Ahead Today

G3: US mortgage applications and import price

Asia: BoT, BSP, BI policy meetings

Market Highlights

The DXY US dollar index was flat on Tuesday’s session, while the US 10-year yield fell by about 7bps. Notably, EURUSD fell below the 1.0900-handle against the US dollar, with markets expecting the ECB to cut its policy rate by 25bps during its upcoming policy meeting on 17 October. Meanwhile, USDJPY retreated from the 150.00-level. The recent sharp yen weakness has renewed market worries about potential FX intervention. Markets now think the US-Japan interest rate differentials will not be narrowing so quickly.

Fed’s Waller thinks the US economy is still solid but recent stronger than expected inflation data is disappointing. While there is room for the fed funds rate to move lower, Waller thinks policy easing should proceed cautiously and gradually. Fed’s Daly said the risks to the Fed’s jobs and inflation mandate are now more balance. She added that monetary policy is currently restrictive as inflation cools and there could be one or two more 25bps rate cuts in the rest of this year.

Brent prices fell after Israel assures the US that any attacks will be on military targets, and not on the energy sector or nuclear facilities.

Shares of Dutch semiconductor equipment maker ASML plunged after providing disappointing sales forecast and warning of weaker China sales ahead amid US tech export restrictions.

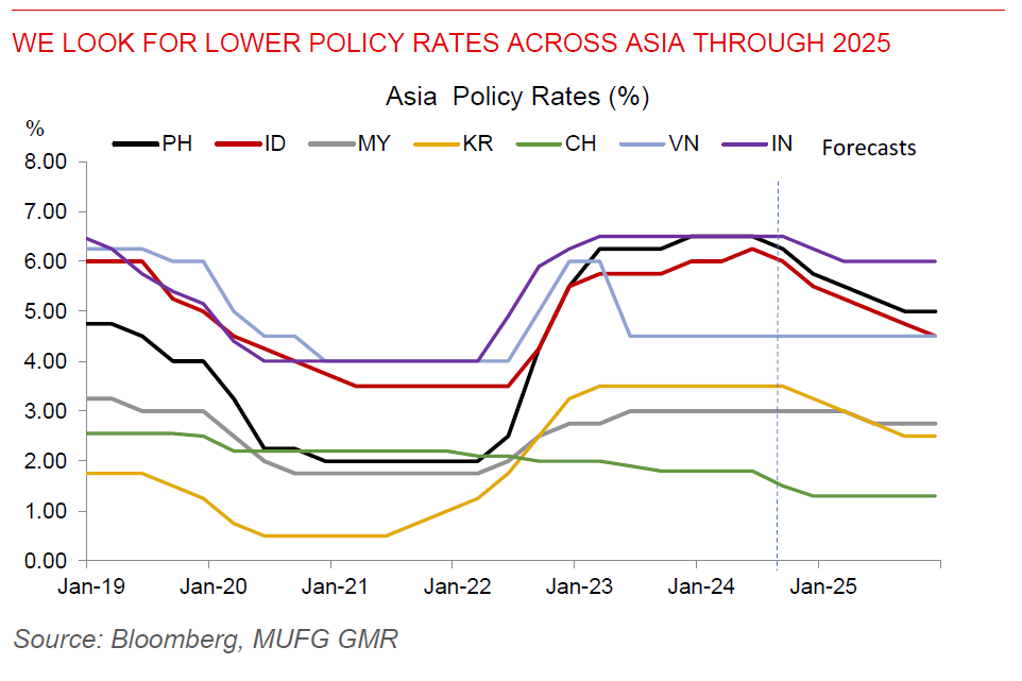

Regional FX

Asia ex-Japan currencies broadly weakened against the US dollar, with CNY (-0.6%), PHP (-0.6%) and KRW (-0.5%) leading losses across the Asia region. A plethora of Asian central banks will meet today. We expect BSP to cut the policy rate by 25bps amid moderating growth momentum and inflation. Despite government pressures for lower rates, our base case is for the BoT to keep the policy rate neutral at 2.50%, with economic growth improving and given the huge interest rate gap with the US. Lastly, we also expect BI to stay on hold after cutting the policy rate in September, given rising Mideast tensions. Nonetheless, conditions are in place for BI to lower the policy rate further. A potential reappointment of Indonesia’s current Finance Minister Sri Mulyani will also bode well for its fiscal outlook. Indonesia’s trade surplus was US$3.3bn in September, slightly narrower than the US$3.4bn surplus a year ago.