Ahead Today

G3: Fed Governor Waller speaks on payments innovation

Asia: China industrial production, China retail sales, China fixed asset investment

Market Highlights

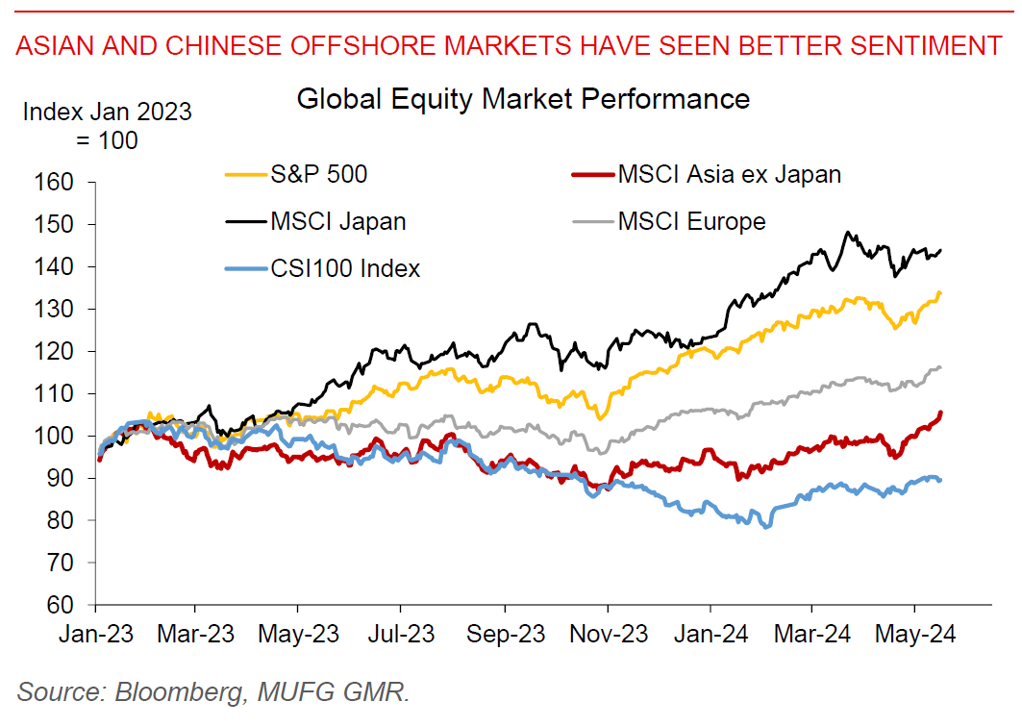

The US data overnight was a mixed bag, with softer growth coupled with a rise in underlying import prices leading to some modest reversal in risk sentiment together with a firmer Dollar. Nonetheless, these moves come in a week when the S&P500 rose above 5,300 while Chinese equities continued to rise albeit from low valuations. US industrial production was softer than expected at 0%mom, while import prices ex petroleum rose 0.7%, indicating some risk of a pickup in tradable inflation moving forward, and to some extent in line with the rise in ISM manufacturing prices paid. Meanwhile, the chorus of Fed officials overnight reiterated patience, even as most believed that policy is in a good place with rates likely to fall as inflation comes off.

The key focus of markets today will be on China’s monthly economic data for April. The consensus is calling for a modest pickup in both retail sales and industrial production to 4.6%yoy and 5.5%yoy respectively. Equity sentiment in particular in the Chinese ‘H’ share market and the Hang Seng Index have been strong, in part on newsflow around possible government measures to digest excess property inventory. Nonetheless, the fundamental macro data would have ultimately to turn for the better to sustain the market’s trajectory over the medium term. Meanwhile, Fed Governor Christopher Waller, a respected hawk on the FOMC with potential for market moving comments speaks, albeit focusing on payments innovation and not monetary policy.

Regional FX

Regional FX

Asian FX generally traded mixed yesterday, with some modest weakness and retracement following the CPI induced strength earlier in the week. The Philippines central bank kept its policy rate unchanged yesterday, but importantly for markets seems a touch more dovish in its tone (see BSP May 2024 – Turning less hawkish). First, the BSP cut its risk-adjusted inflation forecasts for 2024. Second, the BSP said they may cut rates in August. Third, the central bank highlighted indicators point to GDP growth moderation. A less hawkish BSP is not as supportive for the PHP, but our base case assumption is that the BSP rate cut cycle when it starts will be slow and measured. This also has to be balanced with other drivers of the currency including a more manageable current account deficit, rise in FDI approvals, together with possible increase in equity inflows. We are forecasting USDPHP at 57.00 for 4Q2024.