Ahead Today

G3: Germany IFO Expectations, US Durable Goods, US Dallas Fed Manufacturing

Asia: China 1-year MLF, Singapore industrial production

Market Highlights

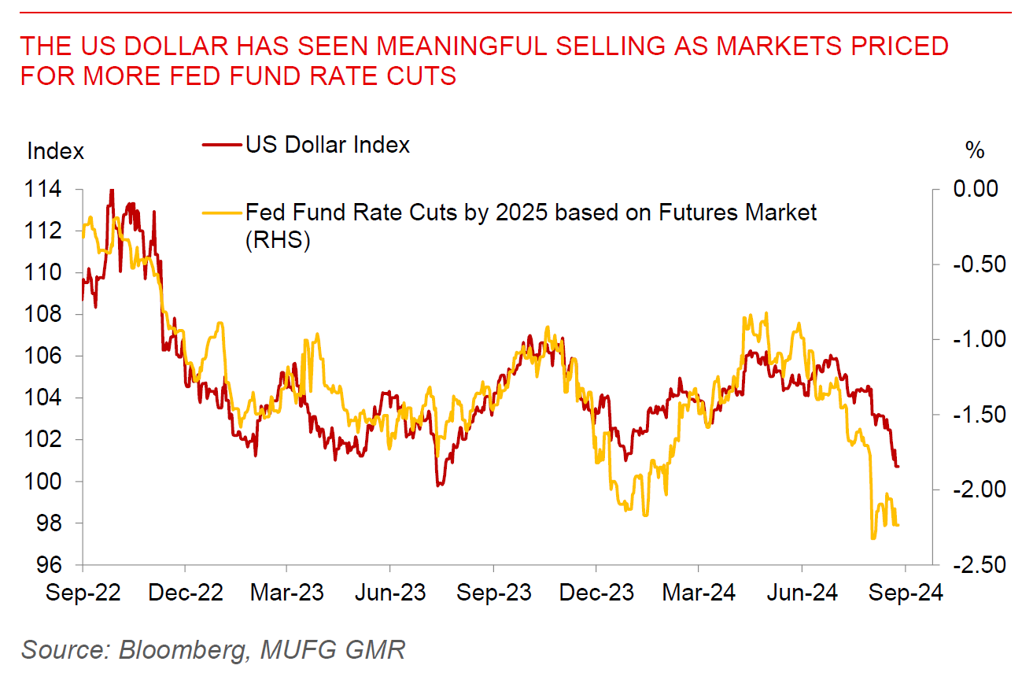

In a dovish speech at the Fed’s Jackson Hole symposium, Fed Chair Powell all but confirmed that a pivot to US rate cuts has begun. He said that “the time for policy to adjust has come”, and that the timing and pace would “depend on the incoming data, the evolving outlook, and the balance of risks”. More importantly for markets, the Fed according to Chair Powell is now putting more emphasis on downside risks to the labour market rather than upside risks to inflation, while also emphasizing that any further weakening in the labour market would be “unwelcome”. In addition, Chair Powell did not push back on market pricing, and nothing he said suggests a 50bps rate cut is off the table (see MUFG US rates strategy – Jackson Hole recap).

In some sense, these signals were in line with the Fed minutes and FOMC speakers over the last few weeks, but the message from Chair Powell was perhaps more unequivocal than what markets were anticipating. The Dollar had a massive move, declining by 0.8%, with EURUSD rising to 1.12 and USDJPY falling to 144 at one point. Asia FX markets which were open during the speech saw big moves as well, with USDSGD for instance now touching 1.300 levels and 1-month USDKRW NDF at 1322.

The flow of US labour market data becomes more crucial than ever now for markets, more so than inflation. The non-farm payrolls and unemployment rate prints to be released on 6 September could open up the possibility of a 50bps rate cut if the numbers come in weak (see Global FX Weekly and Global Markets FX Podcast)

Regional FX

Asian FX was stronger heading into the weekend, with SGD (+0.8%) and CNH outperforming on the back of Fed Chair Powell’s Jackson Hole speech. Bank of Japan Governor Ueda’s testimony to Parliament was also supportive of JPY and Asian FX, by reiterating the guidance from the July meeting, even as he gave a nod to recent market volatility. Singapore’s MAS core inflation for July came in lower than expected at 2.5%yoy, from 2.9%yoy the previous month, with some services costs such as recreation and culture contributing by moderating to 3.1%yoy from 4.7%yoy previously. Meanwhile, Taiwan’s industrial production was stronger at 12.3%yoy in July from 13.2%yoy, helped by stronger electronics and semiconductor production from the AI chip boom. Markets will focus on Singapore’s industrial production numbers out later today, together with China’s 1-year MLF rate which is expected to remain unchanged.