Ahead Today

G3: US manufacturing and services PMI, University of Michigan sentiment and inflation expectations, existing home sales; eurozone PMI; BoJ policy rate decision

Asia: Philippines trade, Singapore industrial production, Taiwan Q4 GDP

Market Highlights

The broad US dollar index has found near term support at the 108.00-level following Trump’s reiteration of his threats to impose tariffs on China imports. A resilient US economy will also support the US dollar. US initial jobless claims were 220,000 in the week ending 18 January, up from 217,000 in the prior week, but still historically low. The 4-week average for new jobless claims application only rose slightly to 213,500, from 212,750 in the prior week. The Trump administration’s pro-business stance, including potential deregulation and the announcement of $500bn of artificial intelligence (AI) investment, could bolster investment and boost hiring. A key macro data highlight for the US today is the US services PMI, which could show services activity continuing to expand this month. Meanwhile, US yields have picked up at the longer end of the curve, staying elevated.

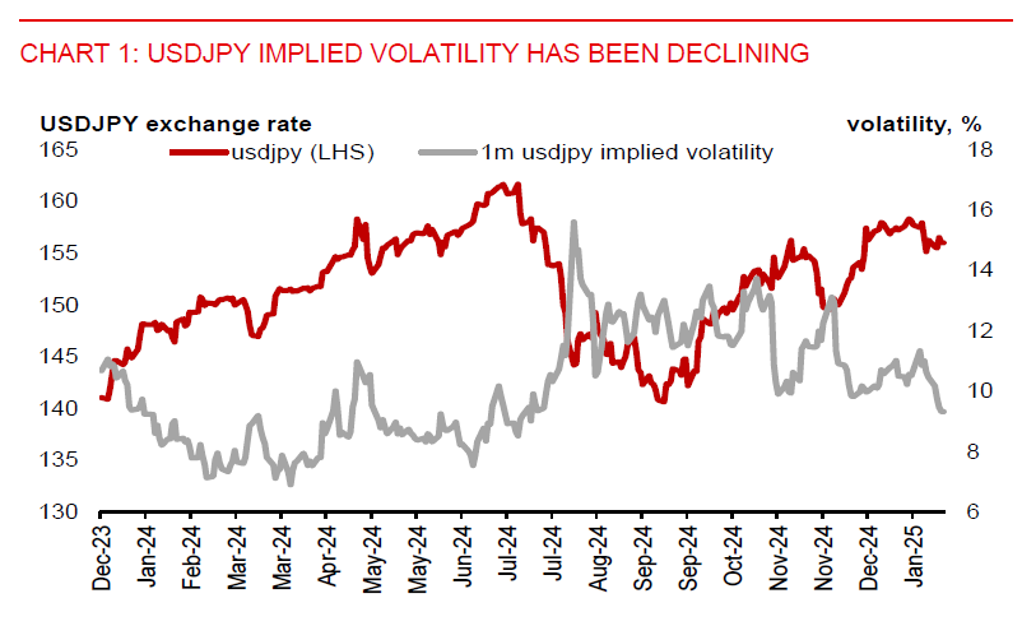

In Japan, we expect the Bank of Japan (BoJ) to raise the policy rate by 25bps to 0.50% today. Japan’s CPI rose 3.6%yoy in December, from 2.9%yoy in November, while core CPI inflation (excluding fresh food) was also up by 3%yoy from 2.7%yoy in November. Markets have fully priced in a 25bps rate hike. There’s also reduced interest in protecting against USDJPY downsides, while 1-month implied volatility has fallen to its lowest level since July 2024. There may be limited positive impact of a rate hike on the yen. Moreover, the BoJ could provide a dovish forward rate guidance, constraining a down move in USDJPY.

Regional FX

Asian currencies have modestly weakened against the US dollar. The Thai baht (-0.6%) led losses in the region following Trump’s threats of imposing tariffs on China imports, which could have weakened market sentiment towards the currency. Moreover, THB appears to be trading stronger than what macro fundamentals would suggest. Plus, tariff risks are looming.

Meanwhile, the Chinese government has announced plans to stabilize the equity market. The government is guiding mutual funds to increase holdings of local equities by at least 10% per year for the next 3 years, while large state-owned insurers will need to invest 30% of their new policy premiums starting from this year.

In Singapore, the MAS has eased its tight S$NEER policy setting via slightly reducing the slope of the S$NEER. This is in line with our expectation. The central bank also lowers its core inflation projection in 2025 to 1%-2%, from 1.5%-2.5% previously. Indeed, disinflation is well entrenched, with December core CPI data showing the year-on-year rate stepped down further to 1.8%yoy, from 1.9%yoy in November. The core CPI print was below the MAS soft inflation target of “under 2%”. Sequentially, core inflation rose 0.5%mom in December. We maintain our forecast for USDSGD at 1.3800 in Q1, especially in anticipation of looming tariffs.