Ahead Today

G3: S&P Global US PMI, euro area PMI

Asia: South Korea’s 20-day trade data, Singapore CPI

Market Highlights

The DXY US dollar index seems to be struggling to stay above the 100.50 key support level, as the US Treasury curve continues its bull-steepening move – when shorter-end rates fall faster than the longer-end. The renewed rise in USDJPY over the past week (+2.1%) helped to support the US dollar index, while the 0.8% gain in EURUSD and 1.5% appreciation in GBPUSD were providing an offset. Any US dollar rebound could prove to be short-lived with US yields set to head lower as the Fed aims to engineer a soft landing for the US economy.

The yen weakness followed the BoJ’s policy decision last Friday to leave the policy rate unchanged at 0.25%. BoJ Governor Ueda sounded less hawkish, saying the upside risk to inflation from yen’s weakness is receding, indicating that the bank is in no rush to raise rates. Also, policymakers are wary about the impact of further rate increases on financial market stability. Meanwhile, the BoJ upgraded its outlook for consumption, while reiterating that it expects inflation to be in line with its outlook in the latter half of its forecast period through FY26, suggesting it remains on a path of rate normalisation. While 10-year JGB yield has fallen since rising to about 1% in July, there’s scope for it to rise gradually as the BoJ continues with rate normalisation and quantitative tightening.

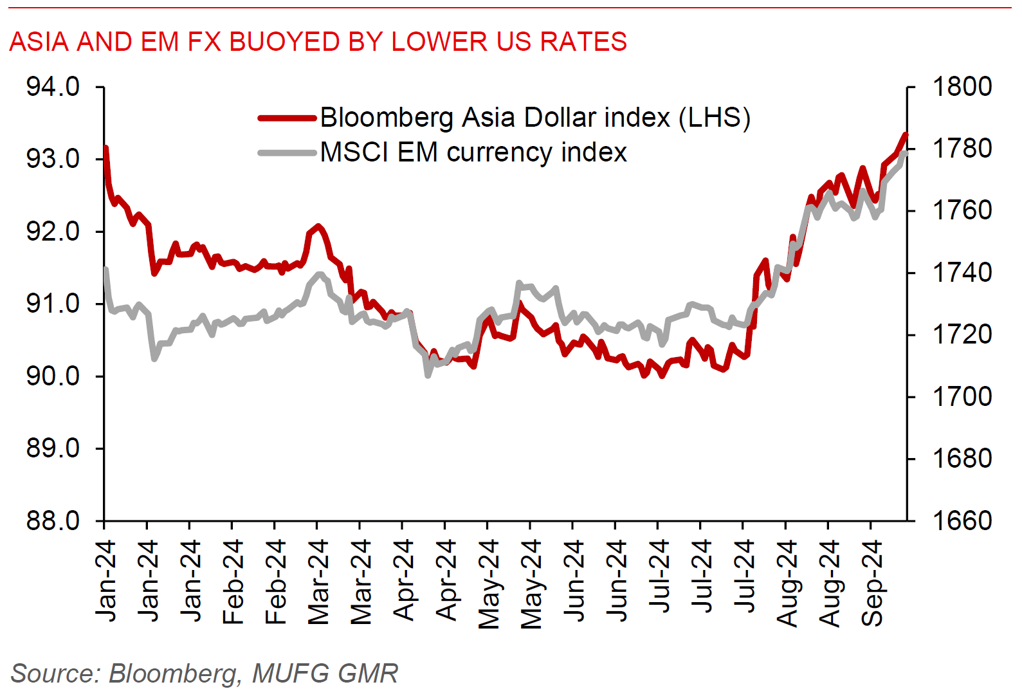

Regional FX

Asia ex-Japan currencies have extended their gains against the US dollar, with MYR (+2.3%) and IDR (+1.6%) leading gains in the region over the past week. But the KRW consolidated between 1325-1350 level, with key support zone at around 1320-1325. The 0.8% gain in CNH over the past week has some positive spillover effects on regional currencies too. There’s no surprise on the PBOC’s rate decision, as it left the 1y and 5y loan prime rates unchanged at 3.35% and 3.85%, respectively. But there’s scope for further declines to stimulate the domestic economy.

The key data highlight for Asia today is Singapore’s CPI inflation data. Bloomberg consensus is for Singapore’s core inflation to pick up modestly to 2.6% in August from 2.5% in July. Should there be a significant easing of core CPI inflation back to the 2% target, MAS could start easing the policy setting in October, keeping SGD advances against the US dollar modest.