Ahead Today

G3: US: mortgage applications, housing starts, industrial production, Fed beige book, Fed Waller speech; eurozone CPI

Asia: Indonesia policy rate decision

Market Highlights

Disinflation in the US has resumed in Q2, but core inflation (particularly services inflation) could remain sticky in the months ahead. US retail sales was stronger than market expectations in June. It was flat in June from a month ago versus market consensus of -0.3%, albeit slower than a 0.3%mom rise (+0.1% before revision) in May. Notably, the retail sales control group – a better gauge of consumer spending and a barometer of inflation – grew 0.9%mom from +0.4% in May, beating market consensus of +0.2%.

Meanwhile, US import price growth was flat, beating market expectations of -0.2% and reversing the 0.4%mom drop in May. Given rising global shipping costs, there will likely be upward pressure on import costs ahead, with potential passthrough to US CPI inflation over time.

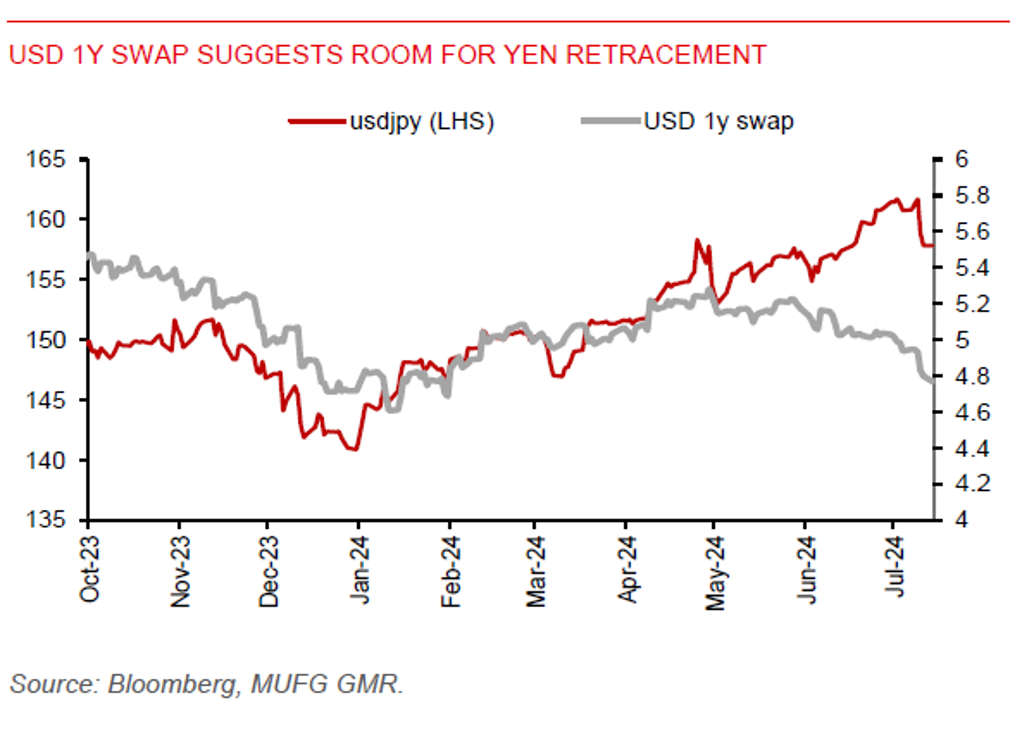

The latest US macro data could help stabilize the DXY USD index, with markets nudging down US rate cut expectations, while eyes are on the major support level at 104 for the downside. USDJPY has found near-term support at the 158.00 level, with topside at 162. A look at the USD 1y swap suggests the yen has scope to retrace.

Regional FX

The key highlight for Asia today is the policy rate decision from Bank Indonesia. BI will likely keep its policy rate unchanged at 6.25%, as depreciatory pressure on the rupiah has somewhat eased. In a recent parliamentary hearing, BI governor Perry has said there is no urgency for further policy rate hikes, and that he prefers to anchor the rupiah via FX interventions and issuing rupiah securities (known as SRBI). With growth still resilient and inflation slowing to 2.5%yoy in June, the outlook for BI-rate will likely be closely tied to the rupiah movement ahead. We think the rupiah will remain vulnerable to geopolitical tensions (from the Middle East conflict and upcoming US elections) and domestic fiscal uncertainty under an incoming new government helmed by Prabowo Subianto. BI rate cuts will likely have to wait till the Fed lowers the policy rate.