Ahead Today

G3: US Initial Jobless Claims, US Continuing Claims, US Durable Goods Orders, US University of Michigan Inflation Expectations, Eurozone Consumer Confidence

Asia: Singapore COE Premiums

Market Highlights

Fed officials agreed in their last policy meeting that they would proceed “carefully”, and only raise interest rates if progress in controlling inflation faltered, according to Minutes from the November FOMC meeting. The Minutes also suggested policy will need to stay sufficiently restrictive for “some time” with no discussion of rate cuts, while highlighting some concerns around deterioration of balance sheets for lower income earners and rising consumer loan delinquencies. Across the Atlantic, ECB President Christine Lagarde said that it is too early to declare victory on inflation, while saying that the central bank needs to know where Europe’s fiscal policy is headed ahead of the bloc’s attempts to revamp fiscal rules.

Overall, the Dollar recovered slightly ending the day mixed, even as US data showed that existing home sales dropped by 4% on the back of higher mortgage rates.

Regional FX

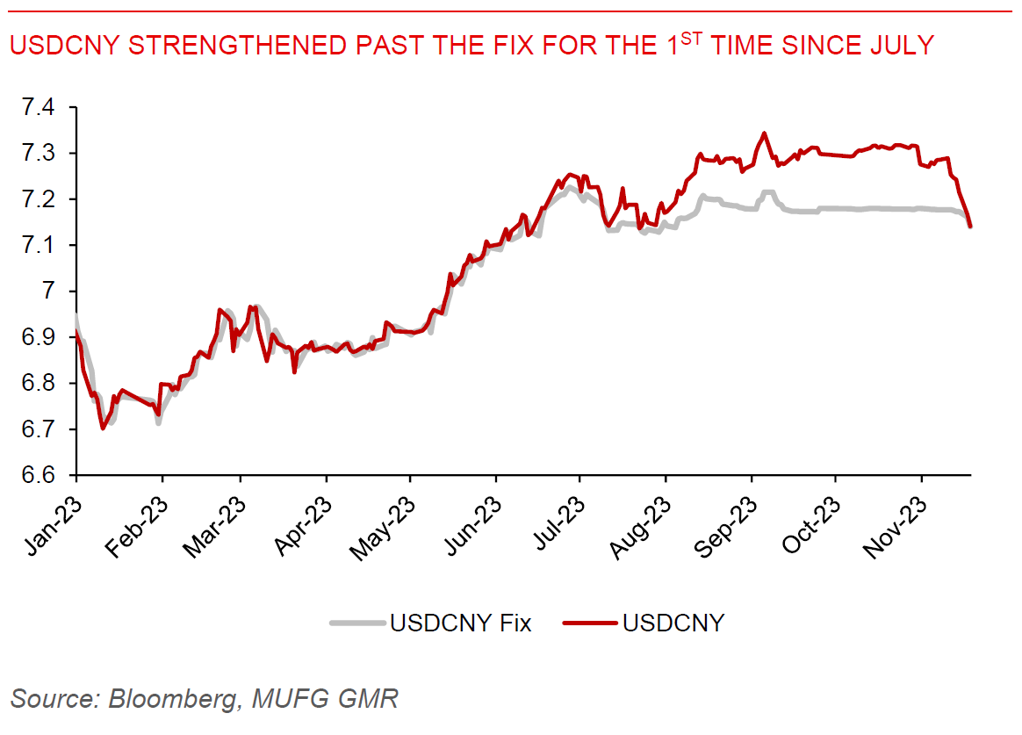

Asian currencies strengthened slightly against the US Dollar, led by USDCNH which fell below the 7.15 levels. Chinese authorities boosted the onshore USDCNY fix by the most since July, and this had a positive feed-through to other Asian FX pairs. Meanwhile, China’s central bank has encouraged some lenders to bring forward some lending to this year to try to smooth the credit cycle, providing further near-term support to the Chinese economy.

Looking at the rest of Asia, we had some good datapoints out of Indonesia. First, Indonesia’s 3Q current account deficit was smaller than expected at US$0.9bn (vs consensus of US$1.8bn), helped by a stabilization in the goods balance, and improvements in services exports driven by tourism. Second, Bank Indonesia’s first auction of its FX-denominated securities (SVBI) was oversubscribed and exceeded its US$200mn target, which could be another tool to attract and retain foreign portfolio inflows. We will have Bank Indonesia’s policy decision tomorrow, and we expect the BI to keep rates on hold at 6% given the stable Rupiah and better global environment.