Ahead Today

G3: US JOLTS Job Openings, Eurozone 2Q GDP

Asia: South Korea Retail Sales

Market Highlights

Ahead of key central bank meetings with the Fed and BOJ later this week, it seemed like a day when the market struggled to get clear directionality, but ultimately ended with a slight risk-off tone in non-US risk assets. The Dollar was stronger by around 0.2%, with EURUSD declining to 1.0818, with also some meaningful divergences across some Asian pairs with MYR outperforming quite significantly. The only datapoint worth noting was a larger than expected fall in the Dallas Fed Manufacturing activity index, coupled with a modest decline in Japan’s unemployment rate. Both factors are supportive of our views that the Fed should start to recalibrate rates soon and could provide some hints in the upcoming July Fed meeting this week, and also for the BOJ to hike rates.

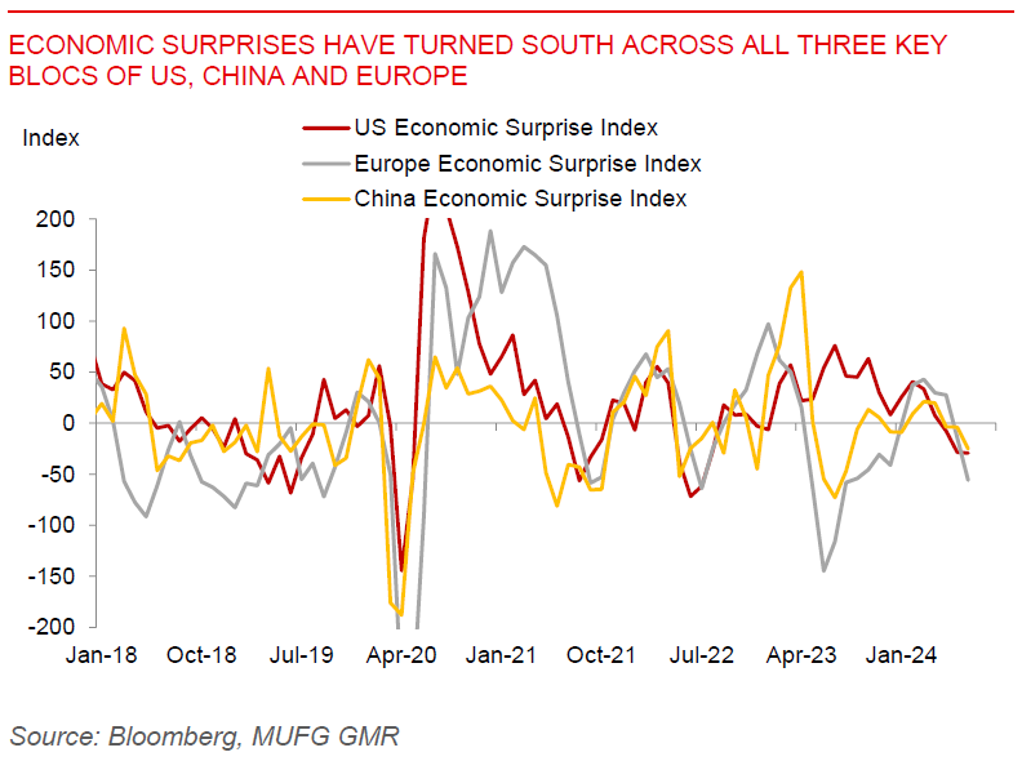

Markets will watch for the US JOLTS Jobs opening coupled with Eurozone GDP data out today. The US jobs opening will be important in terms of details such as the job vacancy rate, which has been highlighted by Fed Governor Waller as a key barometer of when the unemployment rate may rise more sharply when it drops below 4.5%. Meanwhile, the Eurozone GDP data should show some moderation in momentum, but also comes in the broader context of recent negative economic not just in the US, but across the board in China and also Europe.

Regional FX

Regional FX

Asian FX markets were mixed, with some divergences across countries with MYR (+0.46%), THB (+0.17%) and VND (+0.11%) outperforming, while IDR (-0.18%) and PHP (-0.13%) underperformed. It was unclear what exactly drove the sharp strength in the Malaysian ringgit given that the latest foreign inflows into equities data indicated a small net selling position yesterday. Meanwhile, Vietnam released July macroeconomic data which generally pointed to an economy which is bottoming, and also continues to benefit and outperform in terms of exports. Vietnam’s exports rose a sharp 19%yoy, resulting in a strong trade surplus of US$2.1bn, while retail sales improved somewhat to 9.4%yoy from 9.1%yoy previously. Overall, while USDVND has performed better over the past two months, the key concern for the currency remains still strong domestic capital outflows and in part reflecting relatively low interest rates in the economy.