Ahead Today

G3: US Mortgage Applications

Asia: Philippines Trade Balance, South Korea Household Lending

Market Highlights

Japan’s labour cash earnings growth slowed sharply to 0.2%yoy from 1.5%yoy, adding further reasons for the Bank of Japan to hold rates in the near-term. Markets have already been pricing in for a delay in BOJ rate hike cycle given the uncertainty surrounding the economic impact of the recent earthquake, this wage datapoint adds another reason to the list. Nonetheless, we note there are various measures of wage growth in Japan, and what’s more important for monetary policy is the result of the Shunto wage negotiations up later this year.

Markets overnight saw weaker risk sentiment, with the US Dollar stronger, equity markets down, and US yields lower. It’s not entirely clear what drove the market movements given the macro data overnight did not point to anything exceptional in terms of economic weakness. US NFIB Small Business Sentiment saw some marginal improvement, the US trade deficit was slightly smaller, while Germany’s industrial production was weaker than expected.

Regional FX

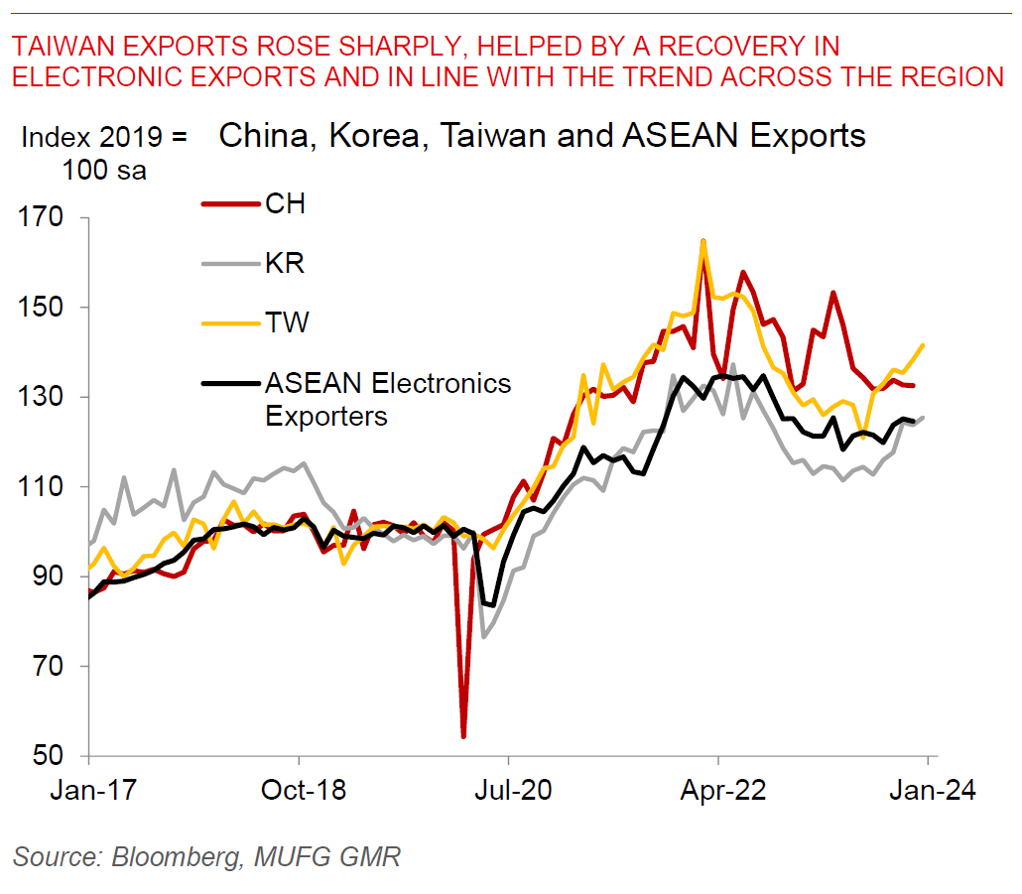

Asian FX were weaker against the Dollar, with PHP (-0.85%) and THB underperforming (-0.6%), and USDCNH at 7.18. Taiwan’s exports picked up to 11.8%yoy up from 3.8%yoy, driven up by exports to the US coupled with a sharp rise in machinery and electronics products. The improvement is also in line with the picture we see across the region such as out of Korea, Singapore, Thailand and Vietnam, and could indicate some improvement in the global goods cycle coupled with product specific trends such as the AI chip boom. Meanwhile, both the Philippines and Thailand central banks were at the receiving end of clamours from their respective governments to cut rates, with Thailand’s Prime Minister saying he will meet the BOT governor a day after prodding the central bank to consider lowering interest rates. Meanwhile, the Philippines Finance Secretary estimated that the central bank can cut its benchmark rate as much as 100bps as inflation cools to within the central bank’s inflation target.