Ahead Today

G3: US trade balance, initial jobless claims; ECB policy rate decision

Asia: BNM policy rate decision, Vietnam retail sales, industrial production, trade, and CPI

Market Highlights

In his first speech to Congress since inauguration, President Trump has defended his tariff actions and called for an end to the $52bn Chips Act subsidy programme. But markets have seemingly shifted their focus away from tariff rhetoric for now, and they appear to be concerned about a slowdown in the US economy. The US economic data released yesterday was mixed, though. ADP employment rose 77k in February, slower than the 183k increase in January, missing Bloomberg consensus of 140k. But the ISM services index was stronger than expected, rising to 53.5 in February, from 52.8 in January. Both new orders and employment also expanded, though the services prices paid sub-index jumped to 62.6 from 60.4 in January. Markets have continued to price in about 3 rate cuts for the rest of this year, while the broad US dollar index have fallen by 2.6% this week.

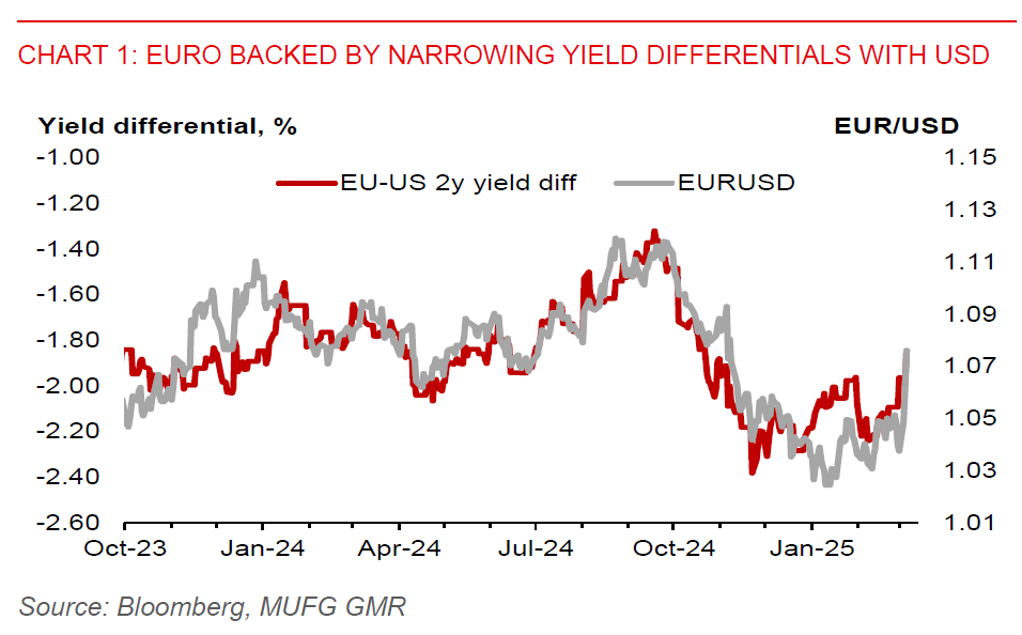

Meanwhile, the euro has jumped by more than 1% against the US dollar in Wednesday’s session, on the back of Germany’s proposed plans to exempt defense and security spending from limiting fiscal spending and to set up a EUR500 billion infrastructure plan. German 10-year bond yields have surged above 2.7%, alongside sharp rises in French and Italian government bond yields.

In Japan, BoJ Deputy Governor Uchida has signalled that the bank remains on a rate normalization path, while adding that it’s unlikely for the bank to do back-to-back rate hikes while the policy rate will eventually rise to at least 1% by end of FY2026. This could continue to put modest downward pressure on USDJPY.

Regional FX

Momentum and FX positioning data point to US dollar declines for now, with Asian currencies further strengthening against the US dollar. Notably, there were huge gains in the KRW (+0.8%) and most ASEAN currencies, namely IDR (+0.8%), MYR (+0.8%), PHP (+0.7%), and THB (+0.6%).

A key highlight today is the BNM policy rate decision. We expect the central bank to keep the policy rate unchanged at 3.00%, as inflation remains contained while economic growth is still holding up.

During China’s National People’s Congress session yesterday, the government has announced a 5% growth target in 2025, unchanged from 2024, while the inflation objective is set at 2%, down from 3% previously. Amidst tariff headwinds, a 5% growth target implies that the government could yet do more on the monetary and fiscal stimulus front to support growth through the course of this year. Other measures announced include a rise in the on-balance sheet budget deficit to 4% of GDP, as well as increasing the local government special bond quota by RMB500bn to RMB4.4tn and the long-term special treasury bonds by RMB300bn to RMB1.3tn. However, fiscal support for domestic consumption remains modest. More efforts will also be carried out to ensure stability in housing and stock markets. Meanwhile, the PBoC has maintained the daily fixing rate for USDCNY at ~7.17, implying that it is less inclined for now to weaken RMB to offset potential negative tariff impact.

Philippines inflation slowed to 2.1%yoy in February, from 2.9% in January, lower than Bloomberg consensus of 2.6%yoy. This may pave the way for BSP to resume cutting the policy rate in Q2.