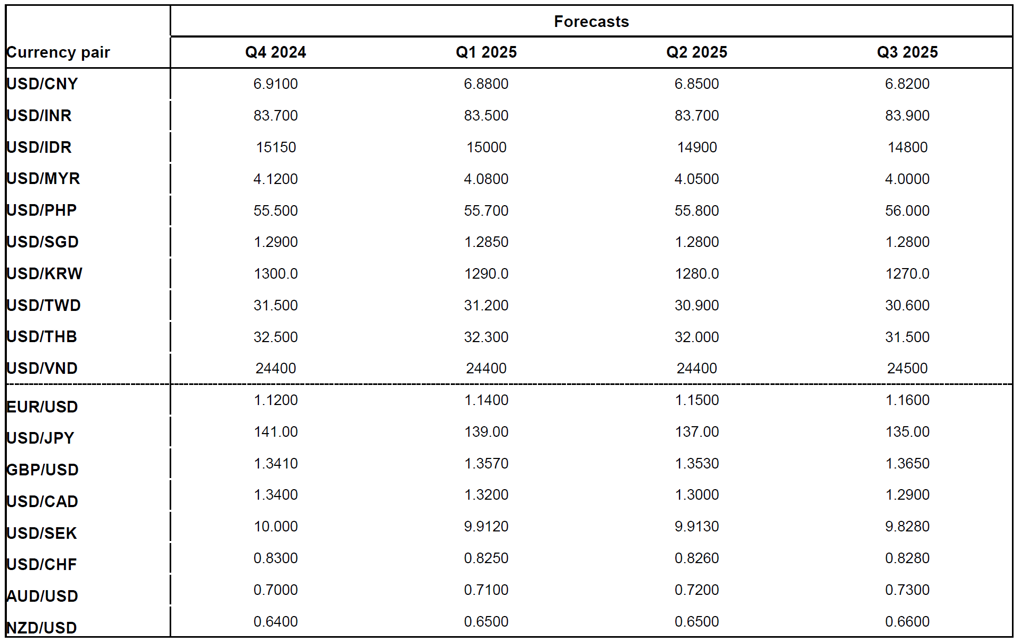

For Q4, our top picks are CNY, MYR, and KRW. We expect USD/CNY to reach 6.91 by year-end, in anticipating additional stimulus packages to stabilize Chinese economy. MYR is to strengthen on strong domestic economic growth, current account surplus and potential corporates’ repatriation of overseas investment proceeds. For KRW, Fed’s rate cut could lessen the appeal of US assets and cool Korean residents’ capital outflow, also potential inclusion into FTSE WGBI may bring strong foreign bond inflows. For INR, although Indian economy remains a bright spot, we think INR should underperform given a relatively sticky current account deficit.

Risks to our call are abundant, and working in opposite directions, with upside risks such as China’s aggressive fiscal policy, and downside risks like the escalation of trade tensions, investment restriction, and higher oil prices due to geopolitical tensions. We discuss the “risk of US tariff policy and its implication on Asia” in this slide pack from slide 29 to 34. More details are enclosed in this file.

Hope it helps,

GMR Asia