Ahead Today

G3: US JOLTS job openings, Conference Board consumer confidence

Asia: Unemployment rate in Singapore

Market Highlights

US 10-year yield rose 49bps in October, supporting US dollar strength, as markets price in the risk of a second Trump presidency and a Republican sweep. Trump’s proposed economic policies (major tariff hikes + a wider fiscal deficit) could have more severe inflationary consequences than during the 2018-2019 trade war. If Trump wins the US election this November, there is scope for US long-term yields to rise. Markets could pare back expectations for the pace of Fed rate cuts. The term premium has risen since mid-September, but still off the highs in mid-2022 and October 2023, while the technical picture has turned bearish since mid-October.

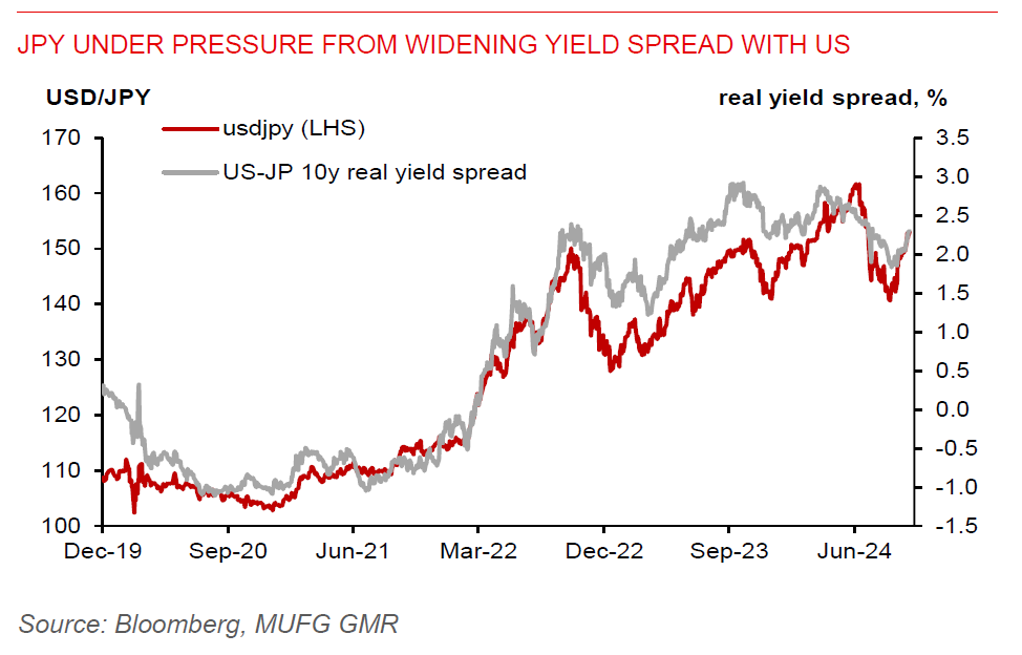

Notably, the rise in US yields have outpaced the 12bps increase in Japan’s 10-year yield in October. Japan’s widening yield differential with the US has been a key driver of recent JPY weakness. The current political shock in Japan will also dampen the JPY. While JPY pared back some losses against the US dollar on Monday’s session, after falling 1%, it was still weaker by 0.4%. In a snap election, Japan’s LDP-led ruling coalition has lost its parliamentary majority in the lower house, falling short of 18 seats to make a majority. It remains uncertain whether Prime Minister Ishiba is able to continue as Prime Minister, given he has lost some political capital. It may be premature to draw policy implications at this stage, but political uncertainty is disliked by markets. The ruling coalition party now has a weaker hand to push through a supplementary budget. An uncertain outlook for Japan’s economy could also affect BoJ’s monetary policy. It’s reasonable to think BoJ would be in no rush to raise rates.

Regional FX

Most ASEAN currencies weakened against the US dollar on Monday’s session, with IDR (-0.5%) and MYR (-0.4%) leading losses. Modest weakness was also seen for the SGD (-0.1%) and THB (-0.2%). PHP gained 0.2%, but this notably followed from a 0.8% decline last Friday. There’s limited movement in VND as it approaches the weak end of its policy band against the US dollar. If Trump wins, there would be further depreciatory pressure on ASEAN FX, particularly SGD, MYR, and THB. IDR would also be under pressure in a period of sustained US dollar strength and high for longer US rates. PHP and VND could be impacted, but less so.

In Singapore, the Monetary Authority of Singapore (MAS)’s said in its twice-yearly macroeconomic review that disinflation will continue, while the economic recovery will extend into 2025. The central bank thinks core inflation will step down to around 2% by end-2024, while averaging around 2% next year. It has also projected growth to come in at the 2%-3% range this year, while growth momentum is likely to continue into 2025. However, rising trade tensions could derail the disinflation process. Downside risks to growth include trade and geopolitical tensions, as well as a slowdown in China. We still look for the MAS to start loosening its exchange rate policy setting in January 2025, while a potential hit to growth from Trump’s tariff could lead MAS to further ease policy to support growth.