Ahead Today

G3: Bank of Japan Policy meeting, Federal Reserve FOMC Meeting

Asia: China Official Manufacturing and Non-Manufacturing PMI, Thailand Current Account, Taiwan GDP

Market Highlights

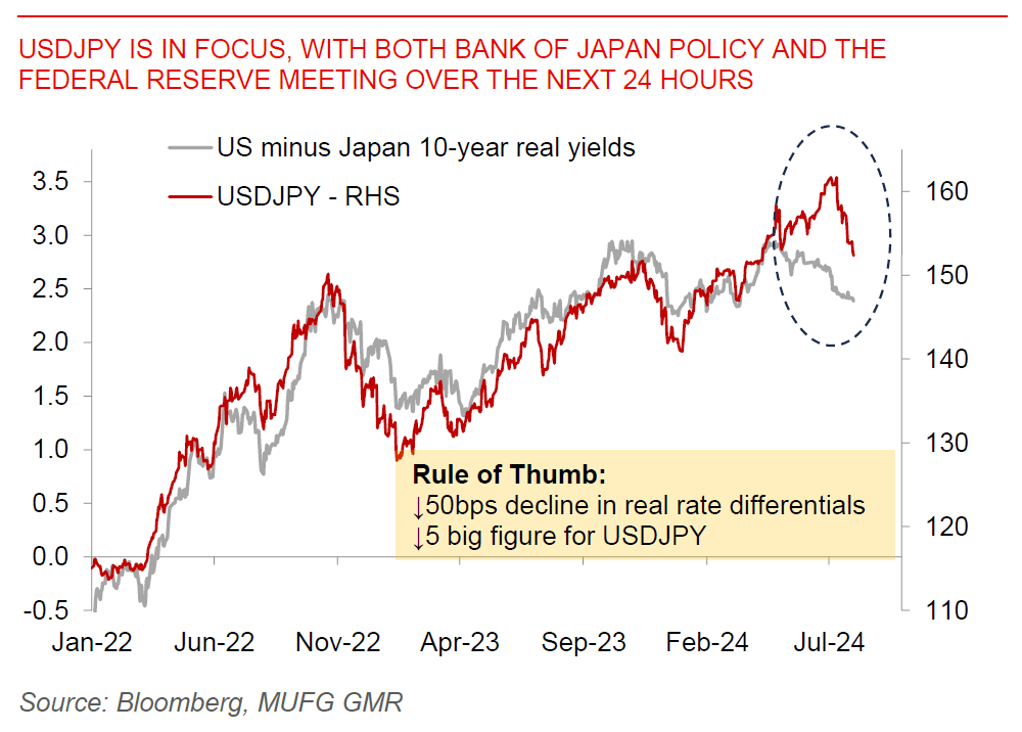

The Bank of Japan meets today, just ahead of the Federal Reserve early morning tomorrow. Our global team expects the Bank of Japan to raise its short-term interest rate by 15bps to 0.25%, although our Japan team has noted that the decision is quite finely balanced given the lack of public comments from Governor Ueda. Meanwhile, BOJ will lay out its plan for JGB bond purchase reductions and we expect a slowdown from around JPY6 trillion/month to around JPY2 trillion/month over the next two years, or quarterly steps of JPY500bn. This should keep upward pressure on JGB yields. Overnight, there were news reports from Nikkei and Jiji that the BOJ board will consider raising short-term rates and this led to some jump in Japan rates across the curve.

All these partly led to JPY strengthening against the Dollar to 152.63 ahead of the BOJ meeting, but probably wasn’t the full story. There was some increase in geopolitical tensions overnight with Israel saying it had killed a senior Hizbollah commander in an air strike in Beirut. This could have also helped the Japanese Yen as a safe haven currency, with gold and bonds rising, and equities declined modestly. Meanwhile, the US job openings and consumer confidence data were somewhat better than expected, but details continue to suggest continued softening in the labour market with quit rates in particular declining further to 2.1%, indicating further moderation in wage pressures

Regional FX

Asian FX markets saw mixed performance, with some divergences across countries with MYR (+0.14%) and THB (+0.17%), while PHP (-0.50%) underperforming. China’s leadership pledged to make boosting consumer spending a greater policy focus, indicating some continued concerns about the near-term growth prospects even as the longer-term focus remains on structural transformation in science and technology, in the readout from its end-July Politburo meeting. Nonetheless, specific policies were lacking, and more details in terms of stimulus could come in the weeks ahead. China will announce the official manufacturing and non-manufacturing PMI today and this will be important to gauge the strength of the economy. Looking ahead, markets will watch closely for the Federal Reserve FOMC decision early morning tomorrow. Our base case is for a dovish hold in rates, with the Fed likely to signal the path towards interest rate cuts later this year (see FOMC preview).