Ahead Today

G3: US PPI

Asia: India WPI

Market Highlights

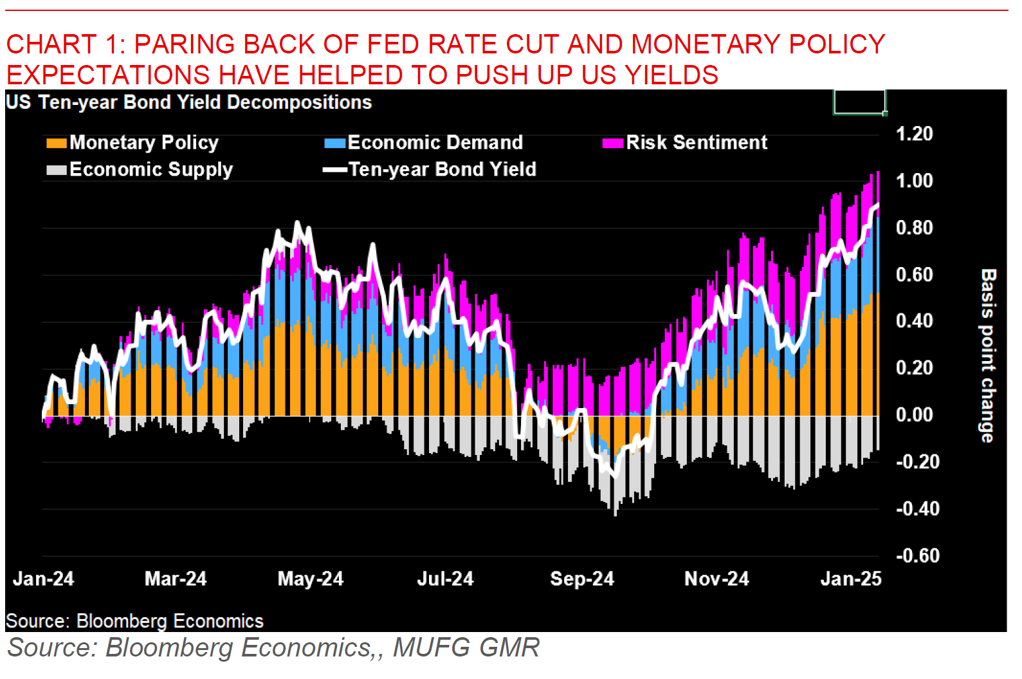

Asian FX continued to be weighed down by a stronger Dollar, higher US yields, and weak risk sentiment in our region, before paring back some losses as news emerged about Trump’s economic team discussing a gradual approach to raising tariffs. The big driver of markets this week has been the continued paring back of Fed rate cut expectations following from the strong non-farm payrolls print, with markets now pricing in fully for the next Fed cut only from October onwards. EUR/USD fell to as low as 1.0177 at one point which impacted a whole range of Asian currencies, even as USD/CNY was relatively stable in part due to central bank policy push back.

Beyond tariffs and the robust US labour market, the outgoing Biden administration even in its vestiges imposed two potentially important policies. First, he established new limits on the sale of advanced AI chips and the amount of computing power that can be sold to most countries, even as these rules divided the world into three blocs – Tier 1 (including Europe and Japan), Tier 2 (where most countries including in Southeast Asia are included), and Tier 3 (China, Russia among others). There is a long consultation period and as such it remains to be seen whether the Trump administration will follow through. Second, Biden’s administration imposed sweeping sanctions on Russia’s oil trade, targeting tankers, insurance companies, traders among others. Brent oil spiked up to US$81/bbl, while countries such as India and China may be impacted with 25% of Russian seaborne oil reported to be affected.

Regional FX

Asian currencies were generally weaker before paring back some losses overnight, with INR (-0.7%), TWD (-0.5%), IDR (-0.5%) and THB (-0.4%) underperforming. USD/CNY remained reasonably stable at 7.332 with continued pushback against currency weakness by authorities through various tools. Meanwhile KRW outperformed, perhaps partly on news that South Korea’s National Pension Service is selling Dollars to the tune of about US$50bn per month, helping to offset domestic political developments and uncertainty. USD/INR weakened past the 86.50 levels with RBI likely taking a less aggressive approach in intervening and selling Dollars to cap INR weakness, while also taking some measures to address depleting banking system liquidity through conducting buy/sell swaps. We remain cautious on INR and see RBI’s FX policy turning less interventionst and allowing INR to adjust weaker, even as the central bank will unlikely let INR completely go (see INR – Let it go?).